Bitcoin’s correlation with gold is critical as fears of a stock market collapse grow

Bitcoin’s correlation with gold is critical as fears of a stock market collapse grow Bitcoin’s correlation with gold is critical as fears of a stock market collapse grow

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

As the pandemic continues spreading and the stock market keeps climbing, investors are growing increasingly fearful that a collapse is imminent. This is leading some to turn to so-called “safe haven” assets like gold and even Bitcoin.

One prominent economic advisor is now noting that there are several “worrying signs” currently plaguing the market.

This has led him to caution investors against buying stocks that are “stunningly decoupled” from reality.

All eyes are on Bitcoin and gold as fears of a stock market collapse grow

The ongoing pandemic has created a cataclysmic decline in employment across the globe, forcing central banks to fire off their money printers at an unprecedented rate.

Bitcoin investors and “gold bugs” alike have both rallied behind this as a reason for why investors should place a greater emphasis on “hard assets” that are underpinned by scarcity.

Gold has established itself as a safe-haven asset over several decades, but whether or not Bitcoin is able to perform well during a macroeconomic downtrend may soon be put to the test.

Mohamed El-Erian, the former CEO of Pimco and chief economic advisor at Allianz, explained in a recent op-ed that there are some worrying signs in the stock market that he is closely watching.

He points to rising corporate bankruptcies, households falling behind on mortgages and rental payments, and other factors as grim signs for what could come next.

He also advised that investors shy away from assets that are “stunningly decoupled” from reality.

“Rather than buying assets at valuations stunningly decoupled from underlying corporate and economic fundamentals, investors should think a lot more about the recovery value of their assets,” he said.

BTC’s correlation to gold suggests it may perform well during a prolonged equities decline

Although Bitcoin failed to live up to its status as a safe-haven during late-February and early-March, it has yet to trade against the backdrop of a prolonged economic downtrend.

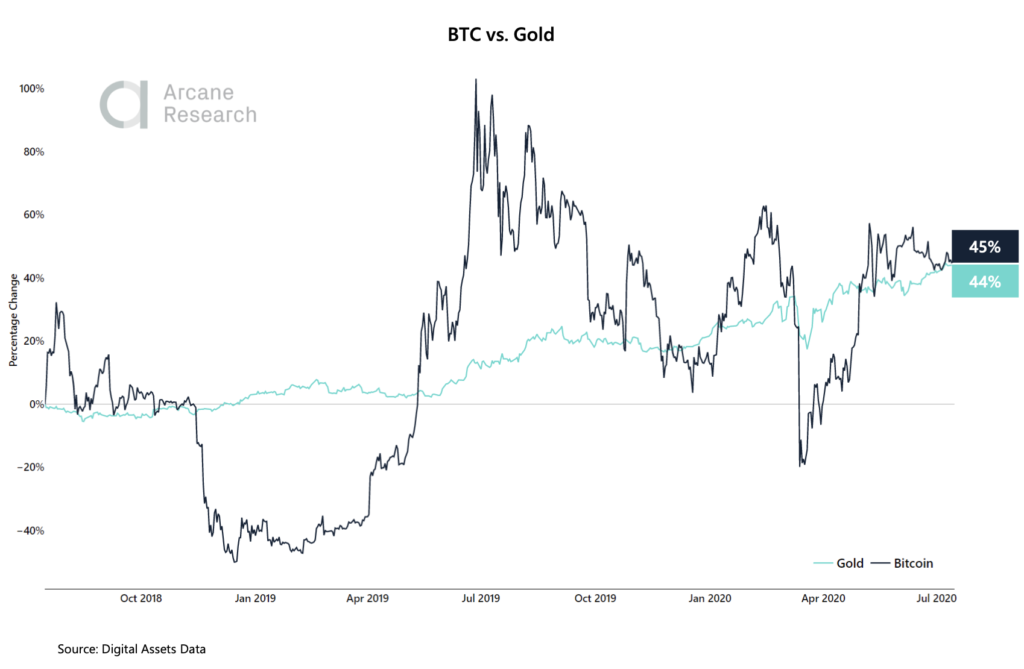

According to a recent report from Arcane Research, despite BTC being incredibly more volatile than gold, the two assets have provided investors with similar returns throughout the past two years.

“Looking at a two-year window, bitcoin have more or less the same return as gold but has been significantly more volatile.”

If the benchmark cryptocurrency can continue providing investors with a similar return to gold in the months ahead, it could significantly outperform equities – assuming they enter a prolonged corrective phase.

Farside Investors

Farside Investors