Bitcoin mining difficulty sees second negative adjustment following April halving

Bitcoin mining difficulty sees second negative adjustment following April halving Quick Take

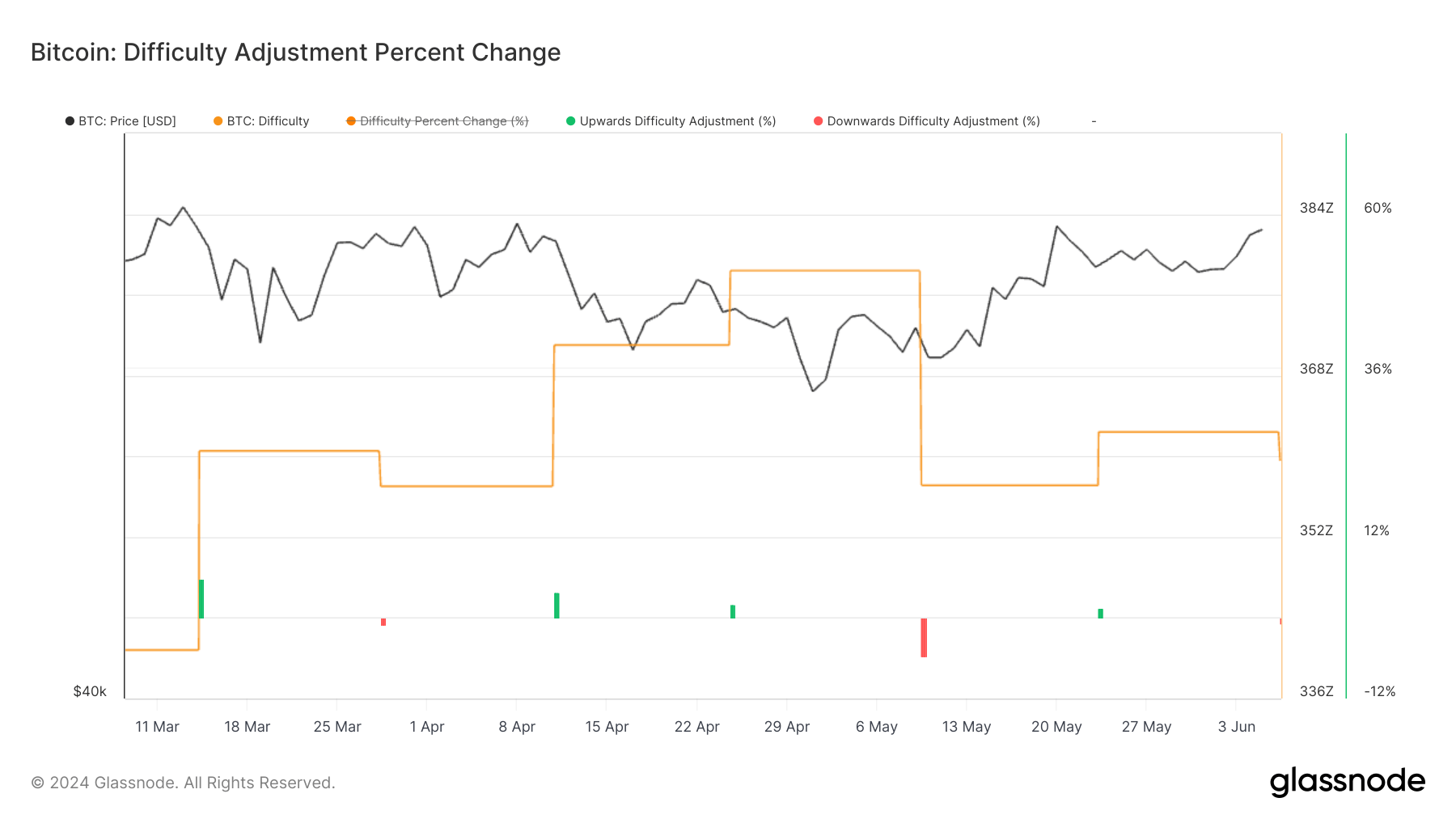

According to Newhedge, Bitcoin’s mining difficulty has decreased by -0.78%. This is the second negative adjustment in the last four, following the Bitcoin halving on April 20. The halving led to a delayed hash rate drawdown due to sustained high fees from Runes, which incentivized some miners to stay online.

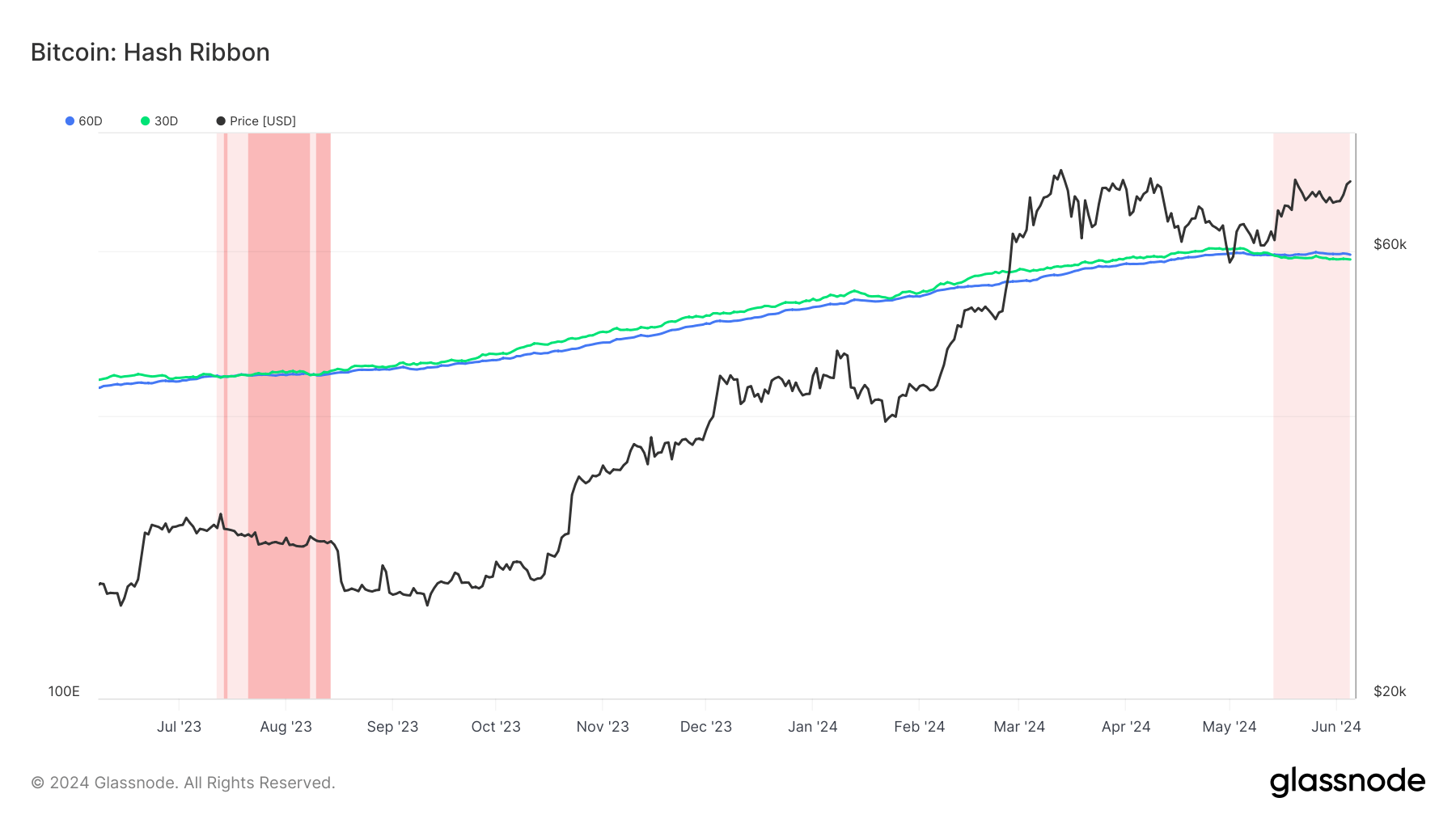

CryptoSlate reports that the hash rate recently experienced the most significant seven-day decline since 2021. Although the hash price has risen from its May 1 lows, it has compressed significantly since the halving. The hash ribbon indicator suggests ongoing miner capitulation, now over three weeks in, with expectations for several more weeks of similar trends.

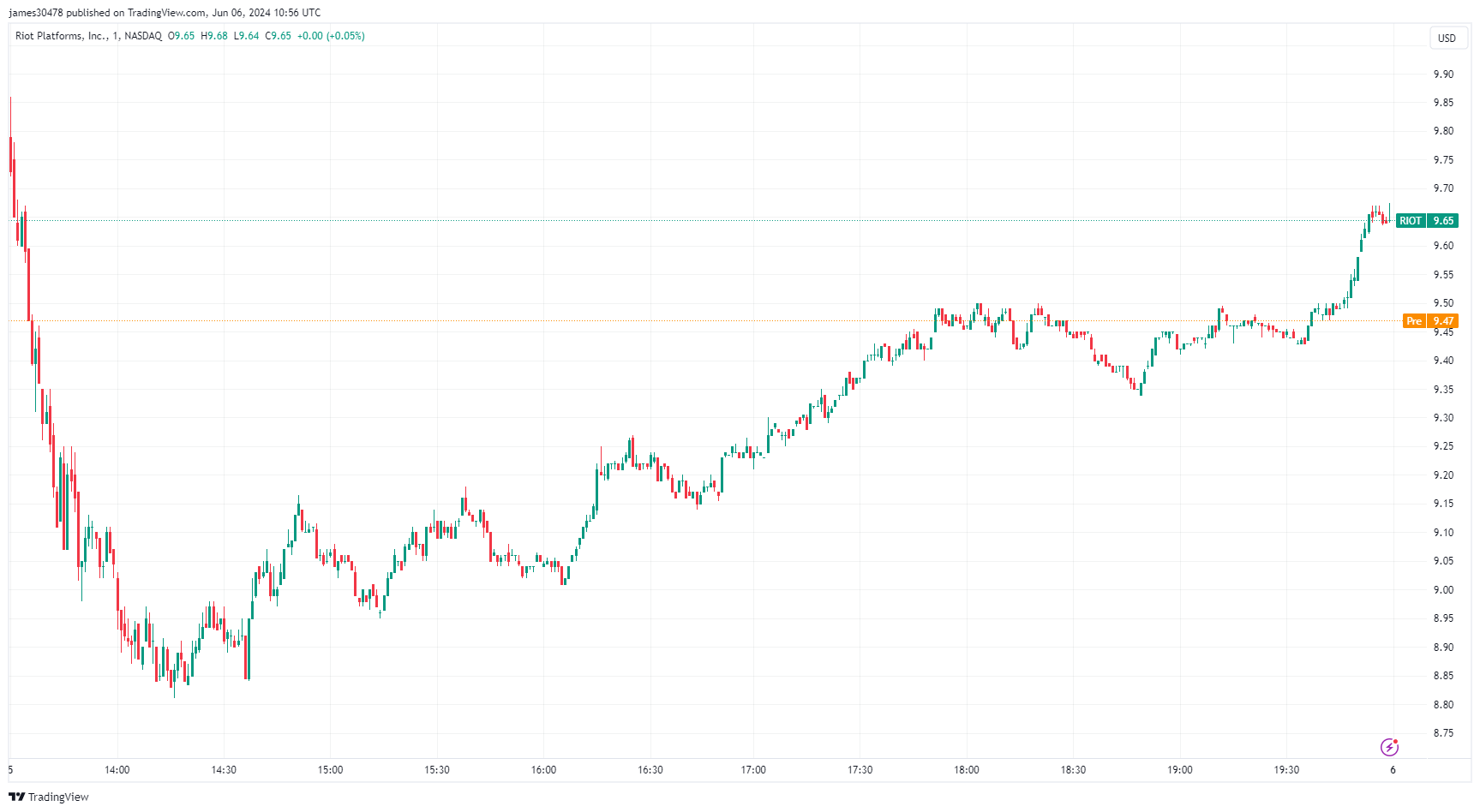

Amid these developments, Kerrisdale Capital has taken a short position on Riot stock, criticizing Bitcoin mining. Riot’s shares dropped by as much as 10% on June 5 following the announcement but later recovered most of the decline.

These conditions highlight the current challenges within the Bitcoin mining industry as miners navigate post-halving adjustments.

Farside Investors

Farside Investors