MakerDAO Votes to Raise Ethereum-backed Loan Interest Rate by 2.0 Percentage Points

MakerDAO Votes to Raise Ethereum-backed Loan Interest Rate by 2.0 Percentage Points MakerDAO Votes to Raise Ethereum-backed Loan Interest Rate by 2.0 Percentage Points

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

MakerDAO, a decentralized autonomous organization that provides crypto collateralized loans, voted to raise interest rates from 1.5 percent to 3.5 percent. The vote is a continuation of two February rate increases in an attempt to curb its Ethereum-backed stablecoin, Dai, from trading below its $1.00 peg.

As Dai continues to trade below its $1.00 peg, holders of Maker (MKR) on Mar. 8th have once again voted to increase interest rates to its loans. The interest rate was increased from 1.5 percent to 3.5 percent. And, if Dai does not stabilize at $1.00, the interest rate will be increased again to 5.5 percent.

Background on Maker’s Loans

Maker is an open platform that provides collateralized loans through a series of smart contracts and oracles, giving users access to credit without a centralized point of control.

Users obtain these loans by locking their Ethereum in a smart contract. In return, users receive Dai, a stablecoin which represents a pool of all ether locked in the platform. Dai is soft-pegged to $1.00 based on the locked-up ETH. Users can then sell Dai for fiat or use it as leverage by trading it for more cryptocurrency.

Currently, users can obtain up to 60 percent of the value of their ether in Dai. If the ratio between collateral and the loan amount provided falls below this 60 percent ratio, then the position is automatically liquidated; consequently, it is often prudent to take loans below this maximum ratio to decrease the chance of automatic liquidation.

To repay the loan and retrieve the locked Ethereum the user must repay the Dai they received in addition to a stability fee, an annual interest rate charged to borrowers to compensate participants who maintain the stability of the system.

How Dai Maintains Its Peg

When Dai is trading below $1.00, users are incentivized to purchase Dai (at a discount from its $1.00 peg) to repay their loans. When Dai is trading above $1.00, Ethereum holders are encouraged to use their holdings as collateral for Dai, allowing them to engage in arbitrage and get more than the current value of their collateral.

When Dai consistently trades above or below these rates, more drastic changes are required. In these circumstances, the stability fee is adjusted up to encourage borrowers to repay their loans—increasing the price of Dai as it is taken out of circulation for loan settlement—or adjusted down to encourage Ethereum holders to obtain loans, increasing the supply of Dai and decreasing its price.

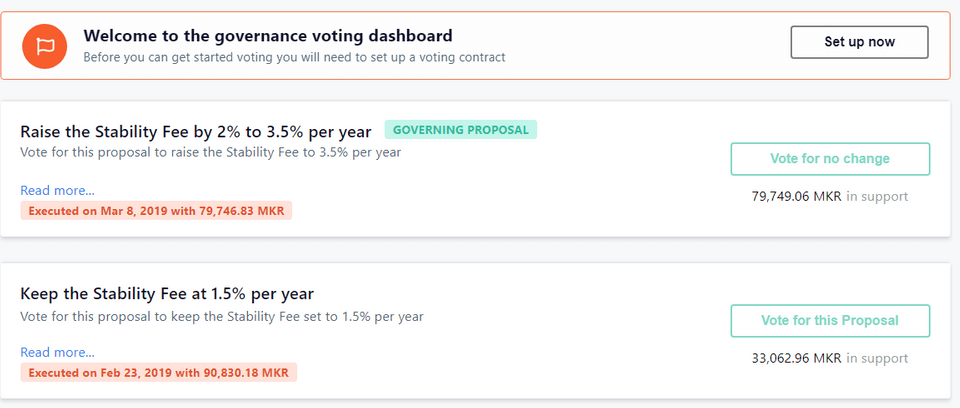

MakerDAO Votes to Increase Interest Rates

One of the advantages of Maker, when it started, was its highly-competitive annual interest rate of 0.5 percent. However, this was unsustainable and the price of Dai began to fall below its $1.00 peg as users in-mass locked up their ether, in exchange for Dai. So far, a whopping 2.0 percent of the total Ethereum supply is locked up in Maker contracts.

In February, the holders of MKR voted to increase interest rates twice, raising interest rates from 0.5 percent, to 1.0 percent, to 1.5 percent. Yet, in a report to the community, the team stated that there was “no attributable impact” on Dai’s price from the previous interest rate increases with prices still hovering between $0.975 to $0.985 in the last 1-2 months.

“Informal discussions with several large Dai market makers have suggested that inventory levels have run high, and balance sheet capacity has diminished. Informal polling through various community channels has also shown strong support for an increase,” according to the report.

As a result, on Mar. 8th holders of MKR voted to raise interest rates again by 2.0 percent to 3.5 percent in another attempt to curtail Dai trading below its peg. If Dai continues to trade below its peg “as measured over the following 7 days, another proposal will be put forth for a subsequent 2% increase.”

Dai Market Data

At the time of press 2:37 pm UTC on Feb. 20, 2022, Dai is ranked #53 by market cap and the price is down 0.72% over the past 24 hours. Dai has a market capitalization of $85.74 million with a 24-hour trading volume of $23.44 million. Learn more about Dai ›

Crypto Market Summary

At the time of press 2:37 pm UTC on Feb. 20, 2022, the total crypto market is valued at at $206.45 billion with a 24-hour volume of $56.62 billion. Bitcoin dominance is currently at 65.51%. Learn more about the crypto market ›

Farside Investors

Farside Investors

CoinGlass

CoinGlass