Bitcoin futures premium spikes as traders flip long; factors to consider

Bitcoin futures premium spikes as traders flip long; factors to consider Bitcoin futures premium spikes as traders flip long; factors to consider

Photo by KaLisa Veer on Unsplash

Bitcoin futures have seen rising premiums throughout the past week, pointing to a large spike in demand for long-favoring positions amongst traders.

Although this may bode well for the cryptocurrency’s short-term price trend as it flashes some subtle signs of strength, it is important to keep in mind that this premium can shift at any moment if Bitcoin incurs any massive volatility.

Options traders are also paying a premium for calls – suggesting that they too believe Bitcoin is poised to see some further upside.

Bitcoin’s rise from weekly lows sparks “FOMO” amongst futures traders

Bitcoin has seen a notable rise from its weekly lows of under $8,800 that was set just a few days ago.

After buyers posted an ardent defense of this level, the cryptocurrency was able to rally to highs of $9,700. Although it has since lost its momentum, it is still showing some signs of strength as it hovers within the mid-$9,000 region.

Futures traders appear to have taken notice of this newfound strength, as the premiums for BTC futures contracts have seen a sharp rise over the past week. A similar trend can be seen while looking towards options contracts.

This shows that traders are willing to pay more for long exposure to the cryptocurrency.

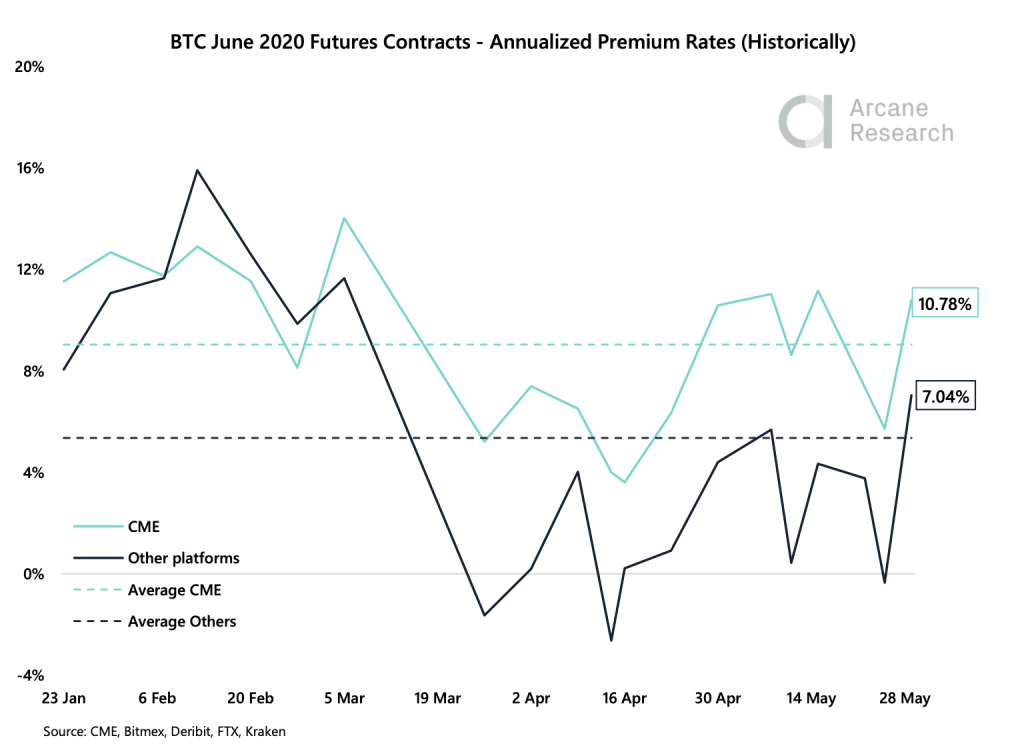

Arcane Research spoke about this trend in a recently released research report, noting that this bullishness has largely come from the CME as well as some other retail-focused platforms.

“The premiums for BTC futures contracts have spiked this week, as the bitcoin price is climbing again.”

It is important to note that these premiums can disappear quickly, especially when Bitcoin posts volatile movements.

Arcane spoke about this as well, explaining that premiums have disappeared on multiple occasions in the time following the mid-March crash.

“However, this can quickly change. We have seen several times since the market crashed in March and traders should watch out for leveraged positions getting liquidated.”

CME traders largely responsible for this premium

It is important to note that traders on the CME are largely responsible for this premium, signaling that institutional investors are widely anticipating the benchmark cryptocurrency to see further upside.

“Both CME and retail-focused platforms are looking more bullish, with the annualized premiums for June contracts pushing above the average levels since late January.”

Data shows that the futures premium on the CME for June 2020 contracts is 0.84 percent, while that seen on more retail-focused platforms sits at roughly 0.55 percent.

The disparity in premiums is even larger for September 2020 contracts, with the CME’s clocking in at 1.99 percent compared to the 1.40 percent seen on other platforms.

Bitcoin Market Data

At the time of press 7:43 pm UTC on May. 30, 2020, Bitcoin is ranked #1 by market cap and the price is up 1.17% over the past 24 hours. Bitcoin has a market capitalization of $175.48 billion with a 24-hour trading volume of $31.16 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 7:43 pm UTC on May. 30, 2020, the total crypto market is valued at at $269.05 billion with a 24-hour volume of $104.04 billion. Bitcoin dominance is currently at 65.24%. Learn more about the crypto market ›

CryptoQuant

CryptoQuant