Binance’s market dominance wanes with regulatory woes and futures market shifts

Binance’s market dominance wanes with regulatory woes and futures market shifts Quick Take

Binance, a dominant player in the cryptocurrency exchange market, has seen a notable downturn in its transaction volume over the past year.

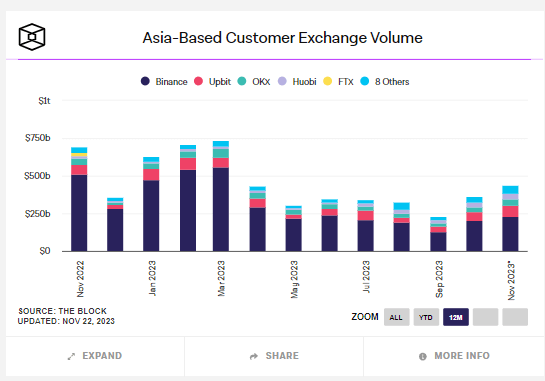

In November 2022, the exchange handled approximately $500 billion in monthly volume. However, according to The Block, by November 2023, this number has fallen sharply to $230 billion. Regulatory pressures have intensified, with the Department of Justice imposing a multi-billion dollar fine, prompting Binance to employ a three-year monitor to oversee compliance.

This downward trend also extends to Asia-based volume, where Binance has seen its numbers halved, with competitors such as Upbit and OKX closing in.

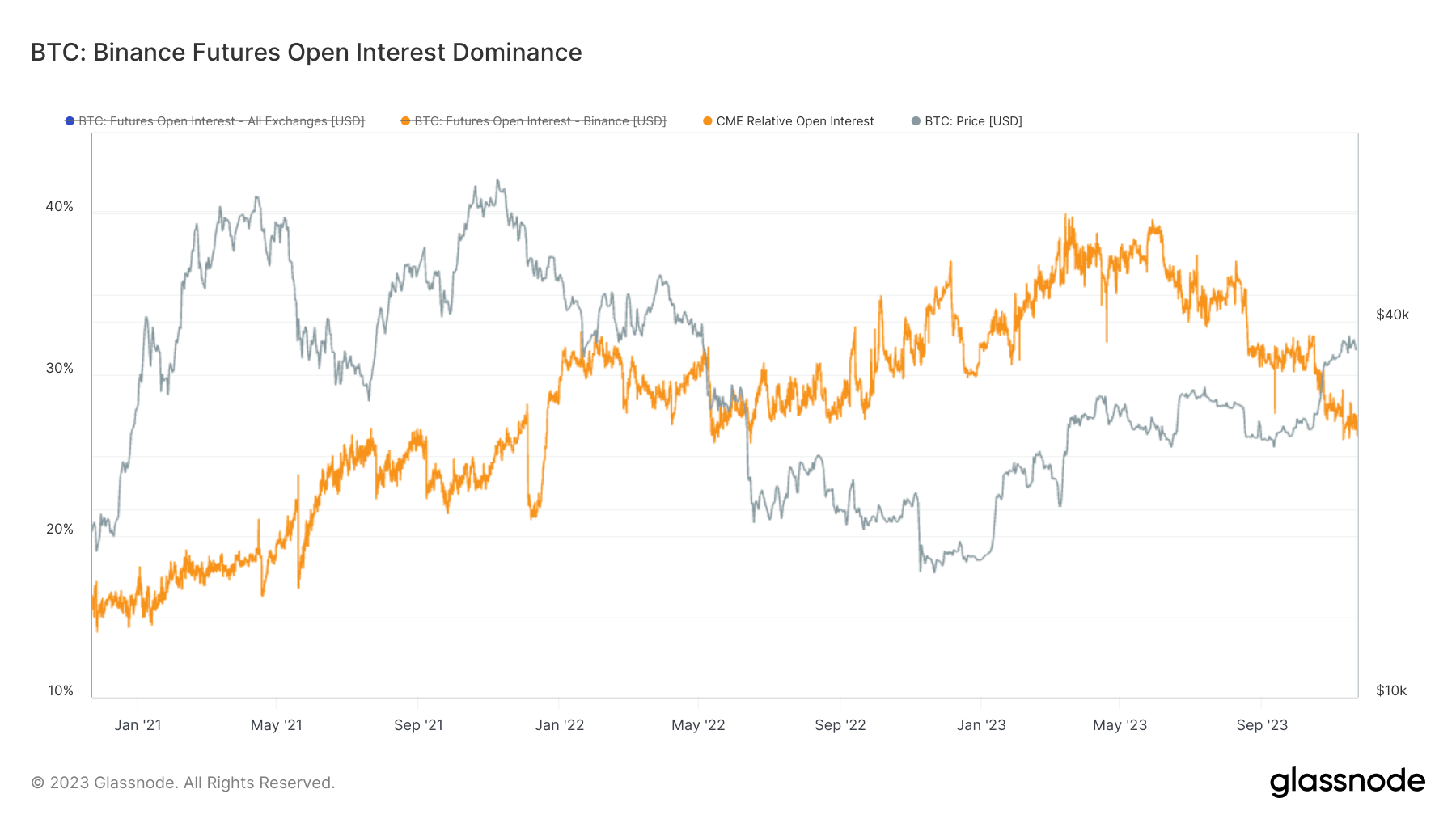

Furthermore, Binance’s share of the futures market has equally suffered a blow, with the Chicago Mercantile Exchange (CME) taking the lead. Binance currently holds 26% of the market share, marking its lowest point since December 2021.

These developments suggest a further contraction in Binance’s market share, potentially exacerbated by the recent fines and compliance demands. This shift may have broader implications for the distribution of cryptocurrency transactions among major exchanges.

Farside Investors

Farside Investors