GameFi Slides on Macro Trends but Individual Projects Shine | April Monthly Report

GameFi Slides on Macro Trends but Individual Projects Shine | April Monthly Report GameFi Slides on Macro Trends but Individual Projects Shine | April Monthly Report

STEPN is one of the hot projects in crypto and has surpassed $2 billion in market cap.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

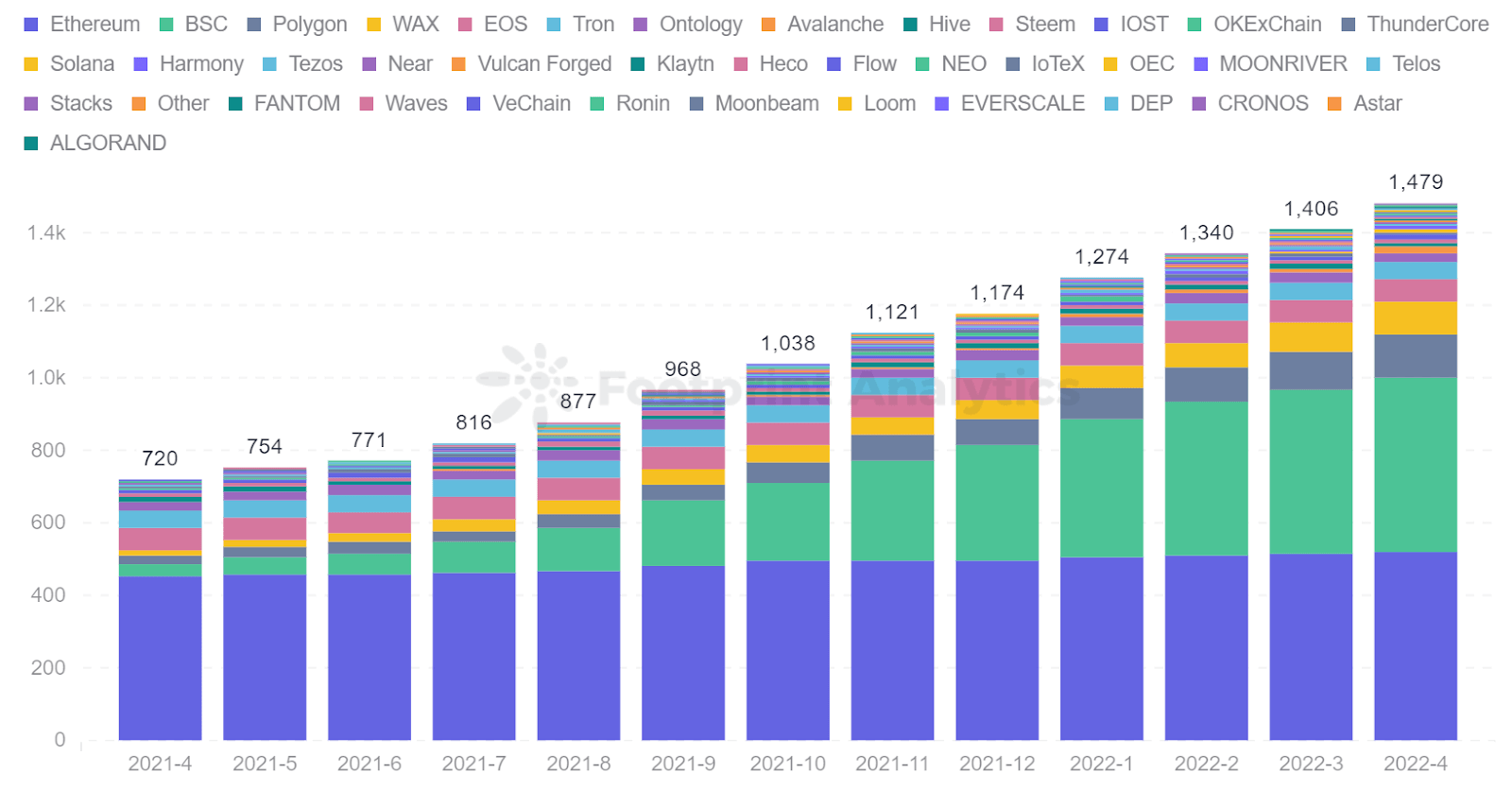

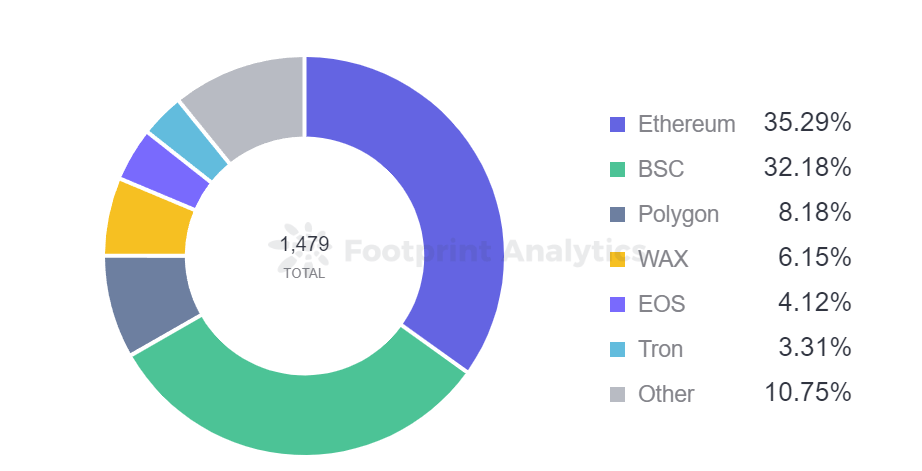

In April, GameFi game projects grew from 1,406 to 1,479, a monthly increase of 5.2%, with growth concentrated in the BSC and Polygon chains. Monthly active users were 9.22 million, and transaction volume was $34.37 million. But compared to March, active users and transaction volume fell by 24.9% and 73.4%, respectively.

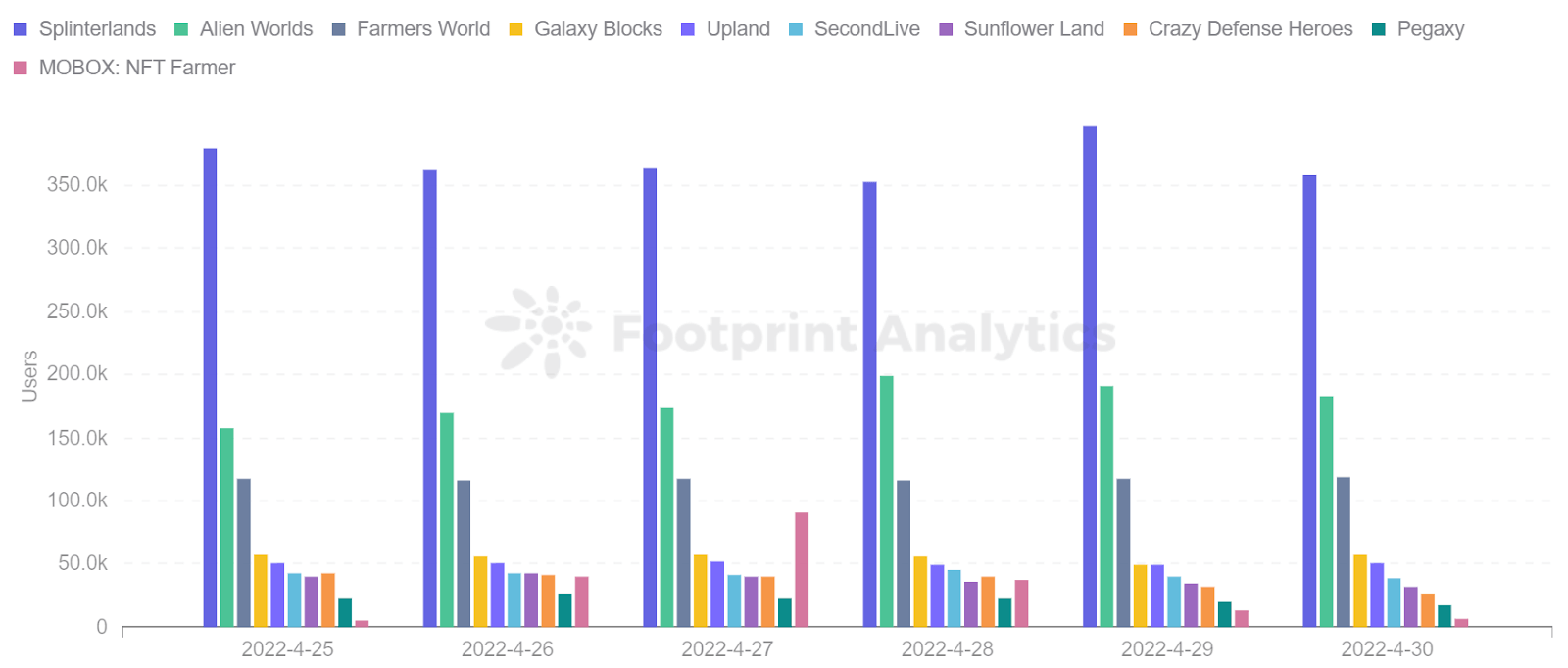

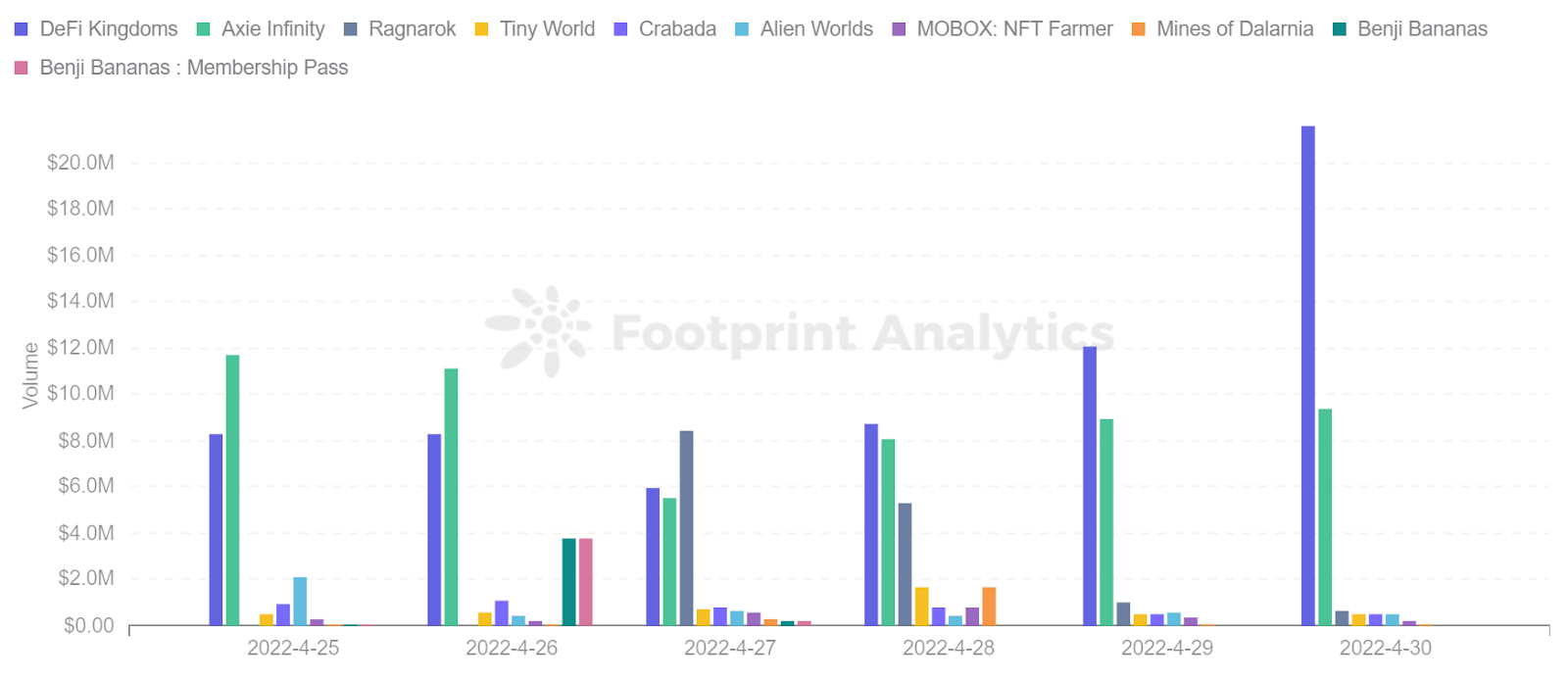

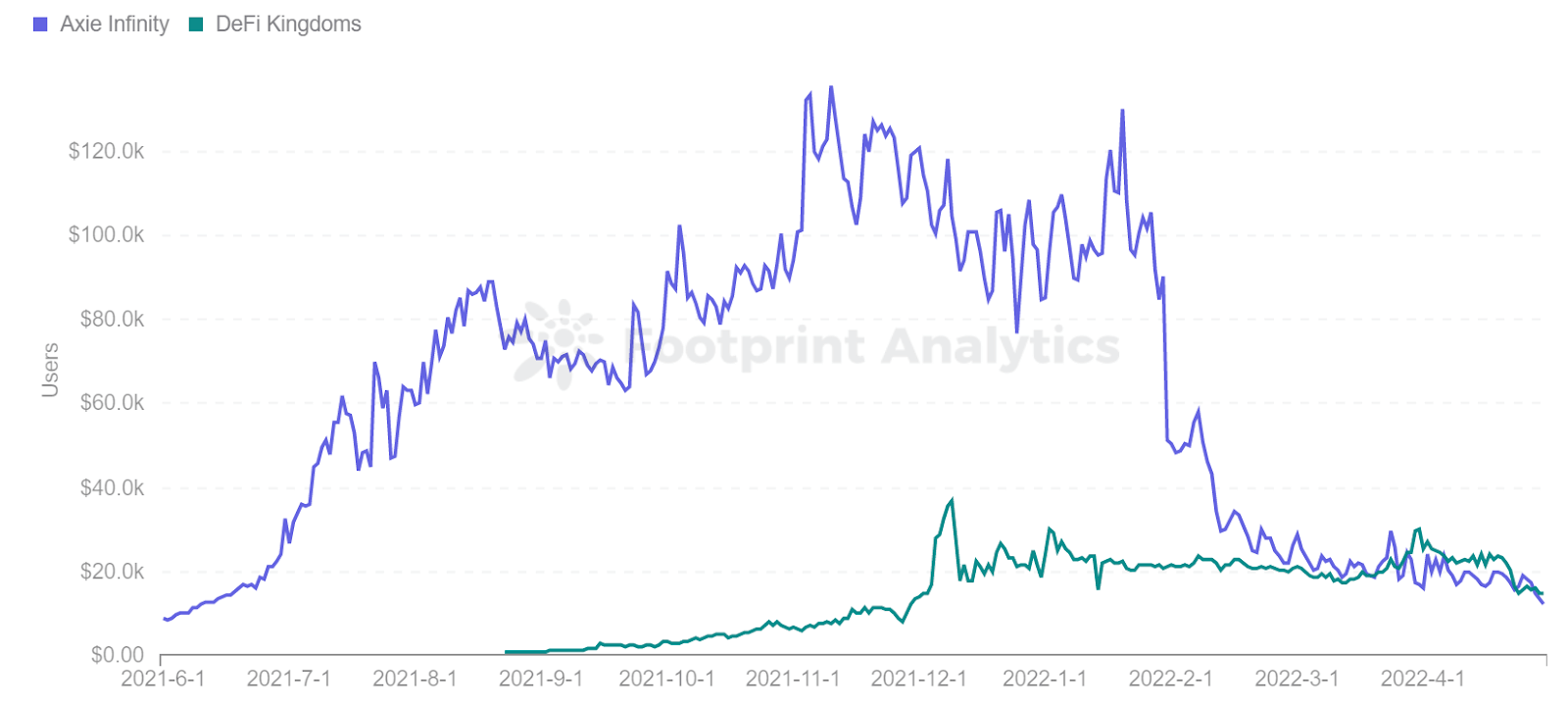

However, despite declining users and trading volume, some GameFi projects continued to perform well. For example, STEPN was the hottest DApp on the crypto market, Splinterlands ranked #1 in daily active users, averaging over 350,000 daily users, and DeFi Kingdoms surpassed Axie Infinity as the most traded GameFi project.

Here’s a look at GameFi’s overall performance in April by the numbers.

GameFi Market Overview

GameFi projects grew 5.2% MoM, with growth concentrated in BSC and Polygon

According to Footprint Analytics, as of April 30, 38 blockchains participated in the GameFi sector, with 1,479 game projects, up 5.2% MoM.

Ethereum’s project count in the GameFi ecosystem is not growing as fast as on the BSC and Polygon chains. The projects on BSC and Polygon have become some of the most popular games in the crypto market today. They include Bomb Crypto and Mobox on BSC, Crazy Defense Heroes, and Pegaxy on Polygon.

Developers prefer BSC and Polygon for games because of their low gas fees, high throughput, and the same high security as Ethereum. The number of projects on Ethereum is gradually divided by blockchains such as BSC, Polygon, and WAX, attracting a large number of game users and projects.

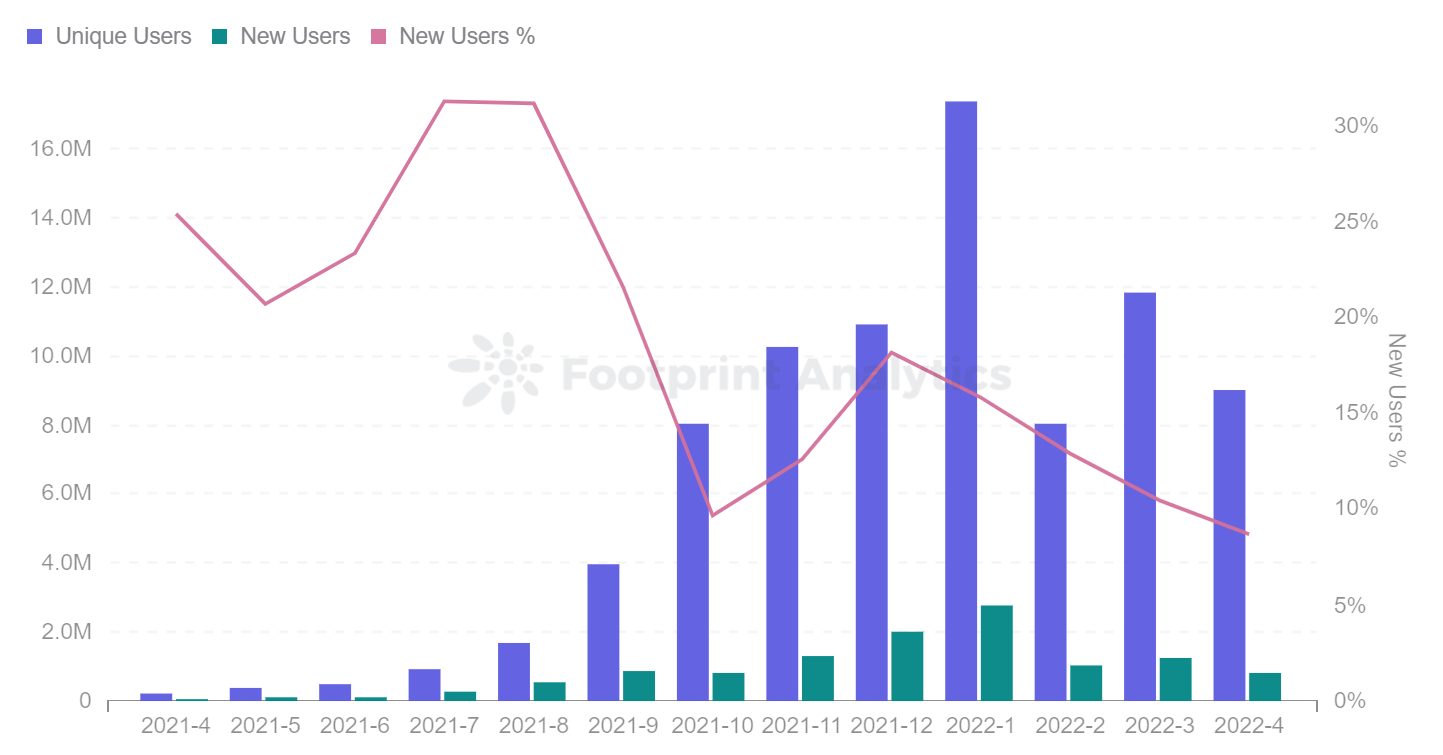

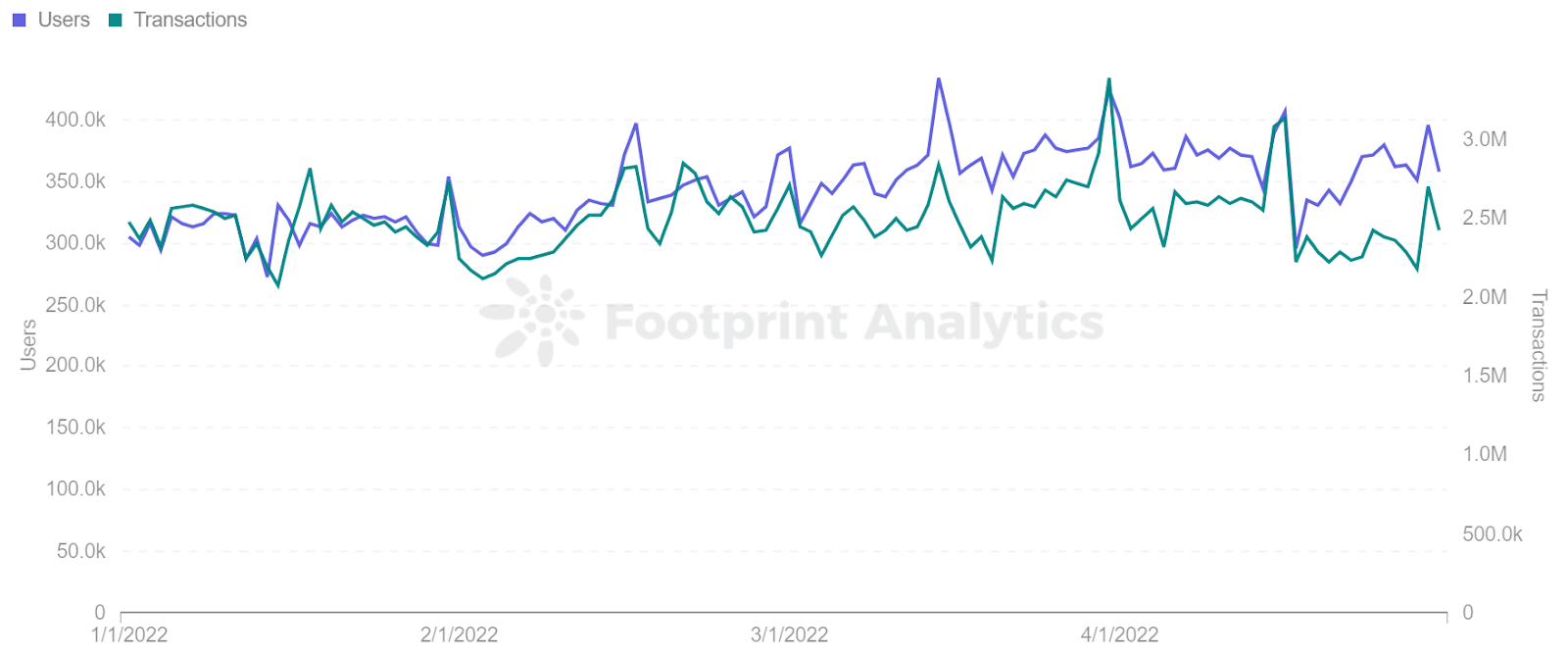

Active users down 24.9% MoM, Gamefi’s transaction volume down

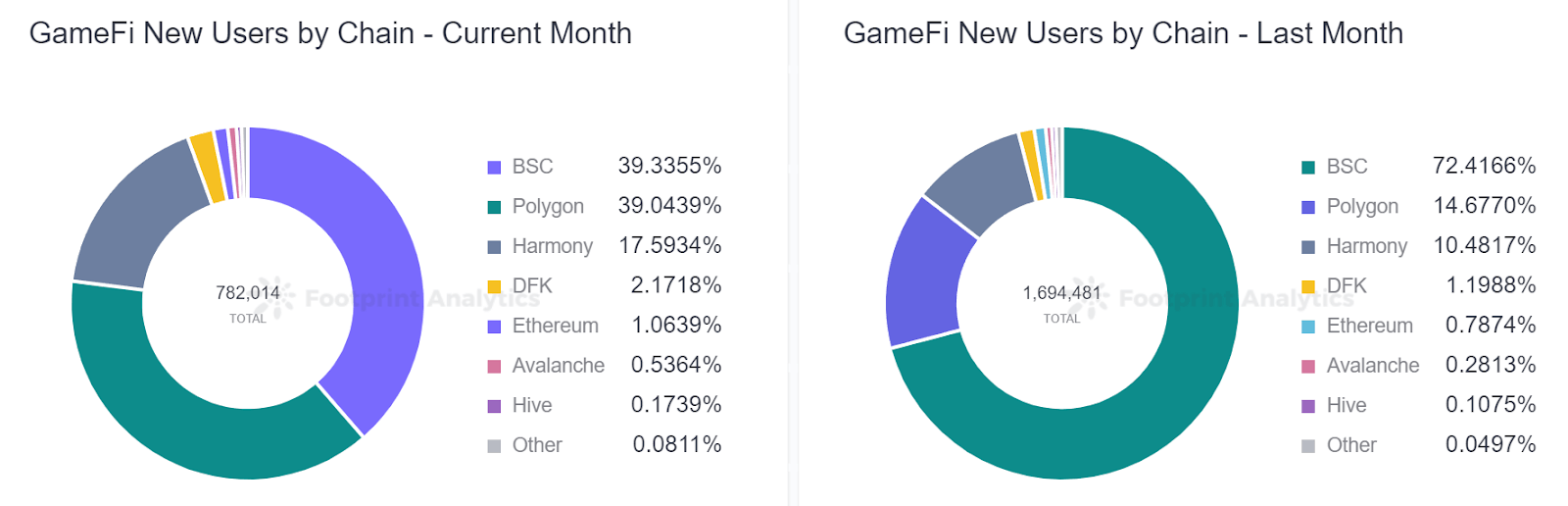

As of April 30, the total number of active users was 9.22 million, of which 780,000 were new users. Compared to March, the number of active users decreased by 24.9%.

Since October, the number of new and active users has declined even though the number of games has increased.

However, some games have seen increases in new users. For example, the Polygon gaming ecosystem saw 25% more new users, led by Crazy Defense Heroes and Pegaxy.

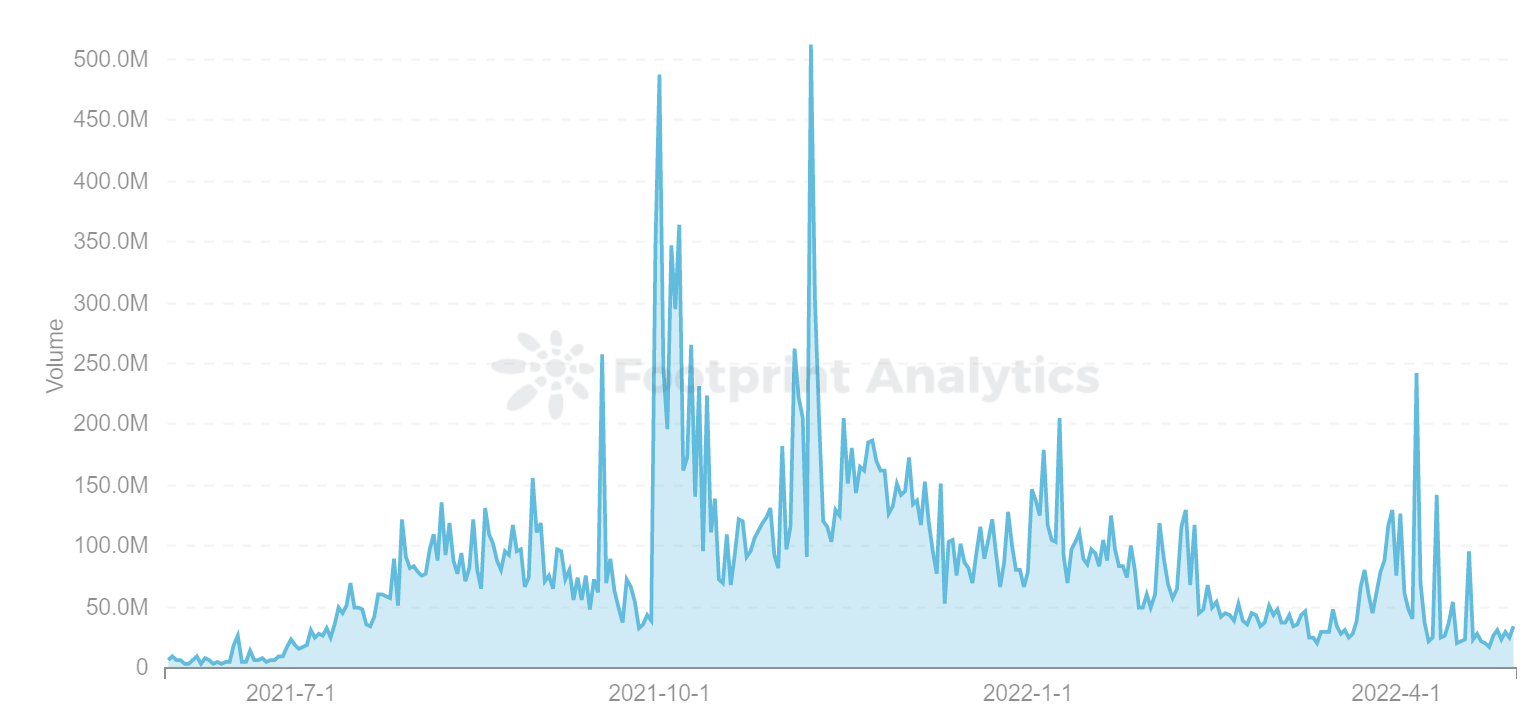

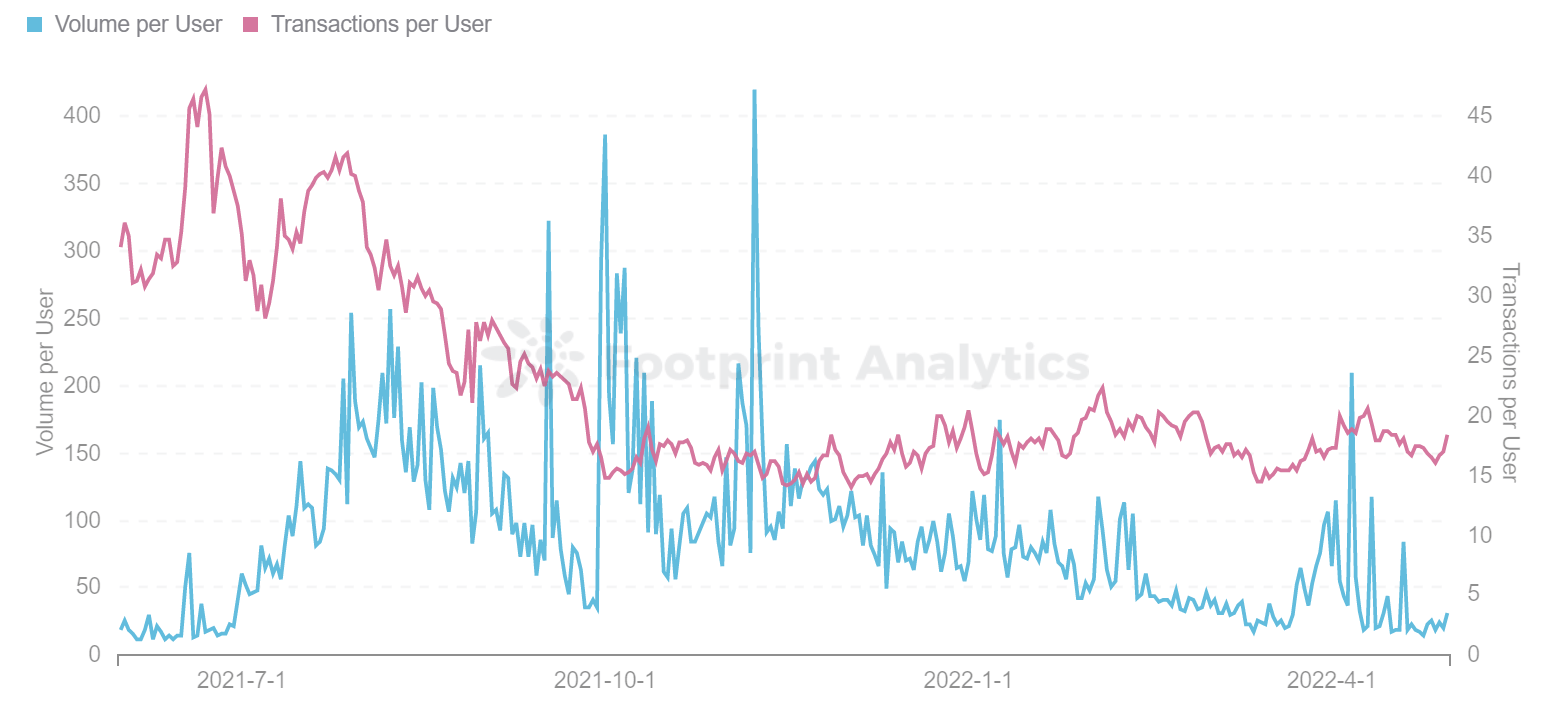

According to Footprint Analytics, trading volumes spiked from October to November, exceeding $510 million per day. However, GameFi trading volume has been in a slump due to macroeconomic trends since January. Per wallet, trading volume has gradually dropped from $105 to $20.

In addition, the Axie Infinity hack in mid-February significantly impacted active users and trading volume—it caused users to lose over $615 million worth of ETH and USDC.

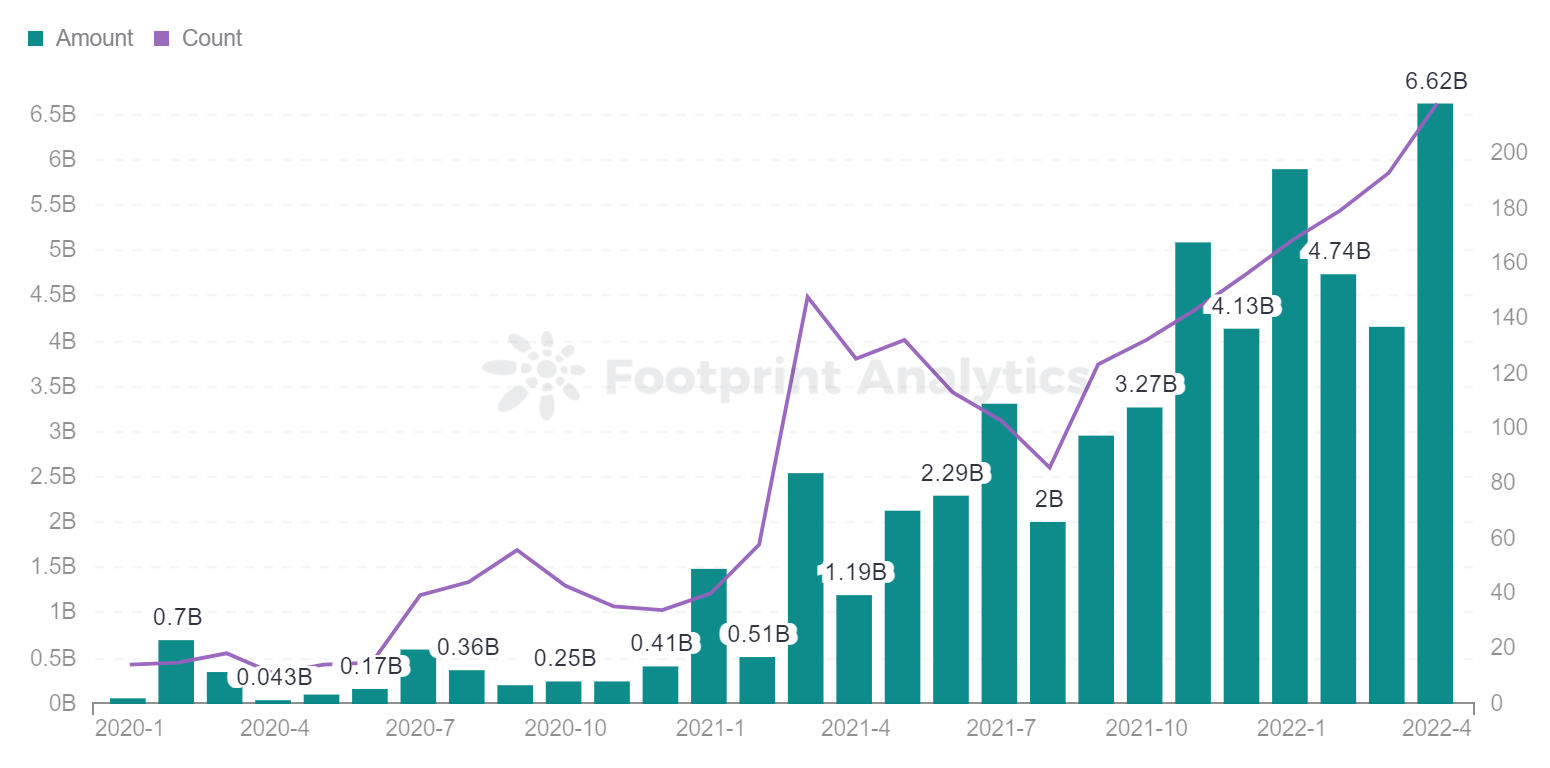

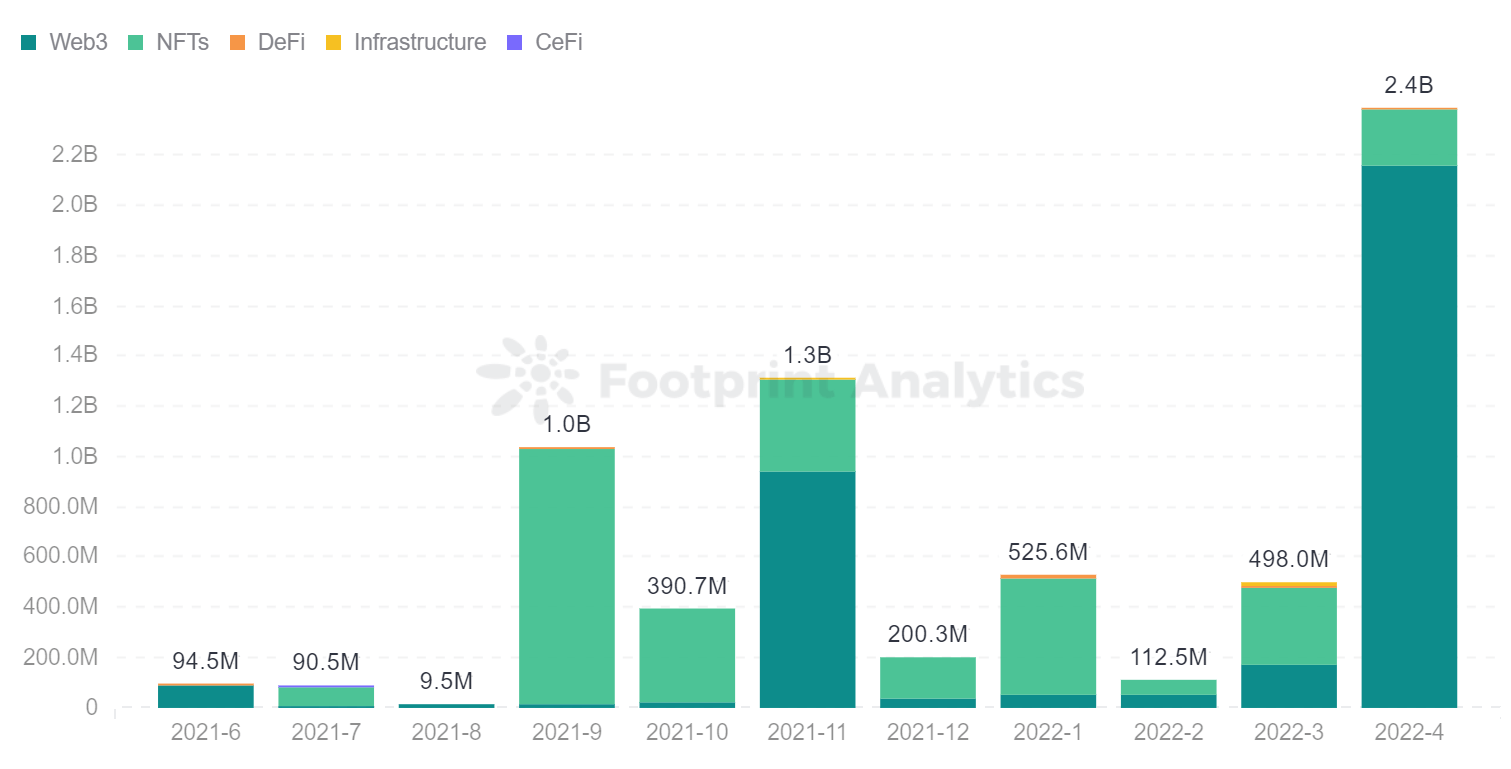

Nearly $2.4 billion raised in GameFi, up 381% MoM

Data shows that April saw the most significant amount of funding across the blockchain sector, with $6.62 billion invested. The GameFi sector accounted for 36.3% of that total, with $2.4 billion in investment. Compared to March, GameFi saw a 381% increase.

Web3 saw the largest investments in the GameFi investment sector, with the STEPN Web3 project, which combines elements of GameFi and SocialFi, the most notable project.

GameFi Data is Underperforming, Still Have Excellent Games

While macro trends are unfavorable, several projects performed well in April. Splinterlands ranked first in the number of daily active users for more than three months, with average daily average users of more than 350,000. DeFi Kingdoms surpassed Axie Infinity to become the largest GameFi project by transaction volume. STEPN has become the hottest DApp in the crypto market with its Move-to-Earn.

Splinterlands holds the #1 spot with 350,000 daily users

Splinterlands, an NFT card game, has become the most popular project in the GameFi sector. According to Footprint Analytics data, the number of users and transactions has gradually increased and stabilized.

Splinterlands has proven popular with its simple gameplay and low barrier to entry. And like Axie Infinity and other games, it adopts a dual-currency model, which has stabilized the liquidity of funds in the game and minimized the impact of token price fluctuations in the secondary market.

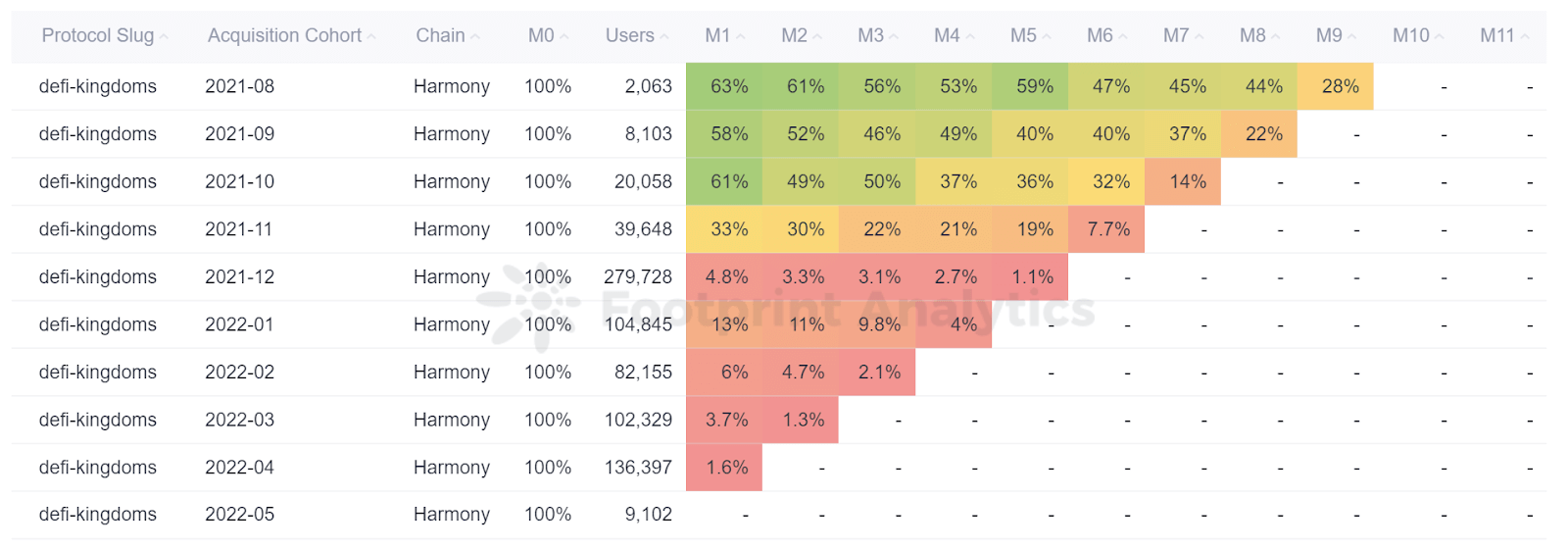

DeFi Kingdoms surpasses Axie Infinity as the most traded project

On March 29, DFK surpassed Axie Infinity as the most traded program. News of the attack on Axie Infinity, which was considered safe, shook users’ confidence, and trading volume fell off a cliff. As a result, it’s been a tough month for Axie Infinity, and hopefully, it will be able to restore user confidence in the game by recovering $5.8 million in funds and launching Axie Infinity Origin’s new arena game mode on April 7.

Although DeFi Kingdoms has no VC funding, they maintain a monthly user retention rate and a solid daily user base through their tokenomics and roadmap.

STEPN becomes the hottest DApp

STEPN is the first successful Move-to-Earn game and has real potential to be the long-awaited game that makes GameFi mainstream.

Users buy NFT sneakers and get paid in the game’s tokens to walk, jog or run. It further gamifies exercise by creating a system of sneaker upgrades.

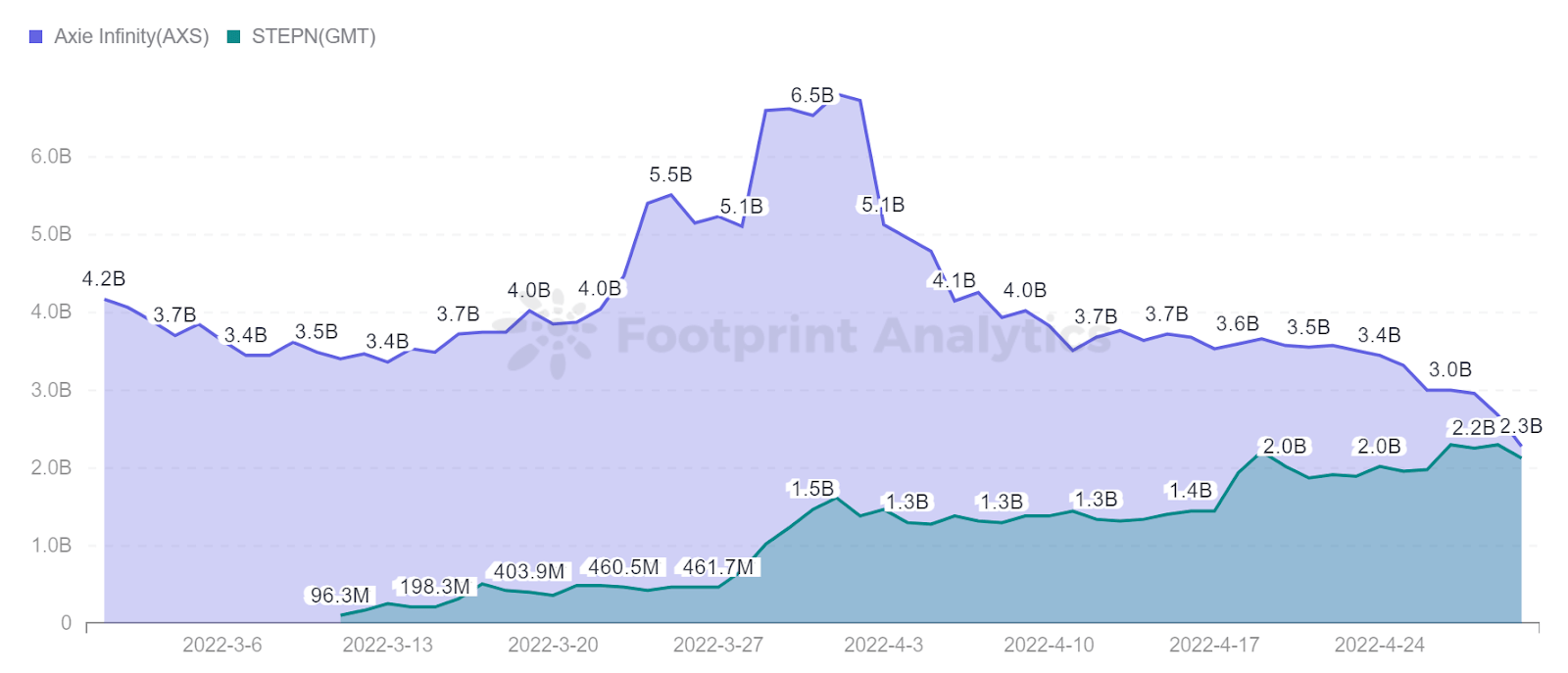

STEPN has been online for less than six months and, as of April 30, its market cap has surpassed $2 billion. At present, Axie Infinity has fallen into the situation of insufficient new users, and STEPN may even exceed the market cap of Axie Infinity of $2.2 billion.

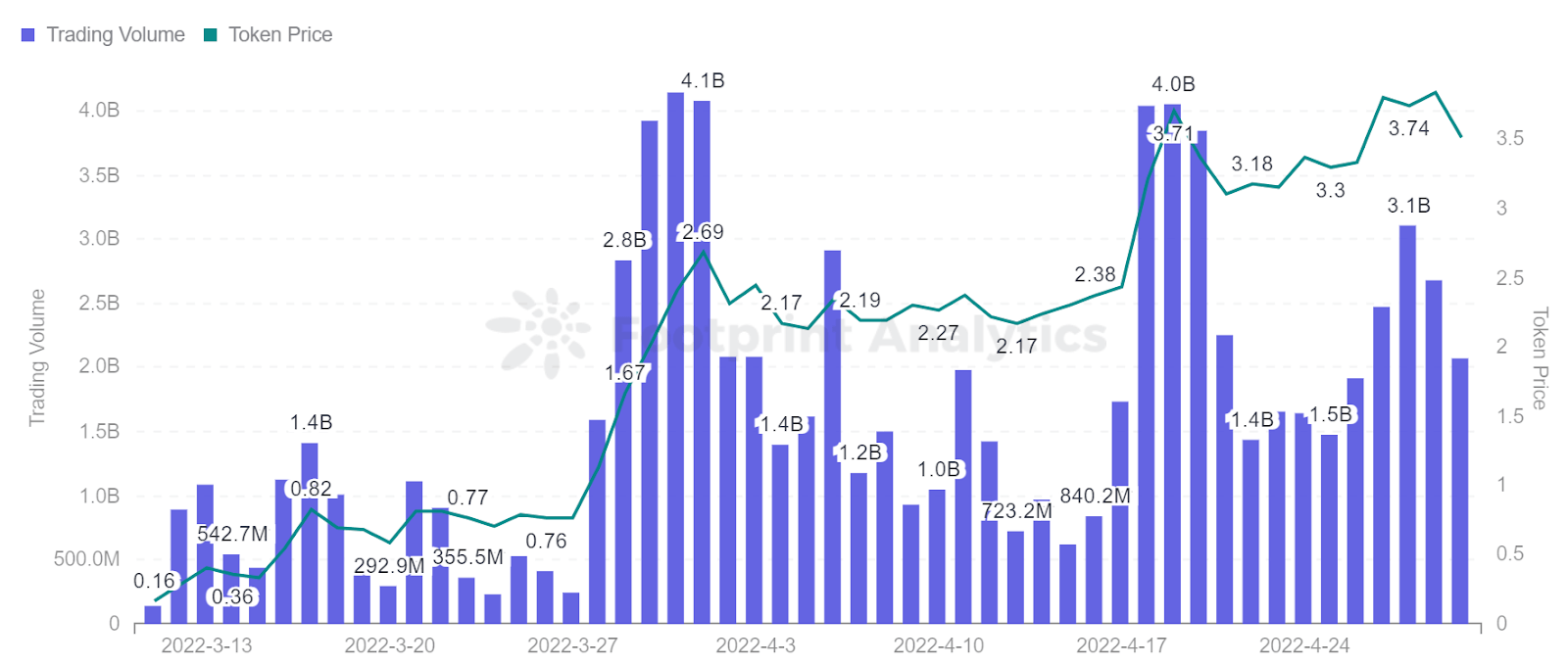

Footprint Analytics data shows that the price of token GMT rose from $0.16 to $3.52, an increase of 2100% in a short period.

There is no doubt that STEPN is currently one of the hot trends on the market.

Summary

While GameFi is unavoidably tied to macro trends, seeing an overall decline in deals and users, individual projects have seen positive news in April. STEPN has grown immensely, DFK overtook Axie Infinity as the most traded project, and Splinterlands stabilized its daily active user base.

April Events Review

NFT & GameFi

- There’s A Louis Vuitton NFT Scam Targeting Whales on OpenSea

- MoonPay’s new minting-as-a-service tool bills itself as ‘AWS for NFTs’

- YGG SEA Secures $15M from Marquee Investors to Boost P2E Gaming in Southeast Asia

- PROOF Raises $10M From Reddit’s Ohanian After Moonbirds NFT Launch

- STEPN says GMT is necessary for all quality shoe castings

Metaverse & Web3

- Asian Billionaires’ Hotel Groups Build Virtual Lands In Decentraland And The Sandbox’s Metaverse

- Pocket Worlds to launch Highrise metaverse on Avalanche subnet

- SNACKCLUB Secures $9M in Seed Funding, Preps to Launch DAO

- ForthBox Closes US $1 Million Seed Round, funded by Fundamental Labs and other VCs

- Metaverse Real Estate Market to grow by USD 5.37 billion from 2021 to 2026

DeFi & Tokens

- Goldman Offers Its First Bitcoin-Backed Loan in Crypto Push

- Evmos-based DEX EvmoSwap announced the airdrop distribution plan, with 11.5 million EMO airdrops

- $248.6 million in BTC transferred from Coinbase to unknown wallet address

- Anonymous whales transferred a total of 7,831 bitcoins from Coinbase

- Fantom-based profit optimizer Redemption hit by flash loan attack

Network & Infrastructure

- Founders from a16z, Solana, and more back a new billion-dollar crypto fund

- TON Users Donate $1B to Advance Ecosystem, Foundation Says

- Flipside Crypto Raises $50M at $350M Valuation

- BNB Chain to burn over 1.8 million BNB, worth roughly $740 million

- Cardano adds almost 100,000 wallets to its network in a month

Institutions

- Coinbase launches a new line of products to mitigate fraud

- Binance Trading Volume Soars More than $440 Billion in Quarterly High

- Bitcoin Miner Bit Digital Files to Raise Up to $500M in Equity

- Owner of Brazil’s Largest Crypto Exchange Plans to Launch Quantitative Trading Service

- Voyager Innovations Raises US$210M to Expand the Financial Services Ecosystem of PayMaya and Maya Bank

Worldwide

- Nepal Shuts Down Crypto Websites, Apps

- Stablecoins Need to Set a Common Standard, Says US Banking Watchdog

- Mexico’s Senate Has Placed Its First Bitcoin ATM

- Malaysian Police Destroy 1,773 Bitcoin ASIC Miners

- London Becomes Hot Job Market for Crypto Industry

This piece is contributed by Footprint Analytics community.

The Footprint Community is a place where data and crypto enthusiasts worldwide help each other understand and gain insights about Web3, the metaverse, DeFi, GameFi, or any other area of the fledgling world of blockchain. Here you’ll find active, diverse voices supporting each other and driving the community forward.

Date & Author: Apr. 2022, Vincy

Data Source: Footprint Analytics – April 2022 Report Dashboard

What is Footprint Analytics?

Footprint Analytics is an all-in-one analysis platform to visualize blockchain data and discover insights. It cleans and integrates on-chain data so users of any experience level can quickly start researching tokens, projects, and protocols. With over a thousand dashboard templates plus a drag-and-drop interface, anyone can build their customized charts in minutes. Uncover blockchain data and invest smarter with Footprint.

CoinGlass

CoinGlass

Farside Investors

Farside Investors