On-chain analysts explain why Bitcoin suddenly dropped 16% in 6 hours

On-chain analysts explain why Bitcoin suddenly dropped 16% in 6 hours On-chain analysts explain why Bitcoin suddenly dropped 16% in 6 hours

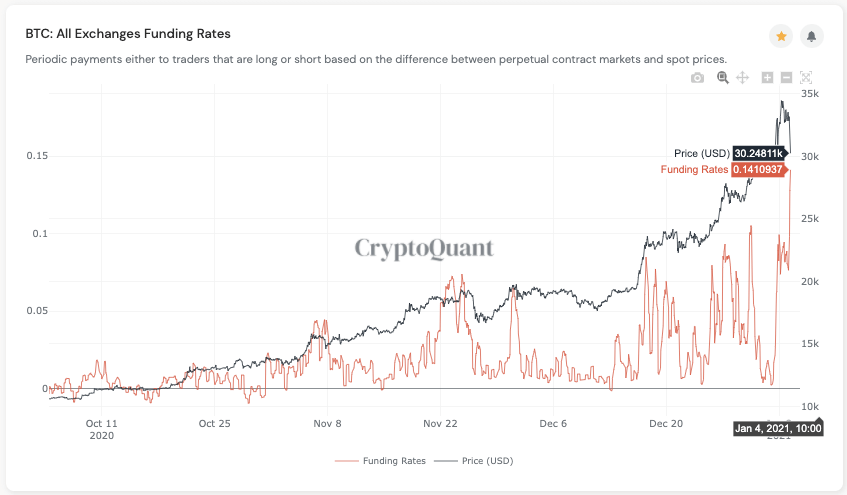

The price of Bitcoin declined by 16% in six hours after an explosive rally to above $34,000. The correction occurred as the derivatives market became extremely overheated.

The Bitcoin futures market can become overcrowded if the market is dominated by either short-sellers or buyers. If either one overwhelms the market, then the probability of a short or a long squeeze occurs. This can create an extreme spike in volatility in a short period.

The Bitcoin futures market was extremely overheated

That is what happened to Bitcoin on January 4. The market was overwhelmed by buyers, which caused the funding rate of Bitcoin futures contracts to surge above 0.2%.

The futures funding rate is a mechanism that incentivizes either buyers or sellers based on market balance. If the market has more buyers, then buyers have to pay a fee to maintain their position, and vice versa.

A short squeeze refers to a scenario wherein short-sellers are forced to market-buy their positions. A long squeeze is the opposite, when buyers are forced to sell their positions.

On January 3, a long squeeze occurred because the market was dominated by buyers. When a minor sell-off occurred, the entire market plummeted violently within a short period.

Ki Young Ju, the CEO at CryptoQuant, said immediately after the drop that the funding rate is too high, which indicates the market is overheated. He wrote:

“I’ll patiently wait for the moment the funding rate cools down. $BTC could go up more, but it’s too dangerous.”

Previously, Ki explained that in a spot market-driven rally, it is important for the funding rate to remain low. He said:

“In this spot-driven & up-only market, a low funding rate could be a buy signal. It seems not a good idea to wait for a correction when institutions buying $BTC.”

Scott Melker, a cryptocurrency trader, similarly said that Bitcoin was overbought. The 4-hour candle chart showed an overbought bearish divergence, which historically led to corrections. He said:

“Line charts can eliminate the noise. Overbought bear div on the 4-Hour, clear head and shoulders. Already shot well past its target (wick not shown on line chart). I want to see RSI make the trip to oversold, finally. It’s inevitable, better now than later.”

What to expect in the near term?

Bitcoin is currently attempting to recover, hovering above $31,000. In the short term, whale clusters show that it is critical for BTC to remain above $28,000, which it tested on January 3.

Whale clusters mark important support levels because they are the price levels at which whales accumulate BTC and do not move their holdings afterward.

Bitcoin Market Data

At the time of press 7:37 pm UTC on Jan. 5, 2021, Bitcoin is ranked #1 by market cap and the price is up 8.16% over the past 24 hours. Bitcoin has a market capitalization of $628.27 billion with a 24-hour trading volume of $63.34 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 7:37 pm UTC on Jan. 5, 2021, the total crypto market is valued at at $914.49 billion with a 24-hour volume of $134.77 billion. Bitcoin dominance is currently at 69.12%. Learn more about the crypto market ›

Farside Investors

Farside Investors

CoinGlass

CoinGlass