Bitcoin breaks $57,000 as on-chain data turns “mostly bullish”

Bitcoin breaks $57,000 as on-chain data turns “mostly bullish” Bitcoin breaks $57,000 as on-chain data turns “mostly bullish”

Bitcoin breaks $57,000 as on-chain data turns “mostly bullish”

Bitcoin, the world’s largest cryptocurrency by market cap, broke the $57,000 price level based on strong fundamentals and favorable on-chain data.

Bitcoin surges

Bitcoin broke the $56,000 level Thursday and surged to the $57,000 price level, one that saw a huge selling at last week and a local peak last month. Sentiment for the world’s largest cryptocurrency is strong as there was no major negative news or other setbacks at press time.

Data from on-chain analytics service IntoTheBlock shows a “mostly bullish” environment for Bitcoin. Despite that, two indicators predict “bearish” activity while four on-chain trackers show a “bullish” sentiment for the asset’s mid-term price moves.

The bearish signs are low ‘net network growth’ at -0.44%. The indicator calculates the true growth of the market using new addresses minus the addresses which go to zero. Another bearish element is the falling number of ‘large transactions’ (-1.30% at press time), meaning the on-chain usage for transactions above $100,000 has reduced in the past day.

A majority of the on-chain data is bullish, however. 0.75% of all addresses are ‘in the money,’ and hence, in profit, while the ‘smart price’—which calculates the average bid-ask levels for Bitcoin trading—flashes a “bullish” sign at 0.33%.

Momentum in the Futures market remains high as well, showing a positive funding level, open interest, and favorable volume among Bitcoin traders.

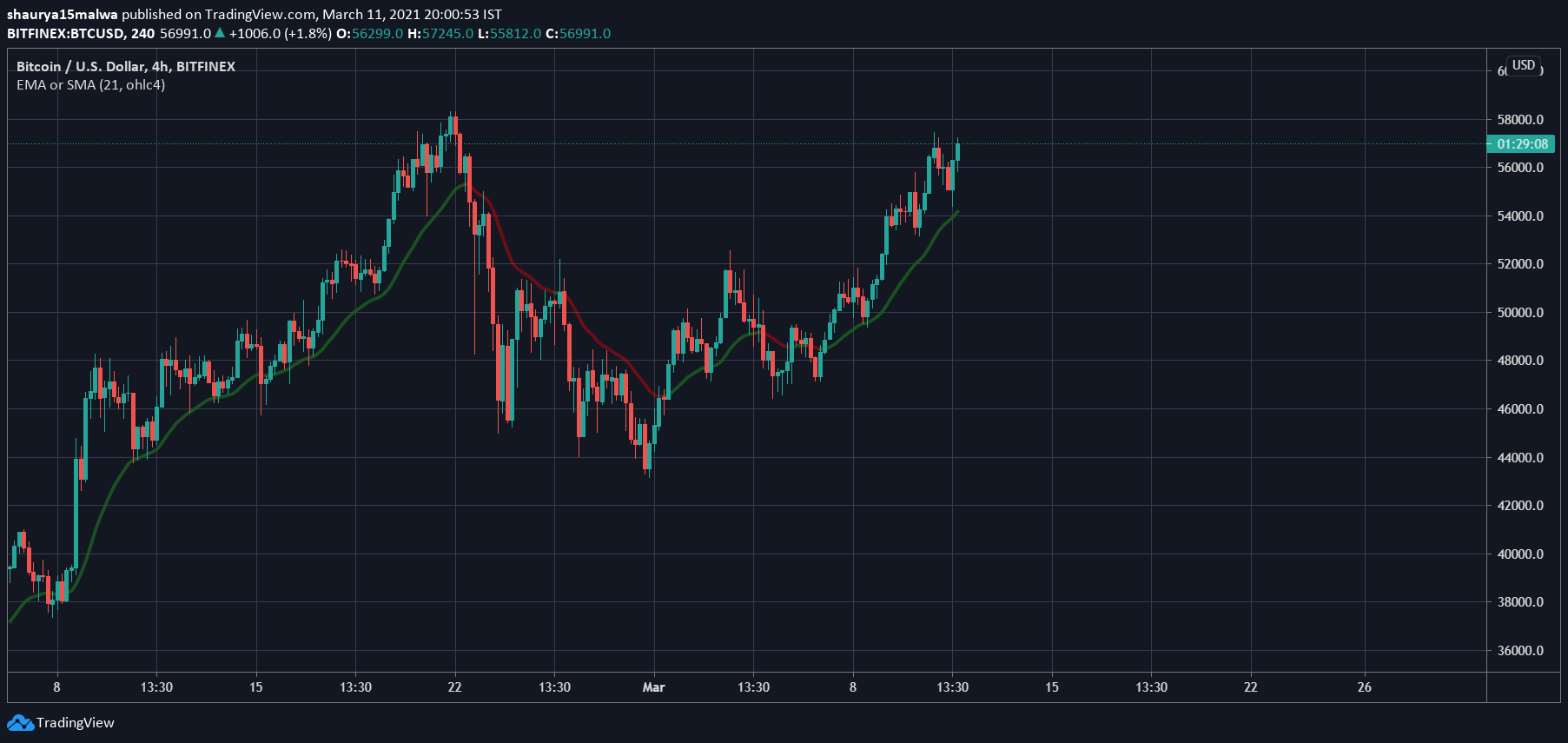

Bitcoin is in a firm uptrend for now, as the below image shows. The asset has surged above its $57,000 level resistance and trades above its 21-period exponential moving average—a tool used by traders to determine market trends.

The next major resistance for Bitcoin is $58,000—its current all-time high—a level that asset reached on February 21 before tumbling down to $43,000 in the weeks afterward.

BNB gains while large-cap alts tumble

Binance’s own BNB token led gains among all large-cap altcoins. The asset surged to $310, an increase of nearly 10% in the past day. Exchange owner Changpeng Zhao has been teasing an announcement since a couple of days, a point that traders seem to be betting on.

I was told it will be tomorrow noon HKT, about 14hrs from now.??? https://t.co/uHFWMUhpGJ

— CZ ? Binance (@cz_binance) March 10, 2021

Meanwhile, other top-ten tokens remained in the red. Ethereum lost -1.2% and oracle service Chainlink lost 3.1% compared to the past day, while Polkadot tumbled by 4% to $29.

Bitcoin Market Data

At the time of press 7:28 pm UTC on Mar. 11, 2021, Bitcoin is ranked #1 by market cap and the price is up 1.01% over the past 24 hours. Bitcoin has a market capitalization of $1.07 trillion with a 24-hour trading volume of $57.26 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 7:28 pm UTC on Mar. 11, 2021, the total crypto market is valued at at $1.74 trillion with a 24-hour volume of $133.81 billion. Bitcoin dominance is currently at 61.38%. Learn more about the crypto market ›

CryptoQuant

CryptoQuant