FTX court filing reveals $7B in assets as firm aims to complete bankruptcy process by second quarter 2024

FTX court filing reveals $7B in assets as firm aims to complete bankruptcy process by second quarter 2024 FTX court filing reveals $7B in assets as firm aims to complete bankruptcy process by second quarter 2024

The court filings showed that more than 75 firms are bidding for FTX or its assets as the company undergoes radical restructuring.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

FTX is eyeing the completion of its bankruptcy process for the second quarter of next year, according to its Sept. 11 court filings.

As per the filing, the firm is currently involved with ongoing negotiations and mediation with stakeholders over the coming months to resolve open plan issues involving its bankruptcy plans. FTX also revealed that more than 75 firms, including existing crypto exchanges and financial and strategic buyers, have shown interest in it.

The exchange said it began a marketing process for the FTX.com and FTX US exchanges in May. According to the company, the FTX restart process considers varying potential structures, including an acquisition, merger, recapitalization, or other transactions to relaunch the FTX.com and/or FTX US exchanges.

Meanwhile, it further disclosed a comprehensive summary of its assets in a recent court submission, showing approximately $7 billion worth of assets, encompassing cash holdings, cryptocurrency, brokerage, reclaimed government assets, and various recovery endeavors.

Solana dominates FTX crypto holdings

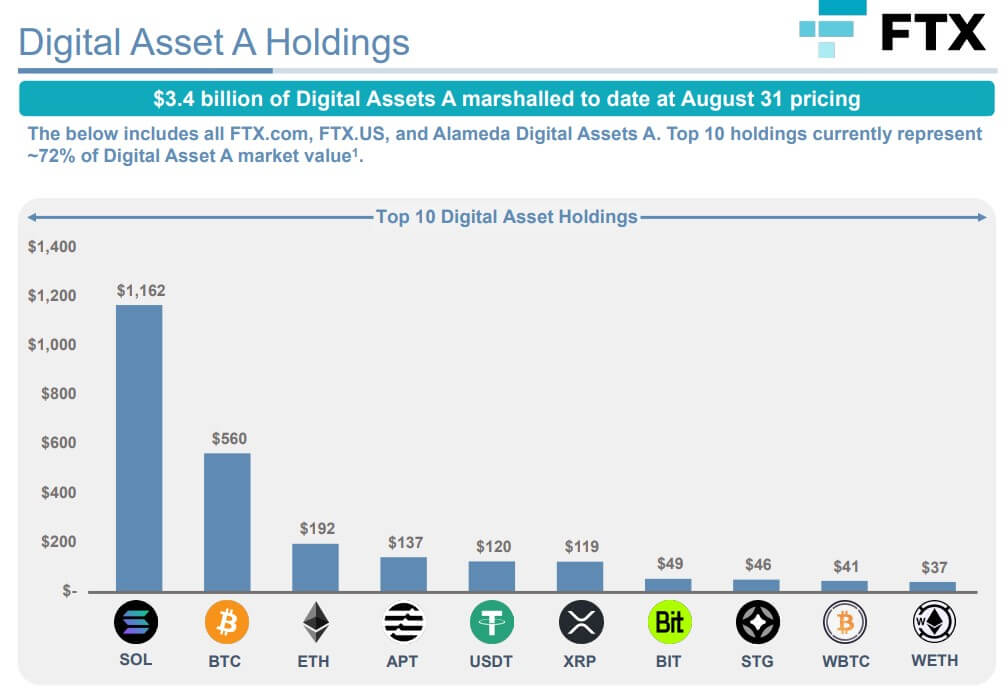

Per the filing, the embattled cryptocurrency company currently possesses a diverse portfolio of digital assets valued at $3.4 billion, with its top 10 holdings accounting for roughly 72% of this valuation.

This portfolio includes $1.16 billion in Solana (SOL), $560 million in Bitcoin (BTC), $192 million in Ethereum (ETH), and $119 million in XRP.

The filing also showed that the firm had hundreds of millions of dollars worth of over 1,300 lesser-known assets “that fail to meet liquidity thresholds and are primarily controlled by it.” Some of the assets in this class include MAPS, Serum (SRM), Bonfida (FIDA), etc.

CryptoSlate previously reported that the bankrupt firm is seeking court approval to allow it to liquidate up to $100 million worth of digital assets weekly, with the ability to increase the limit to $200 million temporarily.

$4.5B worth of venture investments

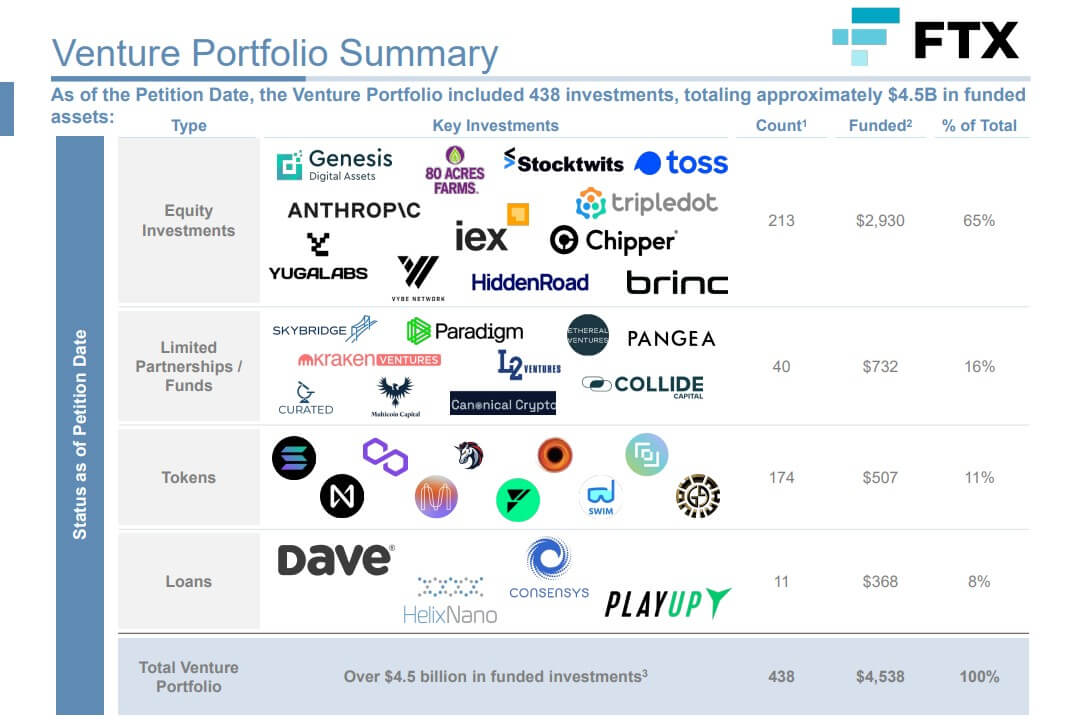

The court filing further showed that FTX had 438 venture investments, totaling approximately $4.5 billion in funded assets.

These investments included equity investments in firms like Yuga Labs, Chipper, Toss, Genesis Digital Assets, etc. It also revealed a partnership with major investment firms such as Kraken Ventures, Skybridge, Paradigm, etc.

Other assets

The filing revealed that the bankrupt firm possesses 38 Bahamian properties, encompassing condominiums, penthouses, and other real estate assets, with an estimated total value of approximately $200 million.

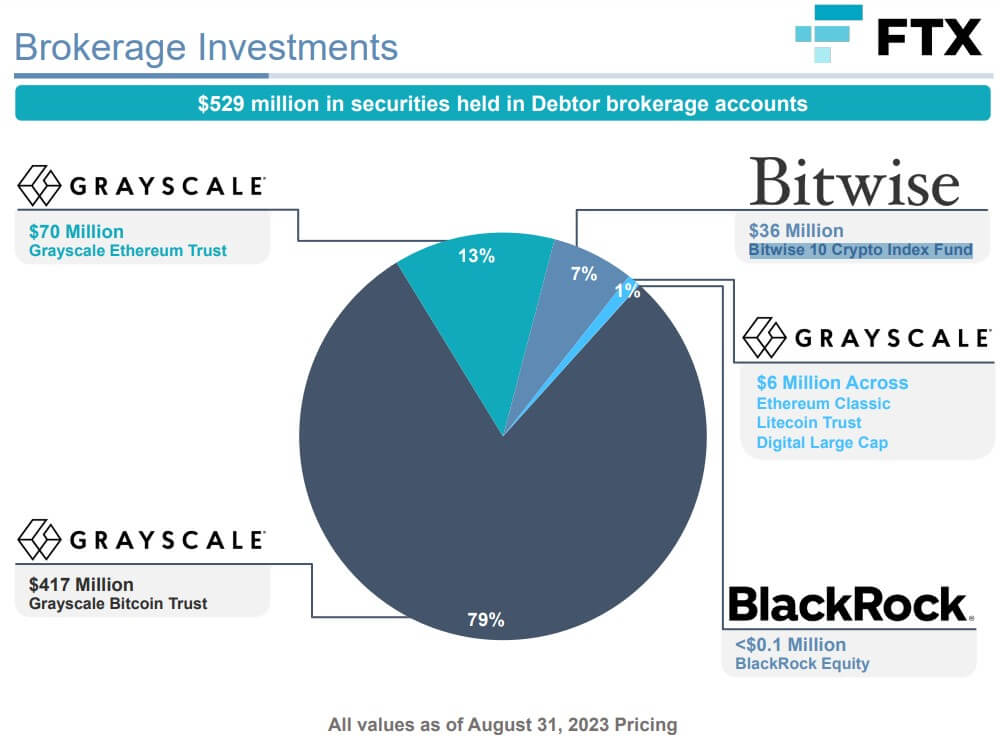

Additionally, the company maintains a significant securities portfolio valued at $529 million, primarily held in brokerage accounts with prominent crypto investment firms such as Grayscale, Bitwise, and BlackRock, the world’s largest asset management company.

A detailed breakdown of these securities holdings indicates that $493 million is invested in various Grayscale products, including their Bitcoin and Ethereum trusts. Furthermore, the firm has allocated $36 million to the Bitwise 10 Crypto Index Fund and has a smaller investment of less than $100,000 in BlackRock’s equity offerings.

CoinGlass

CoinGlass

Farside Investors

Farside Investors