Ark ARKB’s $133.1 million surge leads Bitcoin ETFs to inflows

Ark ARKB’s $133.1 million surge leads Bitcoin ETFs to inflows Quick Take

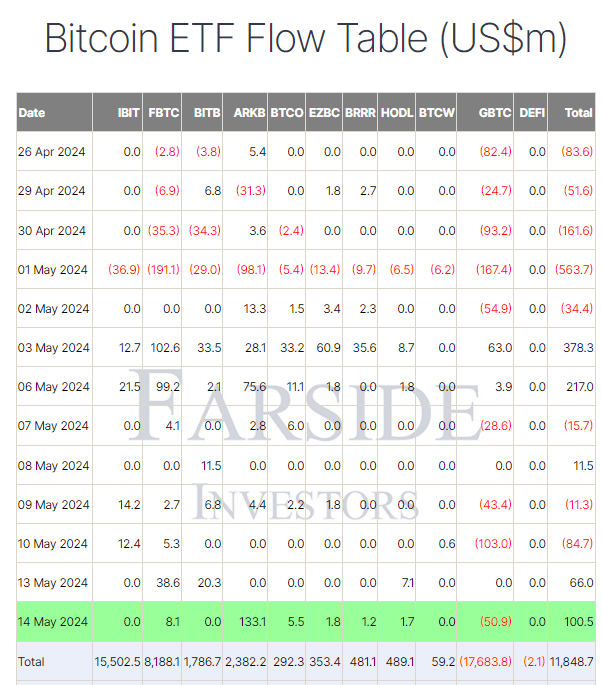

According to data from Farside, Bitcoin (BTC) exchange-traded funds (ETFs) witnessed an inflow of $100.5 million. This marks the largest inflow into these ETFs since May 6 and represents a consecutive day of inflows.

Out of the 11 ETFs analyzed, six experienced positive inflows. The day belonged to Ark ARKB, which saw an impressive $133.1 million inflow, the largest since March 27, bringing its total inflows to $2.4 billion. Fidelity FBTC also recorded an $8.1 million inflow, taking its total net inflow to $8.2 billion. BlackRock IBIT, however, saw neither inflows nor outflows, according to Farside data.

Farside reports that the Invesco Galaxy Bitcoin ETF (BTCO), Valkyrie Bitcoin Fund (BRRR), VanEck (HODL), and Franklin Templeton (EZBC) ETF all experienced inflows. On the other hand, Grayscale GBTC resumed outflows, witnessing a $50.9 million outflow, bringing its total net outflows to $17.7 billion. Overall, ETFs have now seen a total inflow of $11.8 billion.

This development coincides with the recent investments by the State of Wisconsin Investment Board and Titan Global in spot Bitcoin ETFs.

CoinGlass

CoinGlass

Farside Investors

Farside Investors