ETH bull market catalyst? Researcher says we’ve entered a new era of Ethereum tech

ETH bull market catalyst? Researcher says we’ve entered a new era of Ethereum tech ETH bull market catalyst? Researcher says we’ve entered a new era of Ethereum tech

Photo by Simon Abrams on Unsplash

While Ethereum has seen many technical improvements over the years, the past few months have flashed a few signs that change is needed.

ETH Gas Station data shows that the cost of transacting on Ethereum has been higher than normal over the past six weeks, with it costing upwards of $0.40 for an ETH transfer and a handful of dollars for certain smart contract interactions.

While this may not sound like a lot of money, high fees crowd out smaller holders. For instance, a user with $100 wanting to interact with a decentralized finance smart contract may instantly lose two percent of his holdings to fees.

There are also some that have begun to criticize Ethereum’s block times, which while faster than Bitcoin, may still be slow for some applications.

Yet a researcher has observed that we have entered a new era for Ethereum tech, boosting the usability of the network and likely the price of ETH.

A new era for Ethereum technologies

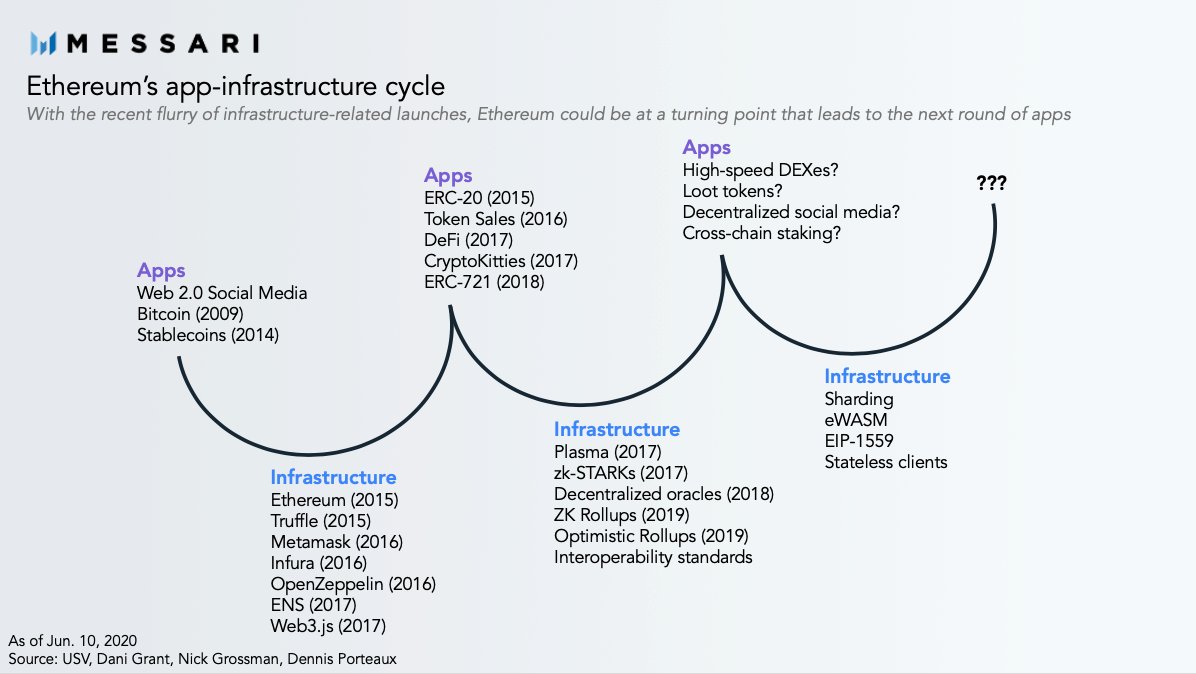

According to research firm Messari’s Wilson Withiam, a researcher, “The building blocks are in place to usher in a new wave of next-generation Ethereum apps.”

The “building blocks” he cited were technological and infrastructure ones, which will decrease friction in sending transactions while increasing usability. Withiam included mentions of:

- Optimistic Rollups, which migrates transactions off-chain but is still secured with Ethereum.

- Decentralized oracles such as Chainlink.

- Ethereum Improvement Proposal 1559, which proposes to burn a portion of transaction fees.

- Sharding, activated through Ethereum 2.0.

Boosting DeFi

A key facet of the Ethereum ecosystem that these technological improvements will help is decentralized finance, better known as DeFi.

DeFi has been branded as one of Ethereum’s killer use cases, but Multicoin Capital’s Kyle Samani sees its growth petering out.

He wrote in a blog post that DeFi is currently reaching a “plateau” due to the slow Ethereum block times, which disallows blockchain financial applications from emulating finance built on the base internet. There are also issues with high transaction cost, Samani suggested.

The technological improvements that were outlined by Withiam could amend these issues.

ETH could benefit

In isolation, Withiam argued, technological improvements or difficulties do not have a macro effect on the price of a cryptocurrency. Yet this may be different for Ethereum, which may garner “novel use cases” due to the development of the network, be that through EIP-1559, Ethereum 2.0, roll-up technology, or etc.

The Messari analyst explained that the “novel use cases that arise” have the potential to do one of two things, both increasing demand for ETH (and thus its price):

- Ethereum may become more usable as a form of money with these upgrades. This was likely in reference to how improvements like sharding and stateless clients can dramatically increase transaction speeds and limit transaction fee friction.

- Demand for ETH may dramatically increase as new use cases of the blockchain garner adoption.

Farside Investors

Farside Investors

CoinGlass

CoinGlass