Bitcoin’s big fish: How Bitfinex whales are quietly shaping market trends

Bitcoin’s big fish: How Bitfinex whales are quietly shaping market trends Quick Take

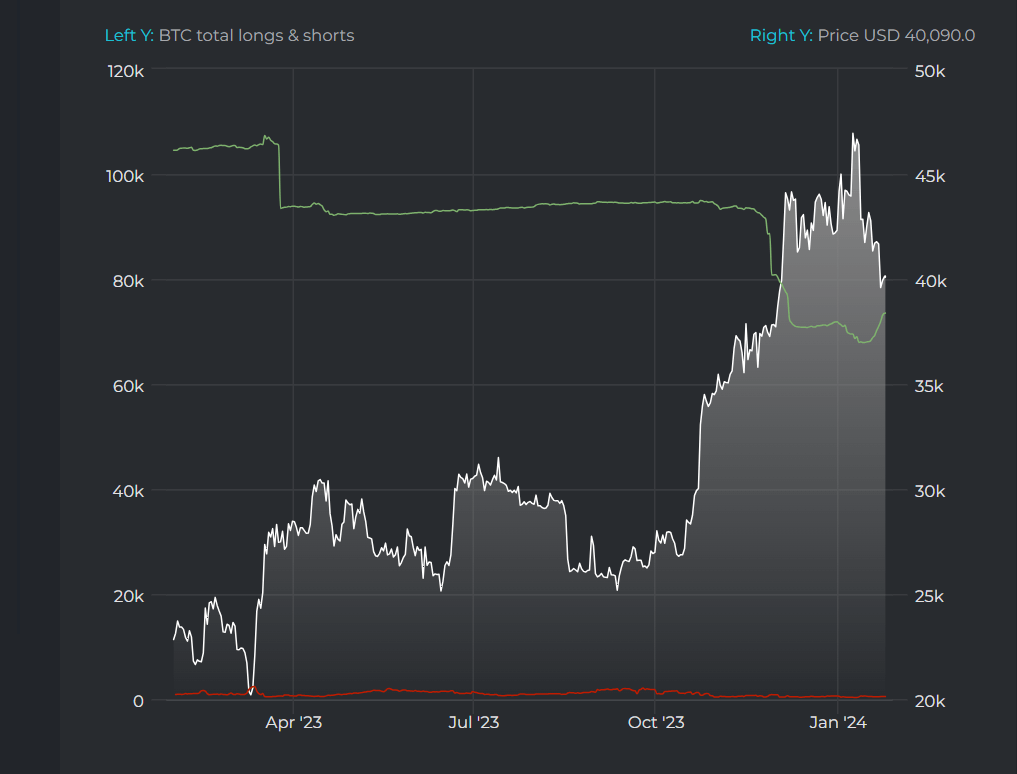

Recent data analysis from Datamish reveals intriguing dynamics among Bitfinex whales, especially their consistent trend in closing long positions. As highlighted by CryptoSlate, a tangible reduction of 3,500 BTC was seen in early December, pulling the total down to 76,500 BTC.

Despite the tumultuous journey Bitcoin has embarked on since then – reaching a yearly high of $49,000 before descending below $39,000 – remarkable shifts have been noticed. On Jan. 14, long positions bottomed out at around 68,000 BTC, only to experience a resurgence with an addition of approximately 6,000 BTC, taking the total to over 74,000 BTC as of Jan. 25.

Alistair Milne further emphasized this trend on Jan. 23, noting an intelligently crafted strategy by these Bitfinex whales. They have adopted the time-weighted average price (TWAP) strategy, which incorporates buying 10 Bitcoins on margin every 15 minutes. This approach, typically utilized in financial markets, seeks to minimize the market impact of substantial orders by dispersing one giant order into multiple smaller ones over an extended period.

These strategic maneuvers indicate a calculated approach by Bitfinex whales that potentially influences the Bitcoin market’s movements.

Farside Investors

Farside Investors

CoinGlass

CoinGlass