DEX tokens soar as trust in centralized exchanges is eroding

DEX tokens soar as trust in centralized exchanges is eroding DEX tokens soar as trust in centralized exchanges is eroding

Photo by Phil Botha on Unsplash

While the past week has been somewhat tumultuous, to put it mildly, for both crypto and stock markets, it looks like digital tokens related to decentralized exchanges (DEXs) are actually having a great time.

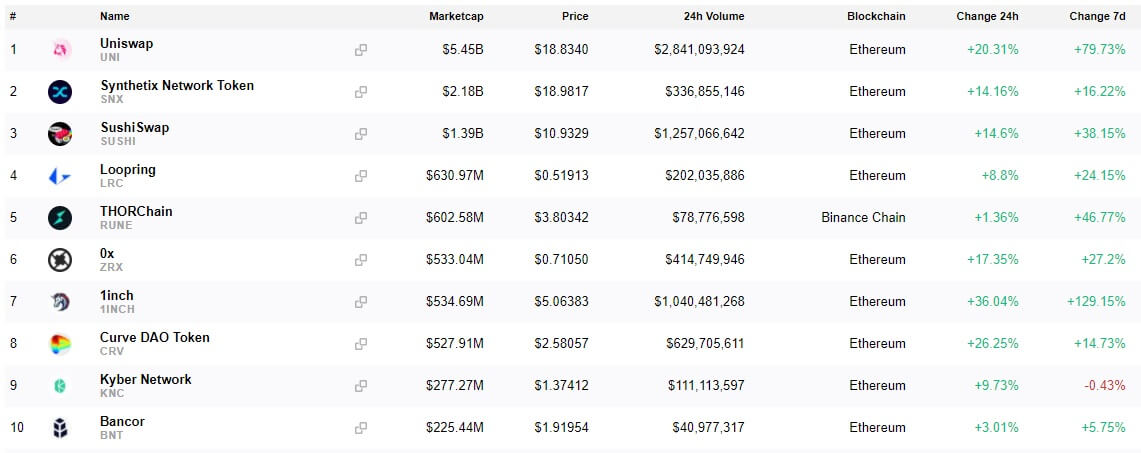

The sector is in the green across the board as most DEX tokens are up anywhere between 1.3% and 317% over the last seven days, according to CryptoSlate’s data.

Over the past week, DEX coins have been performing significantly better than CEX coins. Over the past 7 days:

CEX Coins ? + 7.56%

DEX Coins ? + 43.88%Dive deeper into each sector on CryptoSlate ?

CEX Coins ➡️ https://t.co/W7qSIer6Zn

DEX Coins ➡️ https://t.co/OPJuThMeA9 pic.twitter.com/wUGZgE3Xf6— CryptoSlate (@CryptoSlate) January 31, 2021

DEXs are crypto trading platforms that enable direct peer-to-peer transactions between traders. This means that all trades are executed based on their hardcoded algorithms without any intermediaries. This also means that DEXs can’t restrict trading whenever they feel inclined to do so—unlike some of their centralized counterparts (CEXs) that are owned and operated by certain entities.

While the DEX token sector’s dominance index remains relatively low at 1.35% by its market capitalization, many DEX-related assets saw steady growth over the past week. For example, UNI, the native governance token of widely popular decentralized finance (DeFi) platform Uniswap, is currently trading at around $18.83, up 20.3% on the day and 79.7% over the last seven days.

It is followed by Synthetix Network Token (SNX), SushiSwap (SUSHI), and Loopring (LRC), which saw their prices increase by 16.22%, 38.15%, and 24.15% over the week, respectively.

Overall, only four out of the 30 DEX tokens tracked by CryptoSlate—Kyber Network (KNC), Hegic (HEGIC), Polkastarter (POLS), and MCDEX (MBC)—ended up in the red over the 7-day period.

CEXs left in the dust

This growth is especially apparent in comparison to the centralized exchanges’ metrics. Over the last week, not that many CEX tokens have shown notable results, although there were some exceptions such as Catex Token (CATT, +1,122%), Tidex Token (TDX, +246%), and Voyager Token (VGX, +225%).

In terms of the overall sector change in seven days, DEXs lead with +43.88% while CEXs average price increase was limited to +7.56%.

Perhaps the general public’s attention has begun to turn towards decentralized trading platforms after witnessing the events that unfolded last week. When Reddit group WallStreetBets arguably scored a big win against Wall Street sharks—and on their own field—Robinhood has restricted the trading of GameStop’s stock (GME).

Notably, the exchange has only turned off retail traders’ ability to buy GME, impeding the stock’s price growth—at least on Robinhood’s platform. At the time, many users and experts argued that Robinhood’s decision could’ve easily been interpreted as an attempt to create a safety net for hedge funds’ short positions on GameStop—and put “the little guy” at a disadvantage.

As CryptoSlate reported recently, Robinhood’s actions could also have helped DeFi and cryptocurrencies to get more recognition.

Now would be a great time to explore a decentralized @RobinhoodApp ?

Oh wait, it already exists ?

Trade what you want, when you want. pic.twitter.com/Cd9e63GVOV

— Zerion ? (@zerion_io) January 28, 2021

Or could this be yet another echo of the “Elon Musk effect” in action? After all, Tesla CEO did hit that “Like” button on a tweet about a decentralized analogue of Robinhood. Is there anything he can’t pump?

CoinGlass

CoinGlass

Farside Investors

Farside Investors