Shifting sands: Japan and China’s decreasing holdings in U.S. treasury securities

Shifting sands: Japan and China’s decreasing holdings in U.S. treasury securities Quick Take

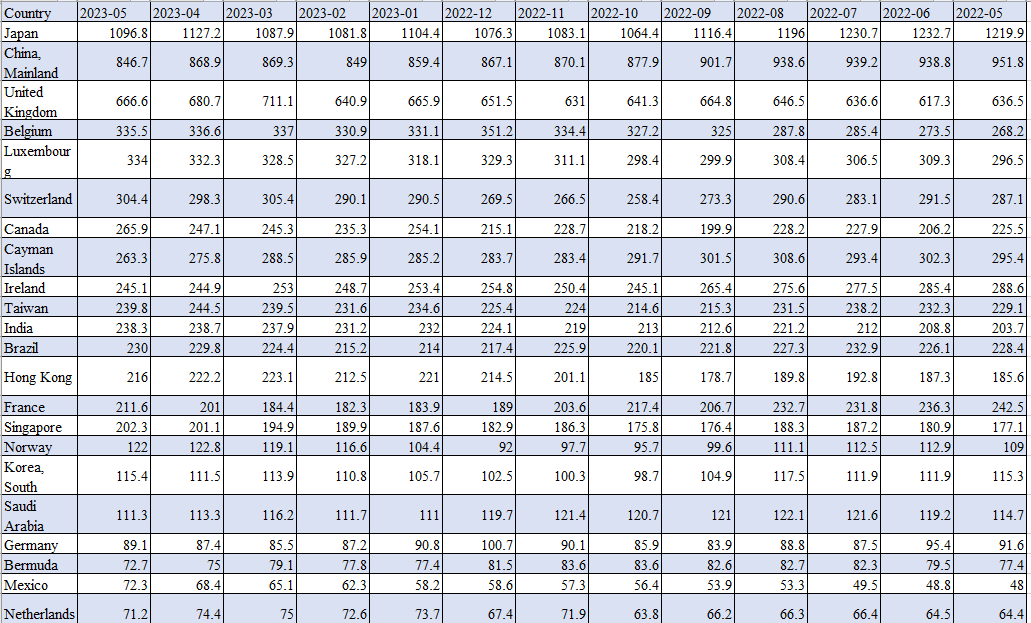

The U.S. Department of the Treasury publishes a monthly report known as the Treasury International Capital (TIC) report, which provides information on the holdings of U.S. Treasury securities by foreign countries.

Japan and China are traditionally the largest foreign holders of U.S. Treasury securities. These holdings are significant because they indicate these countries’ confidence in the U.S. economy. When Japan and China buy U.S. Treasury securities, they effectively loan money to the U.S. government and show confidence in the U.S. economy’s stability.

However, both Japan and China are continuing to decrease their holdings in U.S. Treasury securities, it could indicate various economic scenarios. It could be a sign that these countries are diversifying their foreign reserves away from the U.S. dollar or a signal of their decreasing confidence in the U.S. economy. It could also indicate domestic economic changes within Japan and China, causing them to sell off foreign reserves.

CoinGlass

CoinGlass

Farside Investors

Farside Investors