These are the main factors to consider before investing in the cryptocurrency market

These are the main factors to consider before investing in the cryptocurrency market These are the main factors to consider before investing in the cryptocurrency market

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Investing has never been easier now that on-chain metrics enable market participants to determine who is on the other side of the trade. While this is only possible in the cryptocurrency market, IntoTheBlock maintains that this data can empower investors worldwide.

The power of on-chain metrics

Contrary to popular belief, one of the biggest advantages of the cryptocurrency market is transparency. Through on-chain analytics anyone can determine how many investors are in a given asset, when they bought, and what their cost basis is. These key datasets are essential to determine which digital asset to invest in.

IntoTheBlock uses machine learning and statistical modeling to provide a view of a crypto asset’s profitability and “capital stack.” Bitcoin, for instance, is a great example of decentralization, which makes it ideal to consider as an investment vehicle, according to the firm.

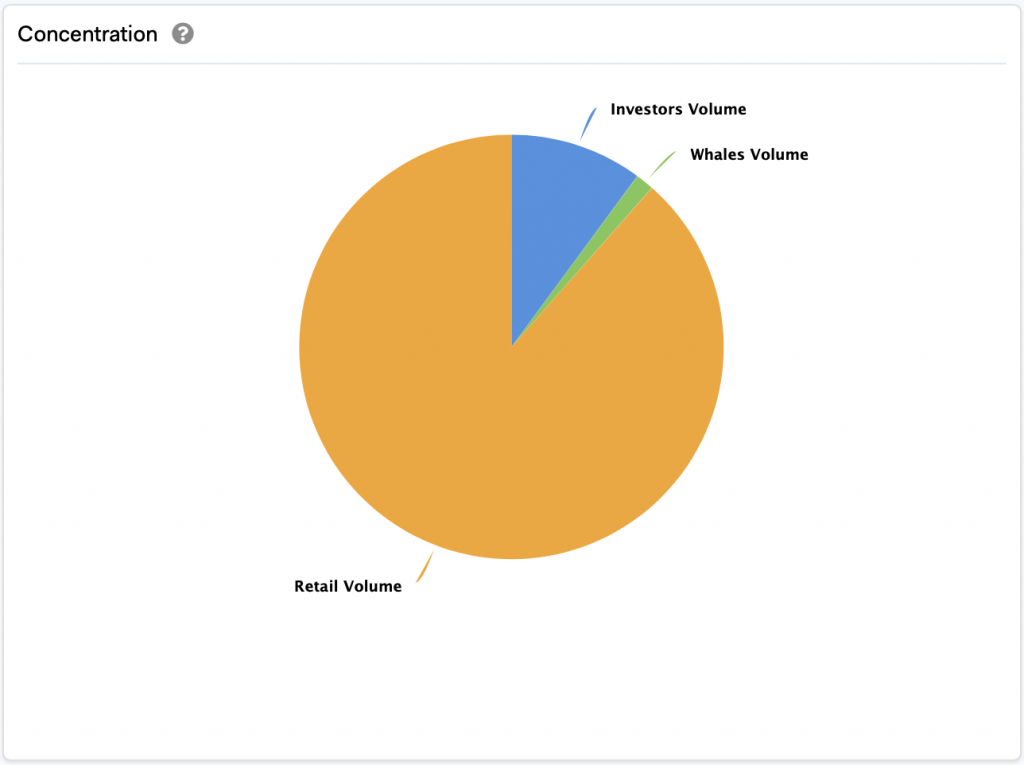

The flagship cryptocurrency only has one “whale” that holds 1.4 percent of its circulating supply. This address has approximately 255,100 BTC and belongs to Singapore-based cryptocurrency exchange Huobi. The other 98.6 percent of the total Bitcoin in circulation is distributed among investors and retail investors. The former holds 10.1 percent while the latter keeps 88.5 percent.

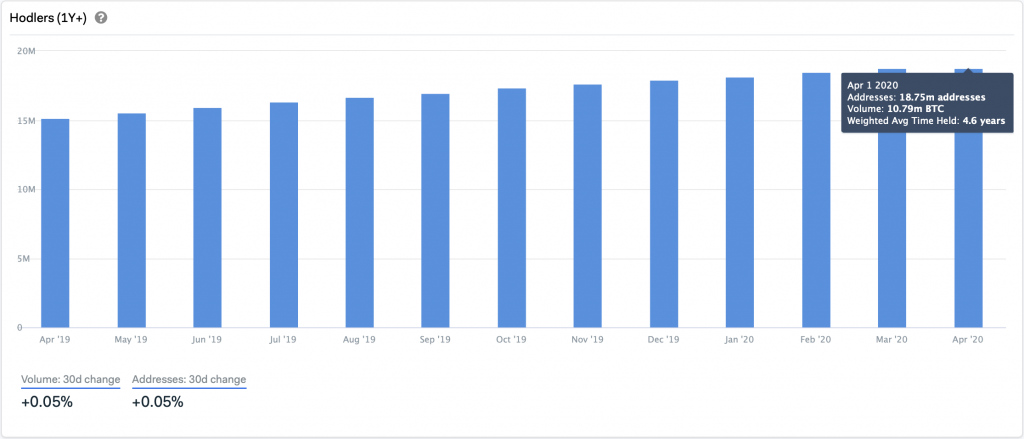

Not only Bitcoin is decentralized, but the amount of holders in the network is at all-time highs, according to IntoTheBlock.

The “Ownership by Time Held” model estimates that nearly 30 millon addresses have a balance in Bitcoin. Currently, almost 63 percent of those addresses are holding 10.8 million BTC for more than a year. This represents a 23.7 percent growth since last year.

IntoTheBlock added:

“To give you more accurate information about this… we can see that the number of Bitcoin’s that hasn’t been moved in over 5 years is up from 3.6m BTC on April of 2019 to 3.95m BTC on April of this year.”

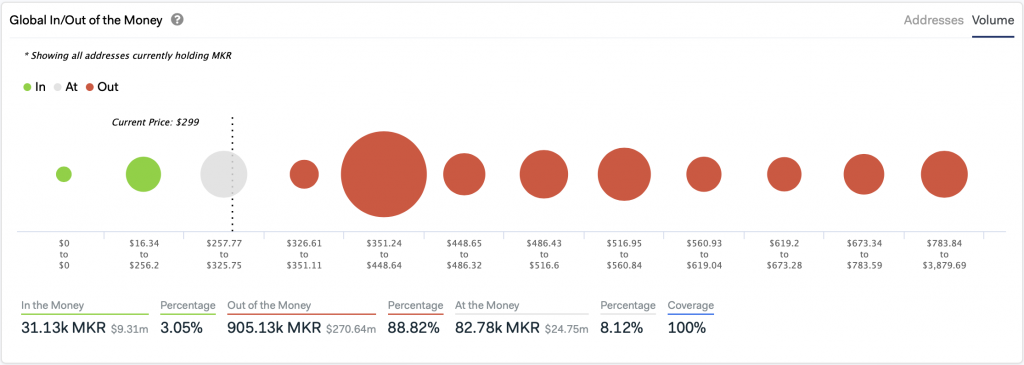

Other assets such as Maker do not provide the same levels of decentralization as Bitcoin and most of its investors will be in the red if they were to sell their tokens today.

In fact, IntoTheBlock’s “Global In/Out of the Money” model shows that 89 percent of the addresses holding MKR are losing money while only 3 percent of addresses are “in the money.”

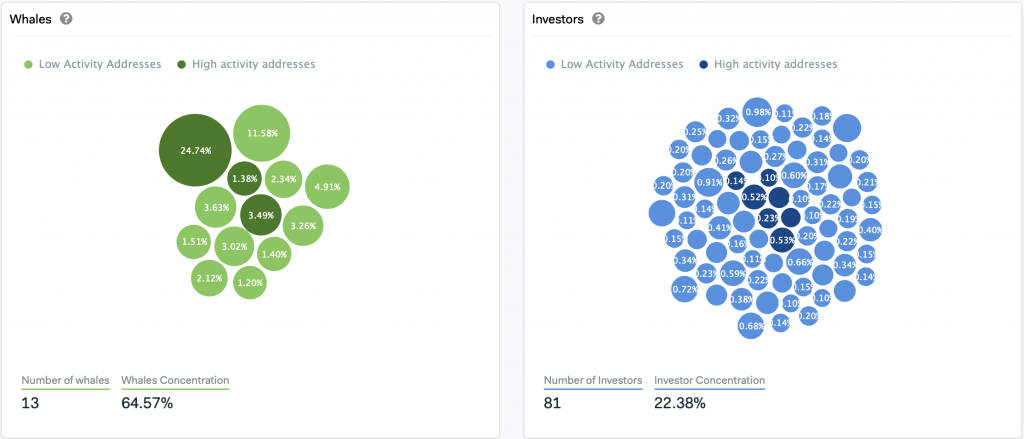

On-chain metrics also reveal that of the 57,520 addresses holding Maker, just 13 of them control almost 65 percent of the circulating supply. And, there is one address that holds nearly 25 percent of the circulating supply.

IntoTheBlock maintains that this could suggest that if anyone were to buy MKR, there is one major address would probably be the one dumping their tokens at a profit.

The ability to determine how centralized an asset is, how large holders can manipulate its price, or how confident investors are is only possible with this new asset class. Although this is not enough data to consider whether or not a given cryptocurrency provides a good investment opportunity, counter-party analysis makes this decision easier.

Farside Investors

Farside Investors