The Layer-2 Wars could be the next big trend in crypto leading up to The Merge

The Layer-2 Wars could be the next big trend in crypto leading up to The Merge The Layer-2 Wars could be the next big trend in crypto leading up to The Merge

DeFi analyst Dynamo DeFi presented the case for The Layer-2 Wars following last week's surge in L2 crypto prices

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

DeFi analyst and YouTuber Patrick Dynamo DeFi, highlighted Monday several exciting trends in the world of DeFi, including the rise of the “L2 wars.” Over the past week, revenue for Polygon, Optimism, and Arbitrum, popular scaling solutions for Ethereum, were up 36% – 54% following Ethereum’s price rally.

Another strong performer was Ethereum Name Service ($ENS). The .Eth hype has proven to be more resilient than many people predicted.

10/15 pic.twitter.com/gspvkLg1uL

— Patrick | Dynamo DeFi 🧨 (@Dynamo_Patrick) July 25, 2022

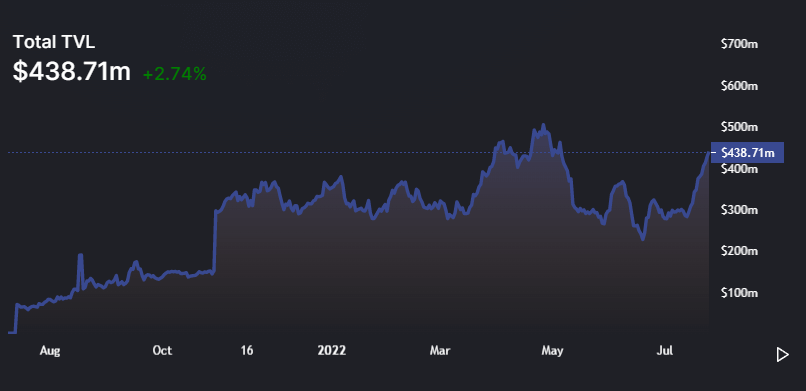

In the DeFi ecosystem, Optimism has been the stand-out player increasing the total value locked by almost 29%. The TVL is now pushing towards the all-time high of just over $500 million at $438 million. Curve supported the growth as it saw an influx of liquidity “increasing its TVL by 54.5%.”

The TVL growth was not limited to Ethereum, with Bifrost and Parallel growing their TVL by 33% and 11%, respectively. According to Dynamo DeFi, when the TVL of parachains is combined, Polkadot now has a TVL of over $1 billion.

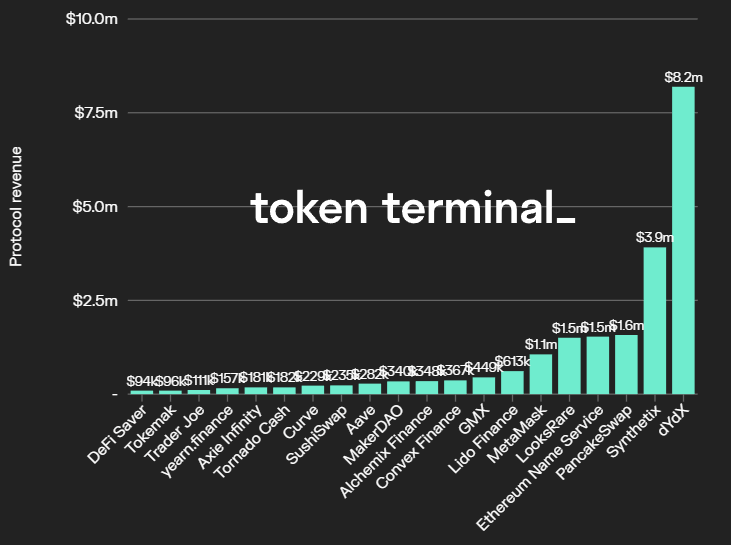

A statistic that is not often tracked is the revenue earned by DeFi protocols across crypto. While investors may often forget that DeFi companies generate revenue through transactions, it is integral to any successful project. The below chart showcases the revenues of the top DeFi protocols over the past week.

Revenue growth highlights a robust business model for the DeFi protocols that has thus far survived the bear market. The shake-out of overleveraged platforms has left DeFi in an arguably stronger position than at the start of the year.

Dynamo DeFi highlights Optimism as the stand-out performer in DeFi this week with growth in TVL, revenue, DEX volume, and transaction count. Optimism flipped Cronos in transaction count, growing 55% to 124,000 transactions compared to 108,000 on Cronos. Interestingly, Ethereum transactions dropped by 1%, while all layer-2s and other scaling solutions increased in transactional volume.

It’s worth noting here that across every stat I track, the growth of Optimism has stood out.

TVL, revenue, DEX volume, transaction counts. Optimism is showing strength across all of them.

14/15

— Patrick | Dynamo DeFi 🧨 (@Dynamo_Patrick) July 25, 2022

Leading up to The Merge, while the price of Ethereum may be rebounding, the utilization of layer-2 DeFi projects is also on the rise. A DeFi summer may not entirely be on the cards yet, but on-chain signals have been bullish for DeFi over the past seven days.

CoinGlass

CoinGlass

Farside Investors

Farside Investors