Bitcoin falls below $70k causing $289 million in total market liquidations

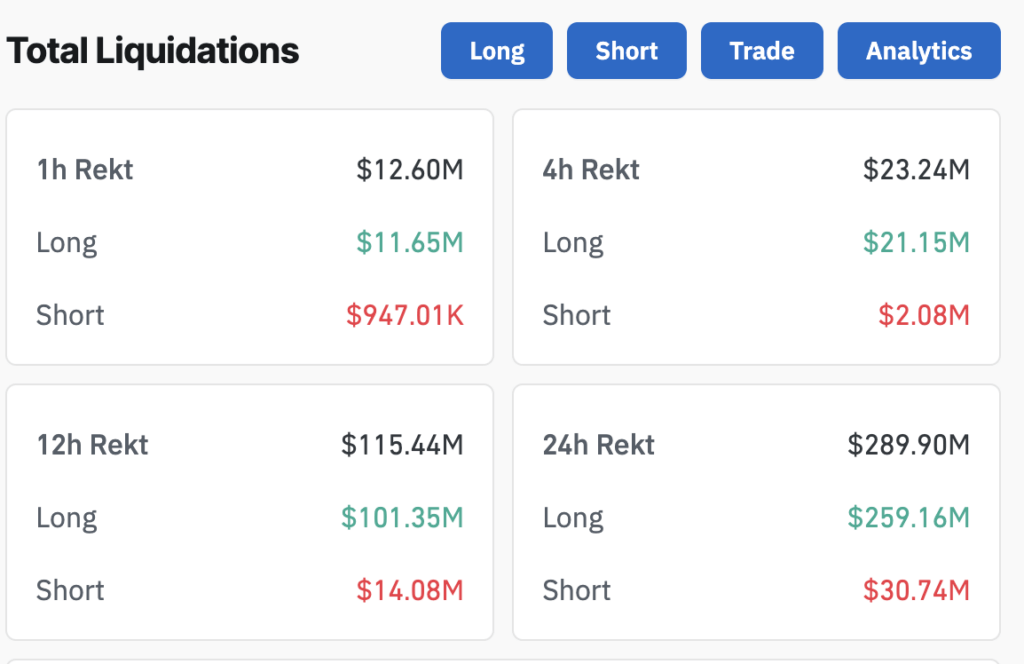

Bitcoin falls below $70k causing $289 million in total market liquidations Bitcoin’s price surged to $72.9k yesterday, nearing its all-time high of $73.7k, before reversing to $69.2k at press time. This volatility led to liquidations totaling $289.93 million in the past 24 hours, affecting 96,574 traders, according to data from Coinglass.

Long positions suffered the most, with $259.21 million liquidated, while short positions accounted for $30.72 million. The largest single liquidation order occurred on Binance’s BTCUSDT pair, valued at $11.26 million.

Bitcoin led in liquidation volume with $89.72 million, followed by Ethereum at $45.21 million and other cryptocurrencies totaling $47.07 million. Binance experienced the highest exchange liquidations at $11.56 million, predominantly from long positions, which made up 89.12% of its total. Bybit and OKX followed with liquidations of $5.33 million and $5.19 million, respectively, also mainly impacting long positions.