Colorado’s Digital Token Act Provides Securities Exemptions to Businesses Leveraging Utility Tokens

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Colorado is becoming a “hub” for startups looking to use blockchain technology to power their business models. The recently signed-into-law Digital Token Act will exempt utility tokens from certain state securities regulations and make it easier for startups to raise growth capital, crowdfund via cryptocurrency, and sell utility tokens in a clearer and more compliant way.

The Colorado Digital Token Act will exempt utility tokens from certain state and federal securities regulations and make the state a friendlier place for blockchain companies looking to leverage the promising technology. The technology, as described by the bill:

“Blockchain technology has the potential to create new forms of decentralize ‘web 3.0’ platforms and applications that have advantages over current centralized internet platforms and applications.”

Solving Regulatory Uncertainty Around Utility Tokens

The impetus of the bill, according to the authors, is that blockchain companies face regulatory uncertainty, especially around the sale and issuance of tokens. These tokens provide growth capital and crowdfunding opportunities. According to the text of the bill.

“[The Colorado Digital Token Act] will enable Colorado businesses that use cryptoeconomic systems to obtain growth capital and help grow and expand their businesses, thereby promoting the formation and growth of local companies and the accompanying job creation and helping make Colorado a hub for companies that are building new forms of decentralized ‘web 3.0’ platforms and applications.”

According to the bill, current state securities laws may impede the use of cryptocurrency that is “consumptive in nature,” tokens which provide “goods, services, or content”—or, in other words, utility tokens.

Legislation Argues Utility Tokens Aren’t Securities

Previously in Colorado, it was unclear whether cryptocurrency, in all circumstances, would be treated as a security. This uncertainty made it more difficult for crypto companies to offer their services and do business in the State.

Based on text from the bill, utility tokens are more akin to offering access to a good or service, and consequently should not be treated as an investment into a company:

“Digital tokens issued to provide access to an amount of a company’s product or service is consumptive in nature, and would not typically be treated as an investment if it is not tied or linked to the future profits and earnings of the company.”

That said, the bill is not free reign for companies to create and trade “speculative” cryptocurrencies that construe themselves as “investment” into a company. There is a list of requirements to qualify as a “consumptive” token:

- Will need to file a notice of intent with the state’s securities commissioner,

- The good, service, or content is available at the time of sale, or all of the below:

- The good, service, or content is available within 180 days from date of sale;

- The buyer of the token is prohibited from reselling or transferring ownership;

- The buyer provides “knowing and clear acknowledgment” that the token is not an investment.

Bill Takes Effect August of 2019

Exciting day for #blockchain technology. @GovofCO @jaredpolis signed the #Digital Token Act today with key legislators, Attorney General @pweiser, and #Colorado cabinet members Patty Salazar with @DORAColorado, @BetsyMarkey with OEDIT, and @TheresaSzczurek of @OITColorado. pic.twitter.com/erOEloEdpy

— TheresaSzczurek (@TheresaSzczurek) March 7, 2019

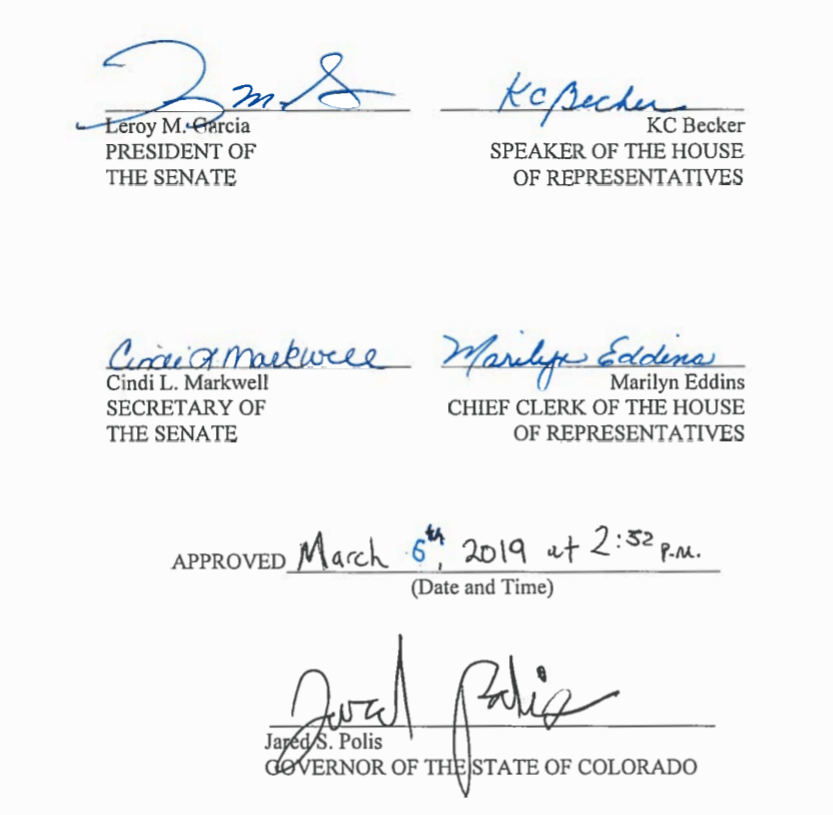

As of Mar. 6th, the bill was signed by the governor of Colorado, Jared Polis, State attorney general Phil Weiser, and president of the Colorado Senate Leroy Garcia.

State bills such as the Colorado Digital Token Act provide much needed regulatory clarity for companies operating in the blockchain and cryptocurrency industry. The legislation is a step forward in establishing what constitutes a “speculative” crypto investment and what qualifies as a “consumptive” utility token that represents the rights to a good or service.

As regulators better define these boundaries, it will enable companies to better leverage the potential of distributed ledgers and cryptocurrencies and consequently allow companies to more easily build and innovate in the space.

The bill is scheduled to take effect beginning Aug. 2nd, 2019.

Farside Investors

Farside Investors

CoinGlass

CoinGlass