Bitcoin dumps $2,400 after setting $67,000 high

Bitcoin dumps $2,400 after setting $67,000 high Bitcoin dumps $2,400 after setting $67,000 high

Traders sold the world’s largest cryptocurrency en masse as it broke all-time highs yesterday.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

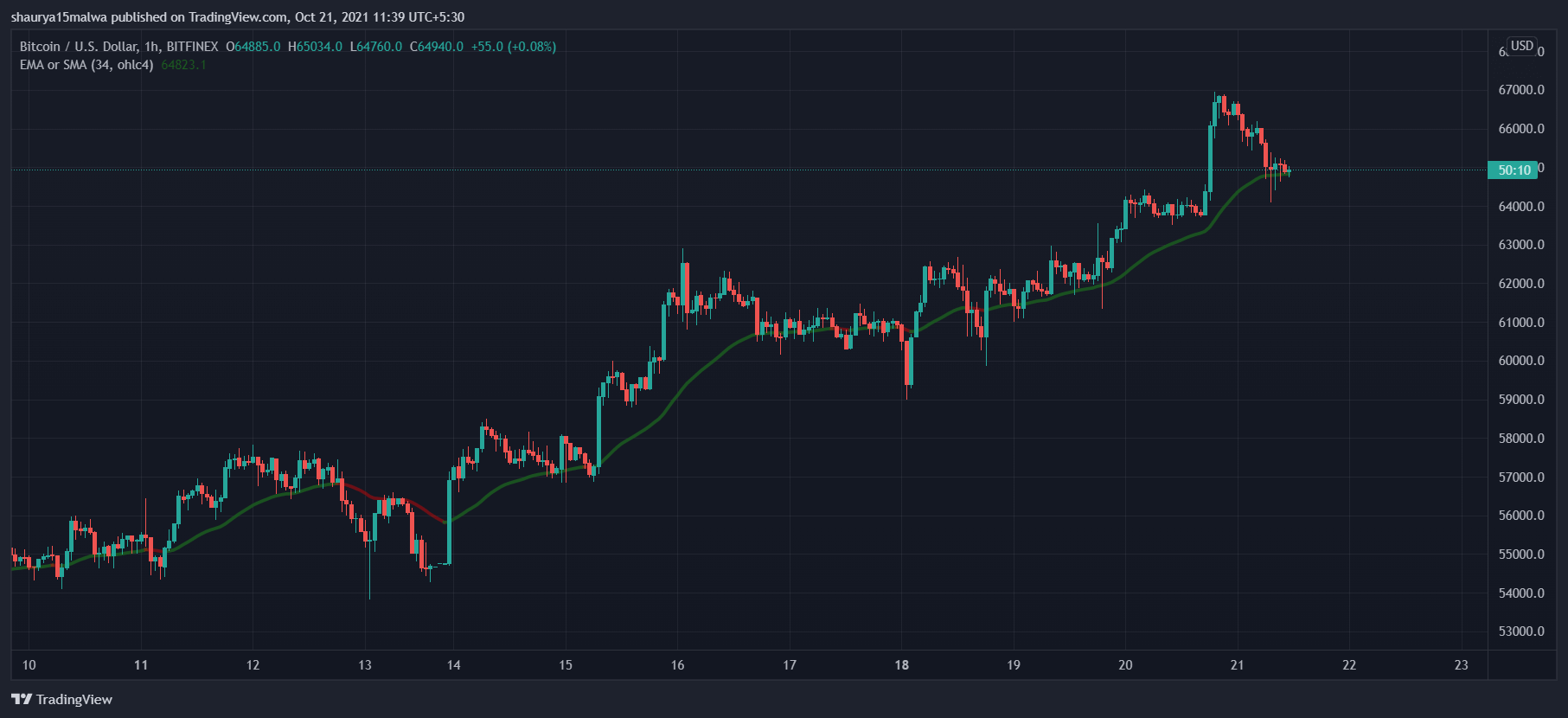

Bitcoin (BTC) dumped nearly $2,400 this morning after setting an all-time high of $67,000 last night, data from multiple sources showed.

The all-time high break came on the back of a futures exchange-traded fund (ETF) going live on Tuesday and seeing over $500 million worth of Bitcoin exposure offered on the first day of its trading.

But traders stepped in this morning to take profits on their gains—sending Bitcoin down by several hundreds of dollars.

Bitcoin sets all-time high

Starting late last evening, Bitcoin saw a sell-off from the $66,964 price level to as low as $64,100 this morning. It saw support at its 34-period moving average—an indicator used by traders to identify market trends based on historic movements—with traders keeping the asset above the $64,800 price level in the past hours.

The move caused over $220 million worth of futures liquidations, data from analytics tool Bybt shows. ‘Liquidations,’ for the uninitiated, occur when leveraged positions are automatically closed out by exchanges/brokerages as a safety mechanism.

The largest single liquidation order happened on Bitmex, a Bitcoin trade valued at $10 million. 66% of all liquidations took place on shorts, or traders betting against rising prices, with crypto exchange FTX accounting for $58 million in Bitcoin futures liquidations alone.

Meanwhile, the Bitcoin sell-off put a brief stop to what was a green surge across the crypto markets last night.

Ethereum jumped 8.9% in the past day to over $4,191 this morning, just $125 away from its May 2021 all-time high. Competitors Solana and Cardano saw gains of 17% and 7% respectively, with ‘digital silver’ Litecoin seeing a 12% price increase.

Arkham Intelligence

Arkham Intelligence