Binance withdrawals spike to $1.4B in 24 hours amid continued executive departure and regulatory struggles

Binance withdrawals spike to $1.4B in 24 hours amid continued executive departure and regulatory struggles Binance withdrawals spike to $1.4B in 24 hours amid continued executive departure and regulatory struggles

Another top executive resigned from their position at the embattled cryptocurrency platform.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

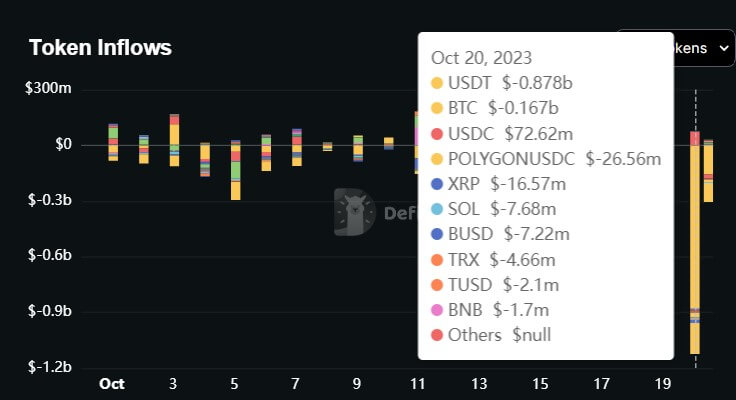

Binance, the largest crypto exchange by trading volume, has endured more than $1 billion of net outflows in the past 24 hours, according to DeFillama CEX’s transparency dashboard. The outflows are coming on the heels of the exit of another top executive from the crypto trading firm.

According to DeFillama’s data, Binance endured $1.4 billion in net outflows during the last 24 hours. A breakdown of the withdrawn assets shows that it comprised mainly $878 million in Tether’s USDT stablecoin and $167 million in Bitcoin (BTC). Other assets, including Solana (SOL), Tron (TRX), BUSD, and XRP, also recorded sizeable outflows during the reporting period.

Notably, this corroborates a CryptoSlate Insight report that stated that around $150 million worth of the top cryptocurrency had left Binance recently amid BTC on exchange balance plunging to a year-to-date low of 2.3 million.

Meanwhile, these outflows significantly pale to what the exchange has handled in the past. Earlier in the year, reports emerged that the exchange had processed around $12 billion in outflows following the FTX collapse of last year.

Binance’s crypto wallets hold $57 billion worth of digital assets, according to DeFillama data.

Staff exodus amid regulatory struggles

Over the past week, the staff exodus at Binance continued with the resignation of the exchange’s French subsidiary director, Stéphanie Cabossioras.

Binance France President David Prinçay confirmed the exit in an Oct. 19 post on social media platform X (formerly Twitter).

Cabossioras’s exit continued a trend that has seen more than five top-level executives leave the exchange this year, including its chief strategy officer, Patrick Hillmann, senior vice president for compliance, Steven Christie, general counsel Han Ng, and director of investigations, Matthew Price.

Aside from that, the exchange regulatory issues have continued unabated, with a Brazilian congressional committee recently asking for the indictment of Binance CEO Changpeng Zhao and three other company executives for engaging in fraudulent management, offering or trading of securities without previous authorization, and operation of a financial institution without authorization.

In other jurisdictions like the United States, the cryptocurrency exchange is currently battling legal actions from two regulatory authorities, including the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), who both allege that the platform has violated federal laws with its operations.