COSS Platform to Expand Beyond Bitcoin and Ethereum Pairs

Photo by Antoine Rault on Unsplash

The COSS platform has taken one step closer to becoming a multifunctional crypto gateway, with this month’s latest roadmap release is expected to mark the start of first cross-border fiat to crypto pairing with the support of USD, EUR, and SGD currencies.

Crypto One Stop Solution, otherwise known as COSS, aims to become the Swiss army knife of the crypto marketplace. For now, the main function of COSS is operating as a centralized profit sharing exchange and payment gateway. However, the platform’s roadmap unveils optimistic plans for the companies expansion into crowdfunding, prepaid cards, smart contracts, and remittances.

Currently, COSS is the 134 largest exchange, boasting $1.1 million in daily volume and operating under a profit-sharing model in which users receive 50% of their exchange fees in payouts.

Much like Kucoin, COSS’s primary competitor, these profits are distributed weekly at a proportional rate across all the supported tokens, meaning tokens with high trading volumes will yield great payout.

However, unlike Kucoin, COSS’ payout is handled by a Decentralized Automated Organization in which payouts are locked at a rate of 50% and will remain constantly fixed even as the platform grows.

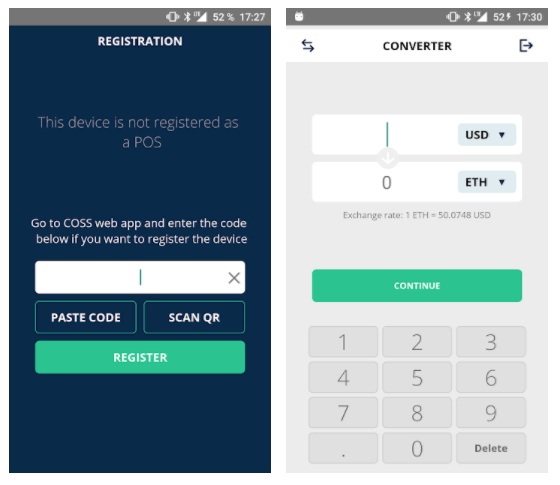

This profit sharing model, in combination with a referral program, directly incentives users to aid in the growth of the platform as greater trade volume yields higher global payout rewards. In addition to their exchange, COSS provides an online payment gateway allowing websites and digital merchants to accept cryptocurrencies, as well as a Point of Sale solution that allows over the counter transactions through iOS and Android devices, enabling a hassle-free crypto payment experience.

Rocky Start Has Stifled Early Adoption

While the growth of the COSS project appears to have stagnated since release, this can be largely attributed to the team’s lack of social media presence and beta software engine. The platform’s exchange is still undergoing major UI and functionality updates, and as such COSS does not wish to allocate any other budget to a marketing team when such funds could be better used elsewhere.

This prioritization of funds is a direct result of its lackluster ICO, netting only $3 million of the $50 million goal, leaving the COSS team on the back foot since day one. However, according to the most recent bi-weekly update, the team is “on track for KYC and FIAT trading to be online by the end of April”.

One of the main obstacles has been providing a reliable high throughput KYC implementation due to the platforms unique operational status:

“We had to set up legal entities in various countries because of the different operational jurisdictions. This allows us to work directly with the local banks, but has also resulted in tedious due diligence procedures from the payment gateways and banks”

Once KYC functionality comes online, COSS will be one of the only platforms providing a fiat based exchange in both USD and EUR, presenting a unique opportunity to prospective investors that is sure to bring an increase in trading volume.

With planned expansions into Mastercard enabled cryptocurrency payment solutions and international remittance, the COSS platform positions itself in an excellent foothold to expand as a cross-border multi-solution provider.