Coinbase sees major Bitcoin withdrawal, holds lowest confirmed supply since 2015

Coinbase sees major Bitcoin withdrawal, holds lowest confirmed supply since 2015 Quick Take

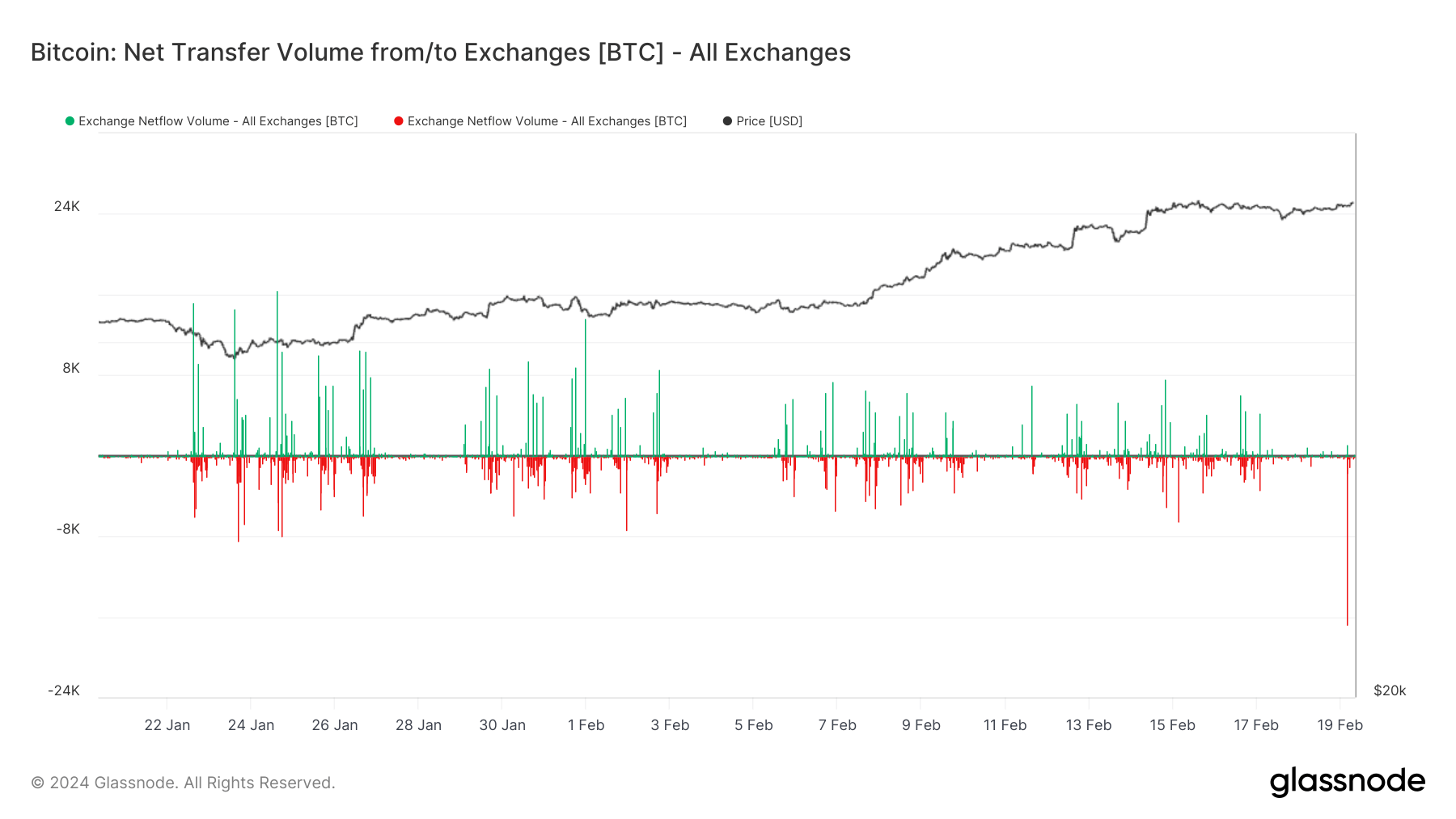

Data unveiled during Asia hours from Coinbase revealed a sizable withdrawal of over 18,000 Bitcoin, as confirmed by Arkham Intelligence, Glassnode, and Coinglass.

This substantial outflow of nearly $1 billion has significantly influenced Coinbase’s exchange balance. The funds have been sent to several different addresses with the Bitcoin split across new wallets. Balances in the new wallets range from $45 million to $171 million, with all UTXOs from the original transaction having been spent.

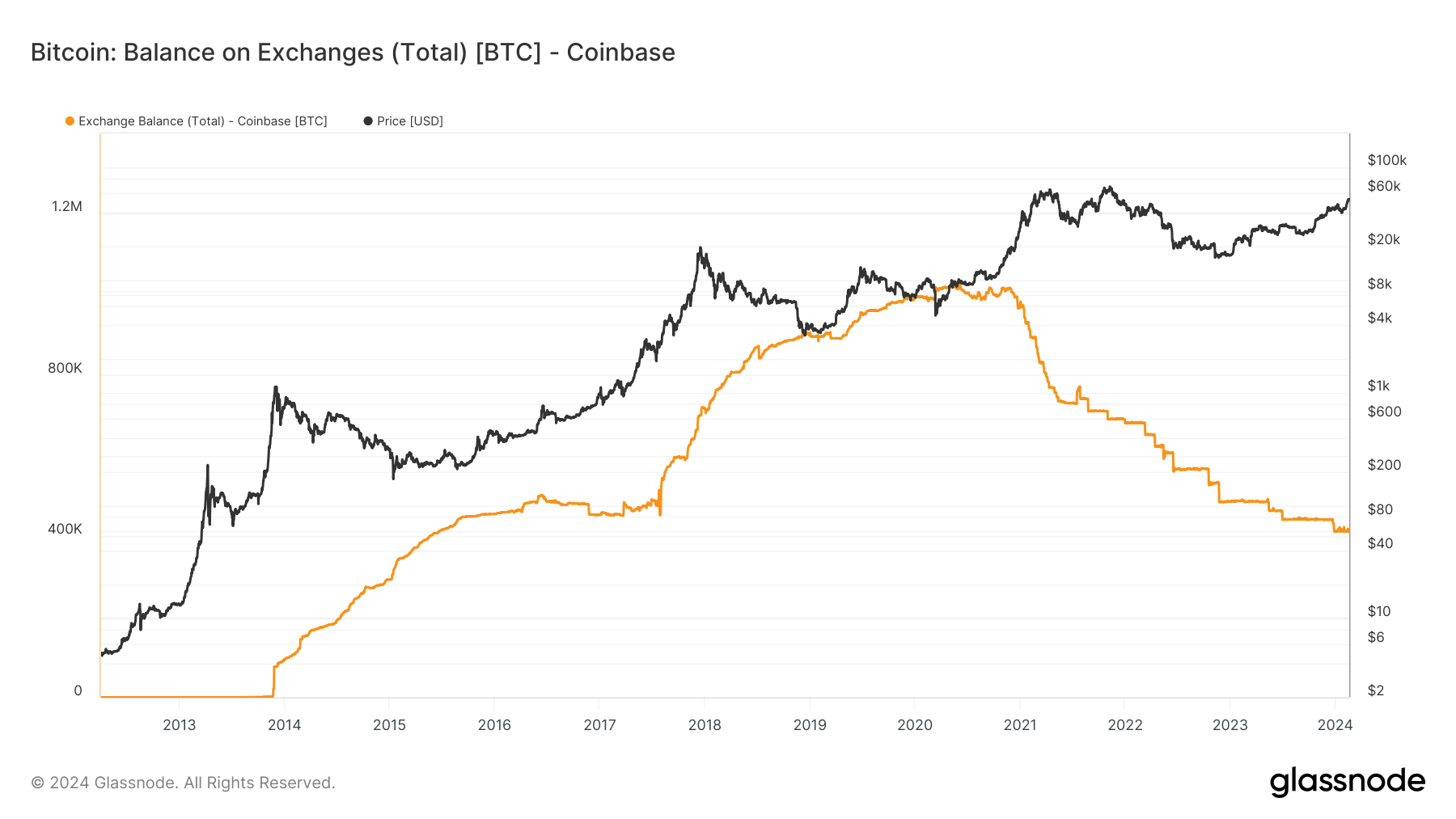

Precisely, the exchange now houses approximately 390,000 Bitcoin, valued at around $20.5 billion. This balance represents less than 2% of the total Bitcoin supply on exchanges. Interestingly, this is the lowest proportion Coinbase has held since 2015, marking a shift in the exchange’s holding patterns, according to Glassnode.

However, it is important to clarify that the motivation for the transfer is as yet unconfirmed, and the Bitcoin has been transferred to wallets that data providers do not tag. UTXO management seems a likely option; however, it is also possible that the funds will provide new liquidity for OTC desks or that the funds have been purchased and transferred into self-custody.

Coinbase’s financial performance also seems to display a bullish narrative. The exchange reported Q4 2023 earnings, declaring a total revenue of $3.1 billion for 2023, with Q4 contributing to one-third of that total.

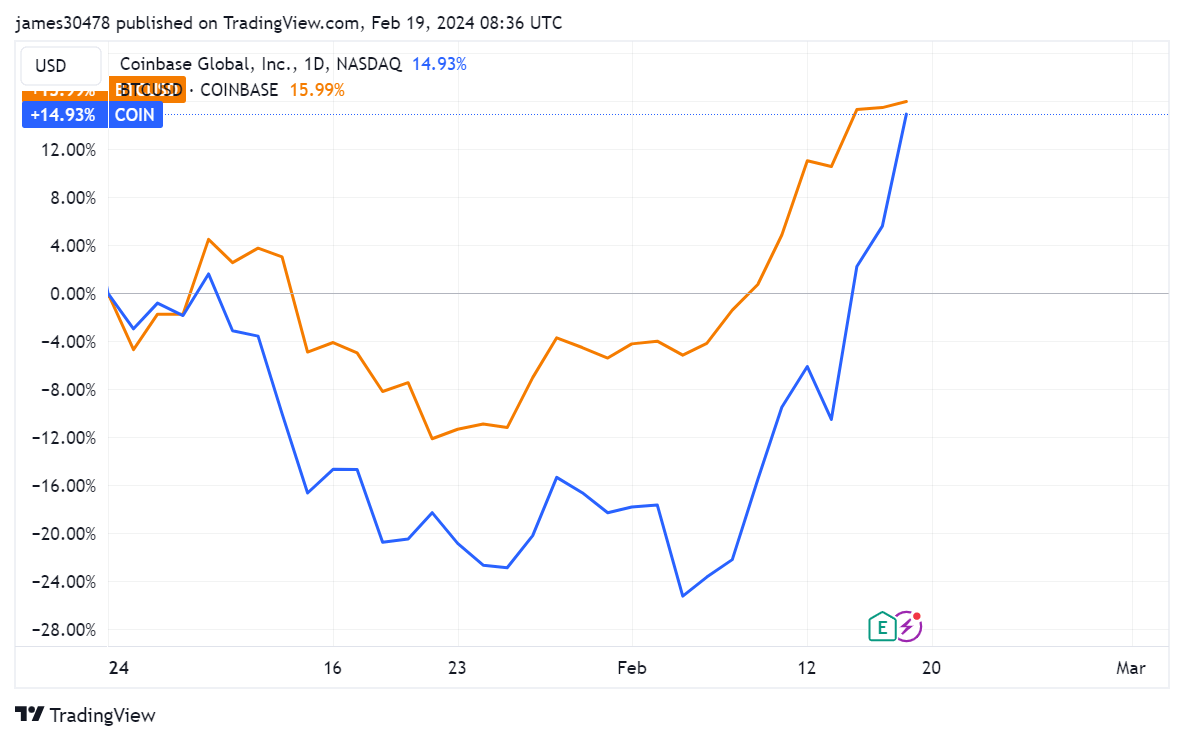

As a result, Coinbase has experienced a 15% increase in its share price since the start of the year.