Coinbase custodies 2.27 million BTC, representing 10.83% of Bitcoin’s supply

Coinbase custodies 2.27 million BTC, representing 10.83% of Bitcoin’s supply Quick Take

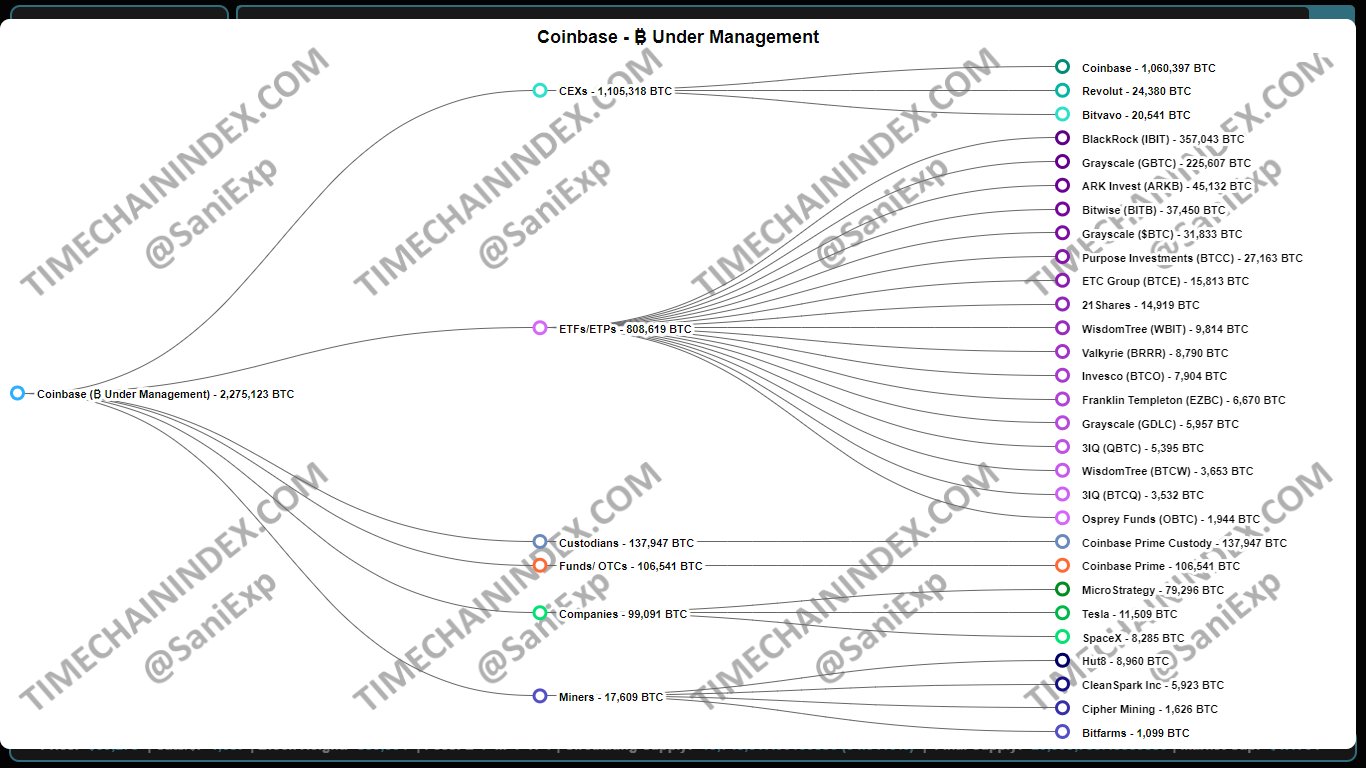

According to an X account, Sani, the founder of TimeChainIndex.com, the Coinbase group currently custodies a total of 2,275,123 BTC, representing approximately 10.83% of Bitcoin’s maximum supply of 21 million. The chart compiled by TimeChainIndex highlights the breakdown of these assets across various sectors.

Centralized exchanges (CEXs) hold a significant portion, with 1,105,318 BTC. Coinbase’s retail exchange alone has over 1 million BTC, with additional holdings from Revolut and Bitvavo. The second-largest category, ETFs/ETPs, accounts for over 808,000 BTC, consisting mainly of US ETFs, which control a significant share of Bitcoin held by investment products.

Coinbase Prime Custody, a specialized service for institutional-grade asset storage, safeguards 137,947 BTC. Meanwhile, Coinbase Prime’s broader services, including liquidity access and trading tools, account for 106,541 BTC through funds and over-the-counter (OTC) services.

Corporations such as MicroStrategy, Tesla, and SpaceX collectively hold over 99,000 BTC, with MicroStrategy leading the pack.

According to an X post by “level39,” MicroStrategy disclosed in a February 2023 10-K filing that it holds its Bitcoin across multiple custodians, including Fidelity, to enhance the security and diversification of its assets.

Finally, miners, including companies like Hut 8, CleanSpark, Cipher Mining, and Bitfarms, hold around 17,609 BTC.

This data emphasizes Coinbase’s significant role in Bitcoin custody, potentially opening up to centralization concerns.