Arbitrum DEXs daily transaction volume eclipse Ethereum, Solana

Arbitrum DEXs daily transaction volume eclipse Ethereum, Solana Arbitrum DEXs daily transaction volume eclipse Ethereum, Solana

Uniswap's daily volume crossed a billion for the first time on a layer2 network via the transactions on Arbitrum.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

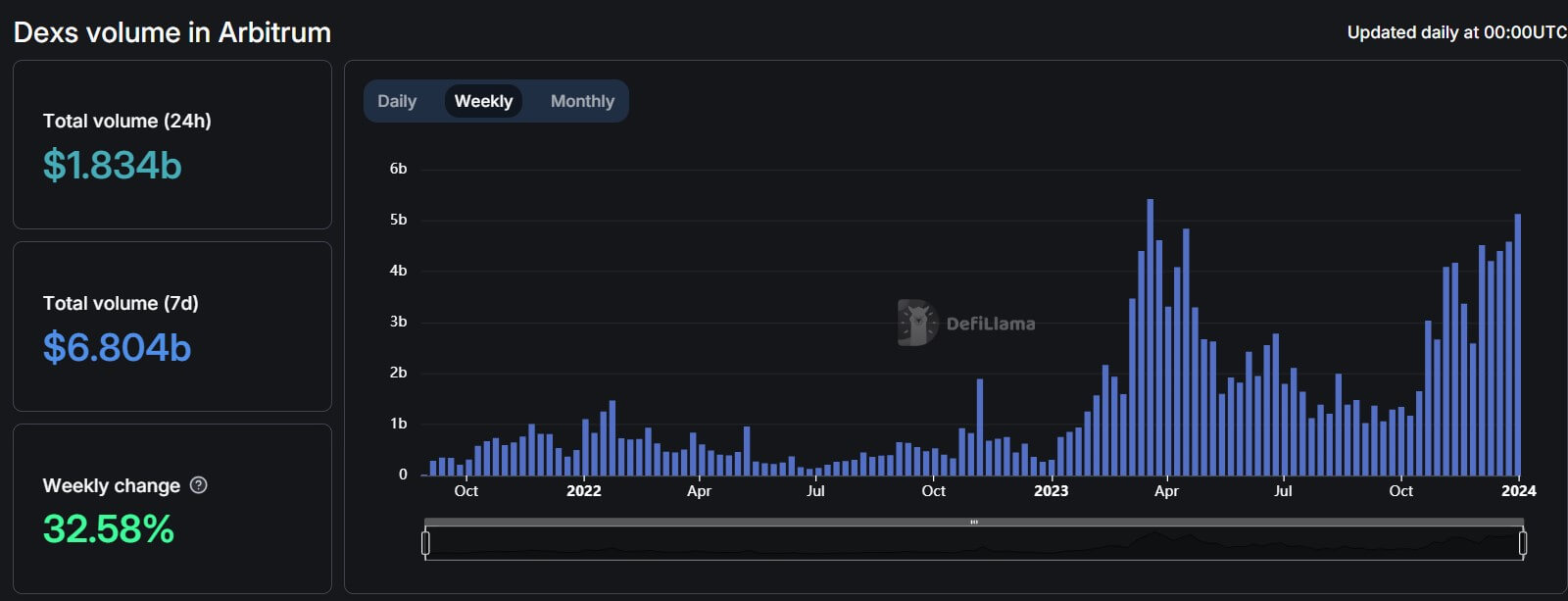

Decentralized exchanges (DEX) transaction volume on Arbitrum, a layer2 network, surpassed that of Ethereum for the first time during the past day, according to DeFillama data.

During the reporting period, DEXs on Arbitrum saw their volume soar to $1.843 billion, surpassing Ethereum’s $1.444 billion and Solana’s $683.59 million.

This surge aligns with Arbitrum’s continuous weekly growth, rising by 32.58% to $6.804 billion, a new all-time high, though still trailing Ethereum’s $9.581 billion. However, it surpasses Solana’s $5.039 billion and notably exceeds Binance Smart Chain’s daily volume by nearly fourfold.

The rising DEX volume also coincided with high-network activity on the layer2 network. During the past day, Arbitrum’s daily transaction per second stood at 14.05, while Ethereum mainnet’s was 12.92, according to L2beat data.

Uniswap dominates

The increased trading volume can be attributed to heightened activity on Arbitrum’s DEXs like Uniswap, Camelot, Ramses Exchange, and Trader Joe. Data from DeFillama shows that these protocols have enjoyed double-digit growth to new highs during the past week.

Uniswap Labs, the developers of the popular decentralized trading protocol Uniswap, revealed that Arbitrum became the first layer2 network to cross a billion in daily volume on the platform on Jan. 4.

Uniswap is the largest DEX protocol by trading volume across all chains, with an average volume of more than $1.5 billion during the past week.

Arbitrum’s rising TVL

The rising DEX volume has also coincided with a sharp increase in the total value of assets locked on the Ethereum-based layer2 network.

Data from DefiLlama shows the TVL on Arbitrum-based applications has increased by around $1 billion in the last six months to nearly $2.5 billion, with the dominant DeFi protocol being GMX, a decentralized spot, and perpetual exchange, which controls about 20% of the network’s total TVL.

Additionally, Arbitrum’s native ARB token recently reached a new all-time high of more than $2 on Jan. 4 but has retraced to $1.94 as of press time, according to CryptoSlate’s data.