Why liquidity of XRP in Mexico is surging after MoneyGram partnership

Why liquidity of XRP in Mexico is surging after MoneyGram partnership Why liquidity of XRP in Mexico is surging after MoneyGram partnership

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

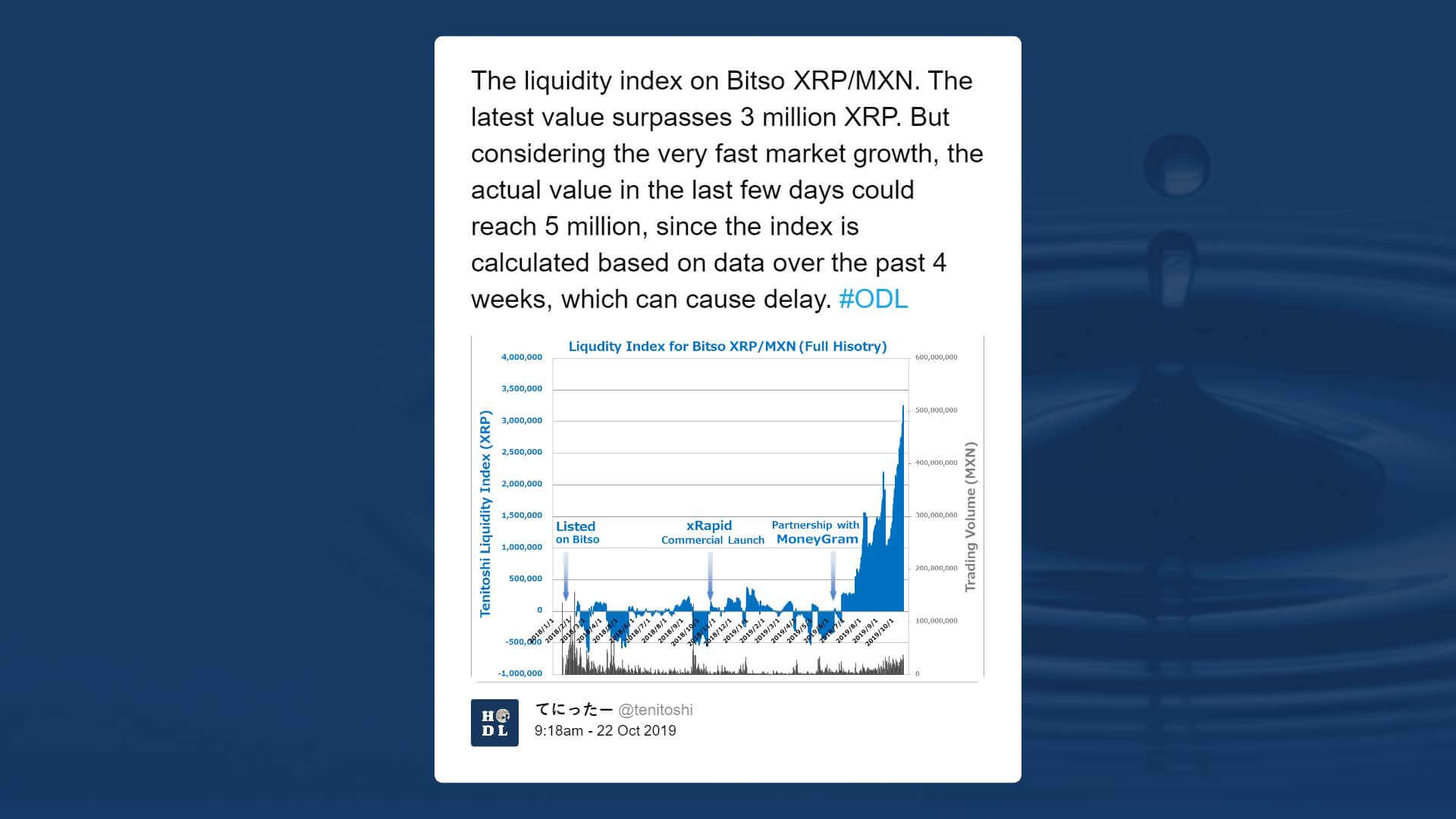

According to an analyst based in Japan, the liquidity of XRP in Mexico, specifically on Bitso, has increased significantly following the partnership between MoneyGram and Ripple.

Prior to the deal, the Tenitoshi Liquidity Index for XRP in Mexico was hovering in the negative, indicating that the volume of the cryptocurrency struggled to recover. The analyst said:

“In principle, market volume cannot be negative. But the calculation of the index sometimes outputs negative values undesirably. It tends to happen if a market is no liquid or very volatile. But those absolute values are negligibly small. So you can think of it as near-zero.”

Volume rising due to remittance usage

In June 2019, Ripple established a strategic partnership with MoneyGram, a major remittance service provider, to utilize XRP in processing international payments.

As a part of the deal, Ripple pledged to invest up to $50 million in the remittance company, anticipating that the partnership would increase the usage of the asset and the XRP Ledger as a settlement layer.

At the time, CEO Brad Garlinghouse stated that Ripple is not leveraging its investment to encourage MoneyGram to accelerate the adoption of the digtal asset.

Garlinghouse also noted, in an interview with Yahoo Finance, that the effect of the MoneyGram deal on the entire crypto market would be bigger than Libra, a cryptocurrency project led by a consortium based in Switzerland that was kickstarted by Facebook.

Based on the volume of the XRP-to-Mexican peso on major exchanges in Mexico like Bitso, it appears that the strategy of Ripple to work with remittance service providers to process payments using the cryptocurrency is working.

Ripple sees MoneyGram as a big catalyst for XRP

In August, Garlinghouse emphasized that MoneyGram will start using XRP to process Mexican peso and Phillippine peso pairings, and the increase in volume will likely be reflected starting the first quarter of 2020. He noted:

“It’ll start to ramp in Q4 but really we’ll start to see more consequential volumes in Q1.”

So far into the year, heading into 2020, the usage of XRP in Mexico, fueled by the MoneyGram-Ripple partnership, is noticeably on the rise and if the trend can be sustained until the year’s end, the volume is expected to rise further entering into the first quarter of next year.

Eric Dadoun, an early stage investor, expressed optimism towards the increase in the usage of XRP, adding that half of the supply of the cryptocurrency being in escrow by Swell 2019, is an important milestone. He said:

“Less than half the total supply of XRP will be left in escrow just in time for Swell By Ripple. Whether you call it a coincidence, conveniently timed or baseless speculation, one thing is for sure… it’s a milestone. Onwards.”

Down by 91% since record high but show signs of improvement

Although the price of XRP has dropped by more than 91 percent from its all-time high, in the past month, the asset has increased from around $0.23 to $0.29, by more than 26 percent against the U.S. dollar.

Technical analysts and traders like Peter Brandt said earlier this month that there are signs that XRP is close to reaching key support levels against BTC, entertaining the possibility of a recovery period.

XRP Market Data

At the time of press 10:13 pm UTC on Jun. 13, 2021, XRP is ranked #3 by market cap and the price is up 1.96% over the past 24 hours. XRP has a market capitalization of $12.82 billion with a 24-hour trading volume of $1.72 billion. Learn more about XRP ›

Crypto Market Summary

At the time of press 10:13 pm UTC on Jun. 13, 2021, the total crypto market is valued at at $223.36 billion with a 24-hour volume of $58.55 billion. Bitcoin dominance is currently at 66.40%. Learn more about the crypto market ›

CryptoQuant

CryptoQuant