In the DeFi world, Yearn.finance distribution concluded – what’s next for YFI?

In the DeFi world, Yearn.finance distribution concluded – what’s next for YFI? In the DeFi world, Yearn.finance distribution concluded – what’s next for YFI?

Photo by Nikola Stojanovic on Unsplash

YFI, the governance token of Yearn.finance, is the fastest DeFi growth story in the history of cryptocurrencies. Within a week, the token accomplished more than what most cryptocurrencies fail to achieve in years.

Astronomical gains are easy when you start from zero

YFI’s price appreciated by more than 100,000% in the process while offering yield farming. Yield farming is a process for users to farm YFI tokens by depositing their stablecoins in YFI pools like Y pool on Curve.finance. The last week was filled with social media activity for YFI skyrocketing because both the yield and the price appreciation were too high to ignore.

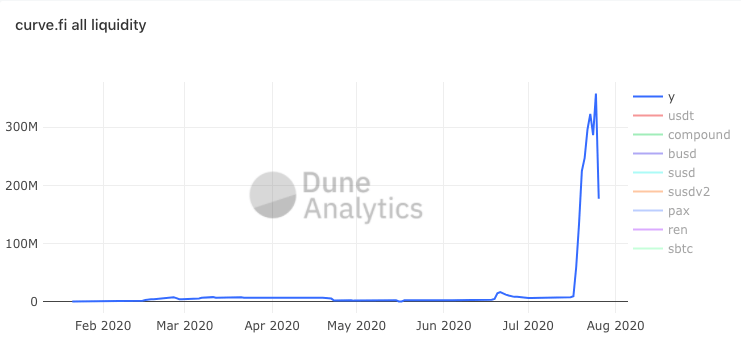

The YFI farming mania brought over $300 million of liquidity on y-pool on curve.finance within a week. Y pool is the pool of yearn.finance.

Another critical aspect that set YFI apart from other DeFi tokens was that it had no pre-mine, no allocation to team or venture capitalists, and no sales rounds. The token was organically distributed like Bitcoin.

There was an opportunity to earn roughly 15-20% in yields last week by yield farming YFI, but that was accompanied by smart-contract risk. The unaudited smart-contract managed to get hundreds of millions from yield-hungry investors.

Quantstamp later unofficially reviewed the contract.

At a time, it was also discovered that Andre Cronje—the founder of Yearn.Finance was initially holding the keys to the wallet, which practically gave him an infinite amount of control—however, he was quick to fix it and set up a multi-sig wallet that did not have him as a keyholder.

In just a week of launch, there have been over 4 serious governance proposals to consider for the YFI community.

Only 30,000 YFI were initially distributed, which is 700 times less than the supply of Bitcoin—21 million.

The current price of YFI is nearly $3,000 but looking only at the price is wrong for YFI which has an unusually low supply. Here’s how much top cryptocurrencies will cost if they had supply equal to YFI.

The token was initially listed on Balancer but was later also added by Uniswap, Poloniex, and FTX.

The first proposal, which was proposed by Andre Cronje for whether to allow minting of more YFI was passed. Though it’s expected, the supply will be very limited even after new proposals are passed since the current token holders who can vote on proposals do not want much of their tokens to be diluted.

A great community

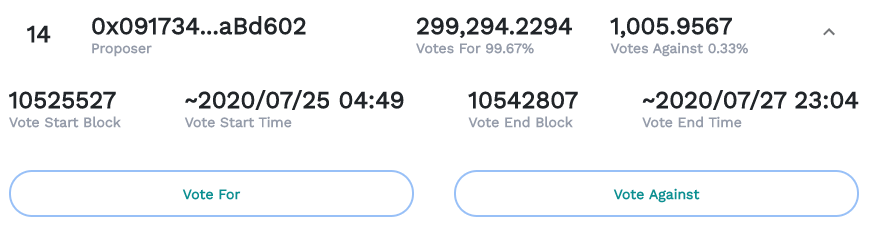

In a new, the community has proposed a new YIP 14, which is a fancy name for proposal to improve Yearn.finance, which is for maintaining yEarn Reserves to pay for operations like smart-contracts auditing, support, and to support the developer.

The community figured out Andre played a Satoshi and didn’t keep anything with himself, so the community came up with a brilliant proposal that involves rewards to the developer as well.

The governance seems to be in the right hands, the project is genuinely community-driven, has no outside influence. The current market cap of the project is $90 million, which puts it behind nearly all major DeFi projects like Ampleforth ($700 million), Compound ($483 million), Aave ($386 million), and REN ($133 million).

Yearn.finance is working on v2, which will make yield farming accessible to smaller players. Currently, yield farming is a whale’s game due to high Ethereum fees. The product description looks promising, and given Andre’s coding capabilities to deliver functional products, this might enable Yearn.finance to live up to its mission – “defi made simple“.