Uniswap network fees remain “attractive” despite plunging UNI price

Uniswap network fees remain “attractive” despite plunging UNI price Uniswap network fees remain “attractive” despite plunging UNI price

Photo by Kaylee Stepkoski on Unsplash

The Uniswap governance token has been seeing some immense turbulence in the time following the launch that took place just a few weeks ago.

Upon listing on Uniswap, the token’s price plunged to lows of $1.00 as a flurry of 400 UNI airdrop recipients cashed out their tokens. Shortly thereafter, large buyers stepped in and propelled its price up to highs of $8.50.

Since these highs were reached, UNI’s price has been sliding lower, with it being unable to escape the immense bearishness seen throughout the aggregated DeFi ecosystem.

Had the token launched in August, there’s a solid chance that it would have seen a much larger and longer-lasting uptrend. Still, the ongoing bear market’s intensity tempered the hype surrounding it and led investors to be aggressive with taking profits.

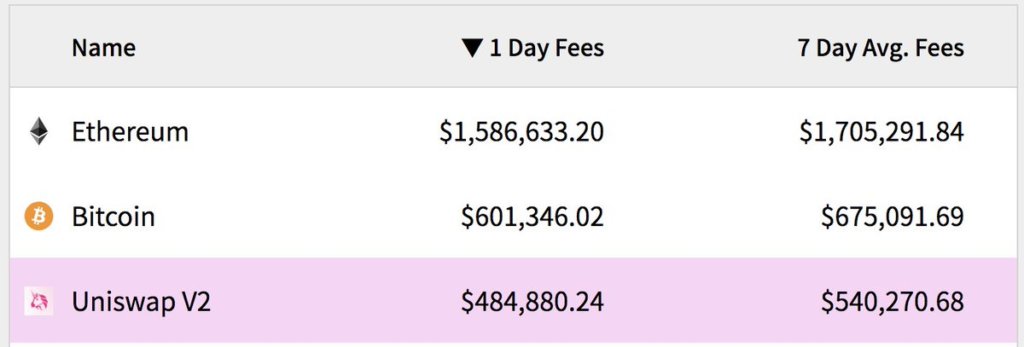

Despite the lack of hype surrounding DeFi and Uniswap at the present moment, one investor is noting that network fees coming from the platform are still quite attractive despite the declining UNI price.

He notes that Bitcoin’s rising dominance could provide investors with some “good value hunting opportunities” over the next few months.

Uniswap’s UNI token breaks below $3.00 as DeFi hype continues fading

The DeFi sector captivated the attention of crypto investors throughout the past few months, but the sharp decline in prices of tokens residing within this fragment of the market has struck a serious blow to the hype that was fueling its rise.

This has created collapsing farming yields, which has, in turn, compounded the pressure placed on this sector.

At the time of writing, UNI’s price is trading down just under 10 percent at its current price of $2.90. This is around where it has been trading throughout the past few days.

Investor: UNI price decline not matching “attractive” network fees

John Todaro – a crypto-focused venture capitalist – explained in a recent tweet that Uniswap network fees remain highly attractive, despite UNI’s price continuously sliding lower.

“Uniswap network fees are still pretty attractive and volumes are still comparable to large centralized exchanges, yet UNI price continues to grind lower. There will be some good value hunting opps in DeFi tokens over the next few months as all eyes turn back to bitcoin.”

If Bitcoin begins recapturing the dominance it has been ceding over the market as it rallies past $12,000, DeFi coins may continue drifting lower – potentially leading some like Uniswap’s UNI into oversold territory.

Uniswap Market Data

At the time of press 9:56 pm UTC on Nov. 12, 2020, Uniswap is ranked #33 by market cap and the price is down 11.11% over the past 24 hours. Uniswap has a market capitalization of $573.61 million with a 24-hour trading volume of $512.76 million. Learn more about Uniswap ›

Crypto Market Summary

At the time of press 9:56 pm UTC on Nov. 12, 2020, the total crypto market is valued at at $365.06 billion with a 24-hour volume of $84.85 billion. Bitcoin dominance is currently at 60.57%. Learn more about the crypto market ›

CoinGlass

CoinGlass

Farside Investors

Farside Investors