Bitcoin surpassing $100k sparks $675 million in market liquidations

Bitcoin surpassing $100k sparks $675 million in market liquidations Bitcoin (BTC) surged past $100,000 for the first time during Asian trading hours, triggering a wave of liquidations across the market that totaled more than $675 million.

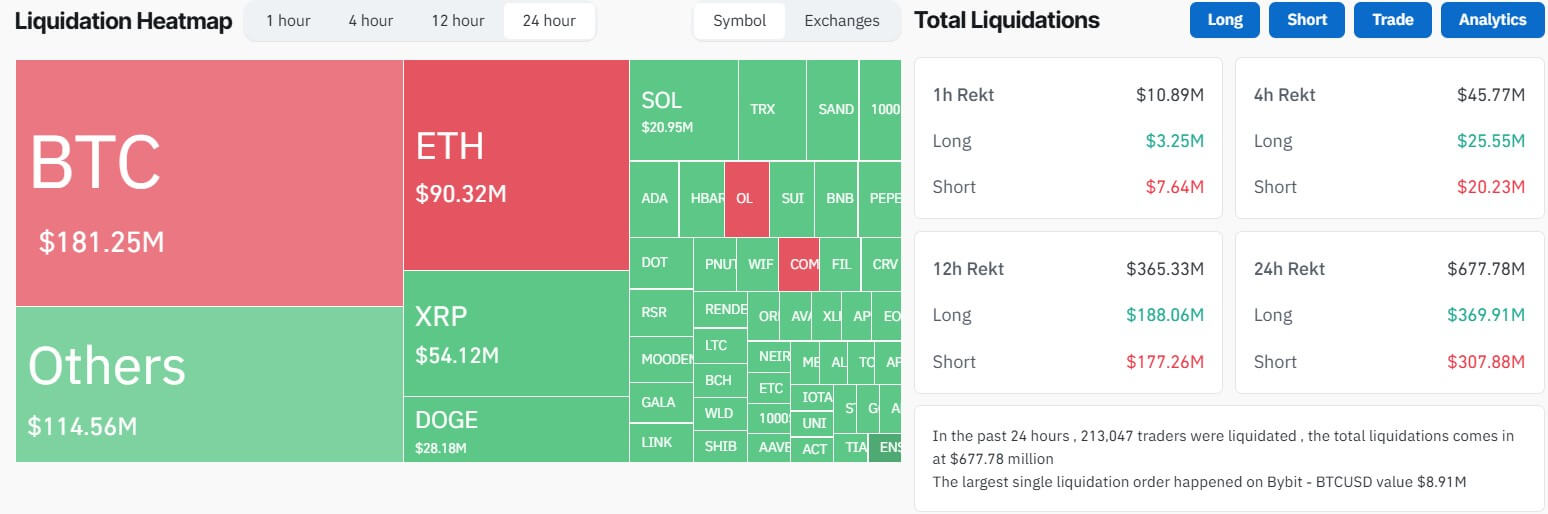

Bitcoin traders accounted for $180 million of the losses, while Ethereum traders faced losses exceeding $90 million. Those holding positions in popular large-cap altcoins, such as XRP, Dogecoin, and Solana, lost more than $100 million, while other assets contributed an additional $114 million in losses.

Data from Coinglass reveals that over 213,000 traders were liquidated, with the largest individual liquidation occurring on the Bybit exchange. This order was a short BTC/USD position worth $8.9 million.

Interestingly, 56% of the liquidated traders were in long positions, betting on rising prices. This outcome was expected, given the prevailing bullish sentiment and the sudden price drops of leading assets like XRP and Hedera in the last 24 hours.

Farside Investors

Farside Investors