5 things to consider when evaluating a new blockchain

5 things to consider when evaluating a new blockchain 5 things to consider when evaluating a new blockchain

A blockchain is a network that supports various types of application development such as DeFi.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

During the blockchain 1.0 period, blockchain applications started to develop rapidly through Bitcoin. While the stage of blockchain only supports the transfer between cryptocurrencies, such a single application scenario leads to less popularity. Therefore smart contracts came into being.

The combination of smart contracts and blockchain expanded the application scenario of blockchain, entering the 2.0 stage with Etherum as an excellent representative. Most DeFi projects (with a small number compared to today) were basically developed only on Ethereum due to its user-friendly development experience and mature network environment. Hence, Ethereum has led this industry of blockchain.

When comes to 2021, more strong competitors of Ethereum have shown up due to the following 3 reasons:

- With the explosion of DeFi development since DeFi Summer in June 2020, more and more transaction activities happen on Ethereum.

- The congestion problem of Ethereum is revealed and getting worse. The roaring increase of Ehereum’s gas fees has driven every developer and investor to look for a replacement with higher efficiency and cheaper costs for users.

- More functionalities Ethereum lacks need to be completed by its own update or another blockchain.

Current status of blockchains

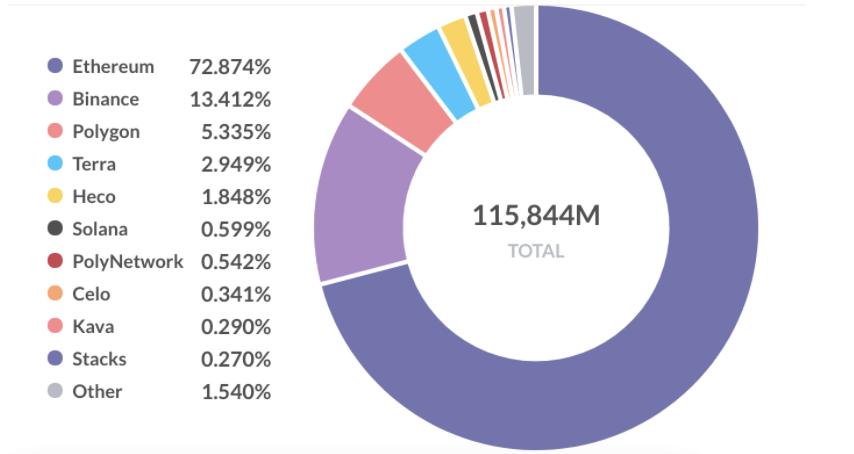

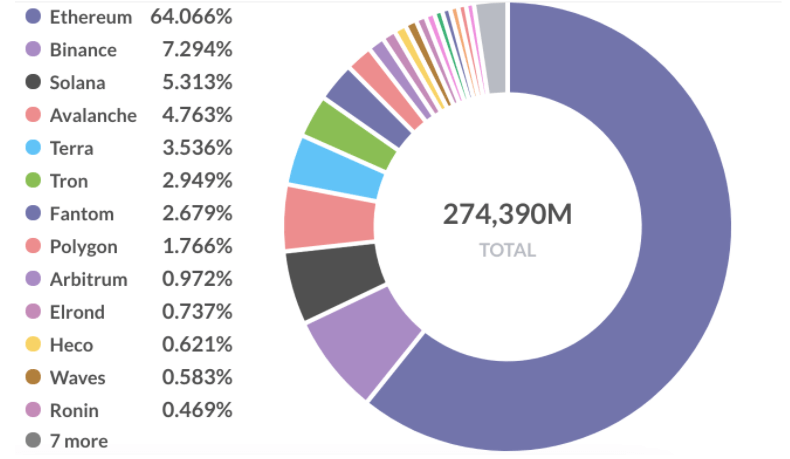

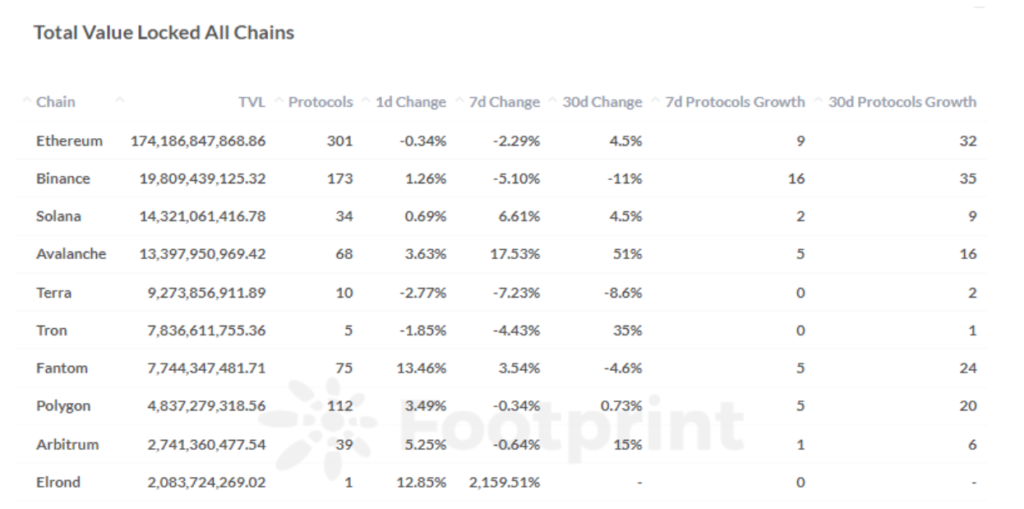

In 2021, the DeFi market continues to grow, also the booming of NFT and Gamefi has driven the explosion of the whole blockchain ecosystem. From the market share of blockchains TVL, that of Ethereum has dropped by 9% from 73% to 64% within 6 months, indicating that other blockchains are rapidly developing and continuously taking up the market share of the Ethereum

How to evaluate a new blockchain

Unlike on-chain projects, blockchain networks as the infrastructure focus more on the construction of its ecosystem. Once the ecosystem is formed, the Matthew effect will appear (the rich get richer) and eventually the head blockchain will take up more than 80% of the market share.

The price of ETH shows the prosperity of Ethereum, rising from $10 (December 2016) to a maximum of $4,000 (November 2021). When a new blockchain appears, how can we determine whether it has a strong potential to grow?

In this article, we mainly evaluate the value of blockchain from the following 5 aspects.

1. Performance

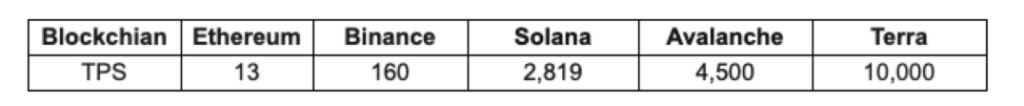

Transaction processing efficiency is an important indicator to measure the performance of blockchain. TPS (transactions per second) refers to the number of transactions that a network can process per second. Higher the TPS, the higher the efficiency.

Most of the new blockchains claim to have a high TPS. While an “impossible triangle” exists in the DeFi world, i.e. high performance, security and decentralization. For example, Solana mainly improves transmission rate ( the performance), but when it reaches a peak, the network becomes unstable.

In September, Solana experienced network downtime. A better solution still needs to be found.

2. Token price

The token price reflects how the blockchain is valued by users and also affects the cost of user transactions

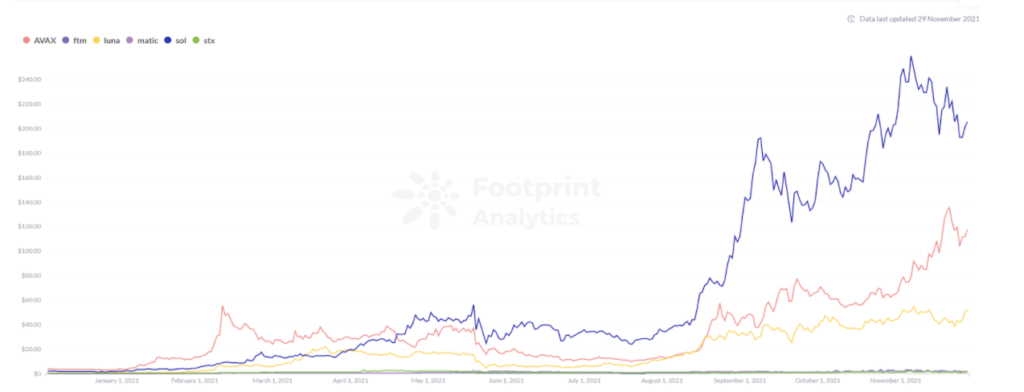

The price of SOL, the token of Solana, rose from $1.80 to a maximum of $259, a 143-fold increase; also the Avalanche token AVAX rose from $2 to $135, a 66-fold increase. Both cases show a high market expectation.

3. Blockchain ecosystem

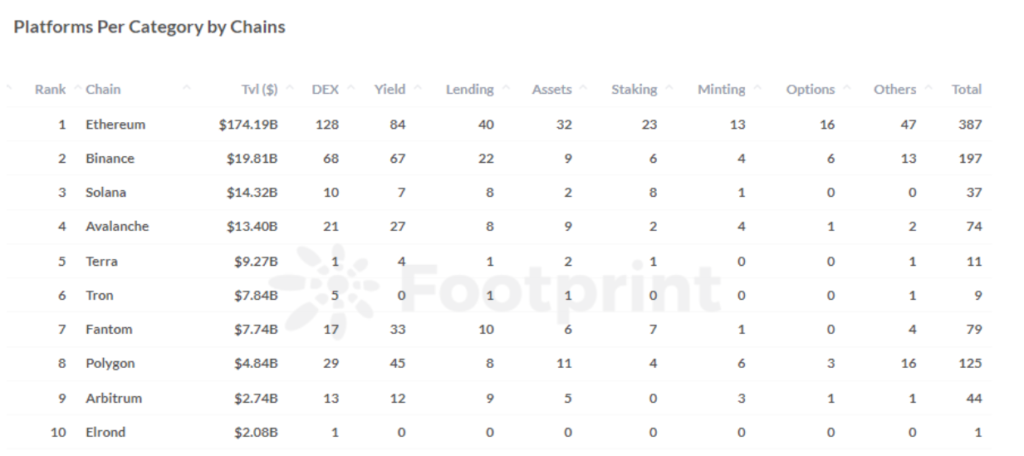

Developing a DeFi ecosystem is never easy. In order to evaluate the value of a blockchain, the completeness of its ecosystem is of high importance, both from number and sector.

Number of projects

Although there are many projects deployed, the number of projects that are actually online is not that much. According to Footprint Analytics, only 5 of the top 10 blockchains have more than 50 projects on-chain.

Blockchains with less than 10 projects need to be further examined. For example, Elrond, the recent popular blockchain with a surge in TVL this month, has only 1 DeFi project, the stability of which is uncertain.

Project Sectors

The diversity of a blockchain ecosystem is good for its balance and stability, with DEX playing a key role. Blockchains with limited project sectors on-chain lack sufficient infrastructure, leading to a fragile ecosystem.

The activity of DeFi projects, the level of developer activities, and the speed of project launch all imply whether the blockchain can attract developers to deploy projects on it.

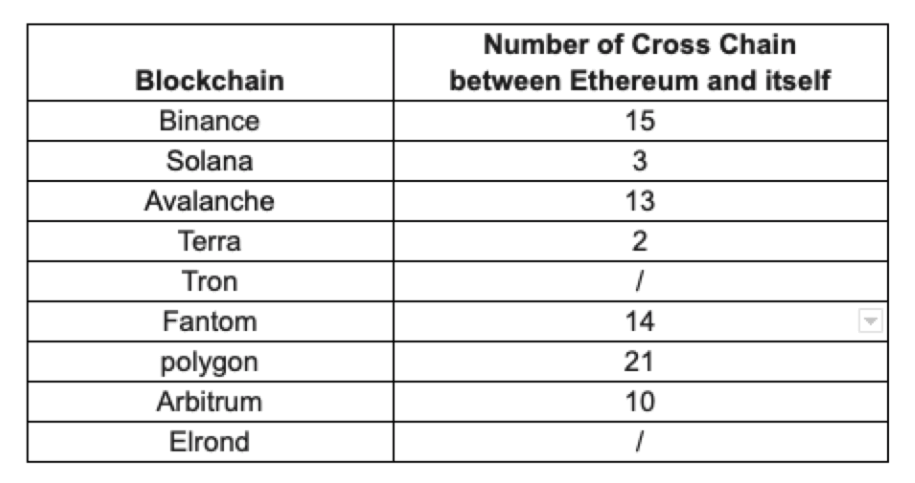

4. Cross-chain tools

Take a look at the current number of cross-chain bridges between Ethereum and the blockchains.

Building an ecosystem of blockchain, cross-chain bridges are extremely important because it allows funds to flow across chains and users can easily transfer assets. This is good for increasing the number of on-chain transactions.

For blockchain projects that have no or few cross-chain bridges, we need to consider its way to interact with other main blockchains.

5. Long-term plan for ecosystem construction and incentives

The main thing for blockchains is to build an ecosystem, which needs a friendly development environment, better performance and user experience.

Good compatibility provides a convenient way to deploy projects directly to other new blockchains. Also, a blockchain that supports emerging project types, such as NFT, GameFi are mostly welcomed. For example, NFT projects on Solana are quite active, and the transaction value has exceeded $700M so far.

This year, many blockchains have established their own development funds for future ecosystem development:

- Polygon launched the $100 million DeFi Fund in April,

- Terra announced the launch of a $150 million ecosystem fund in July,

- Avalanche Foundation announced a $180 million liquidity mining incentive program in August

- Fantom awarded a total of 370 million FTMs to projects with TVLs over $5 million in August

- Celo announced a $100M+ “DeFi for the People” program with Aave and Curve, among others in August

- Harmony announced that it will provide over $300 million in funding over the next four years to support eco-building in September,

- Proximity Labs, a research and development organization investing in the NEAR ecosystem, announced it would allocate 40 million NEAR tokens over the next four years to support the DeFi ecosystem, worth more than $300 million in October

These blockchain incentive programs are launched to motivate the ecosystem. In addition to driving up TVL and Token prices, the incentive programs will also attract more developers to deploy on-chain projects.

Summary

Overall, a valuable blockchain should have a number of advantages, such as:

- Eco-experience friendly: Compared to the congestion and high Gas fees on Ethereum, new blockchains basically have faster speeds as well as lower costs

- Deployment of cross-chain bridges: The increasing demand for cross-chain bridges makes it indispensable

- Strong compatibility: enables projects to quickly deploy and migrate to new blockchains

- Exploration of new areas: ecosystem attracts developers to deploy trending projects such as NFT, GameFi, etc.

- Incentive programs: similar to Avalanche, Polygon has launched Defi Fund program to encourage developers

The above five aspects reflect the growing strength of the blockchain.

Currently, due to high liquidity and transaction volume, Ethereum is still the first choice of most DeFi projects.

However, Ethereum will not be the only option. It needs to compete with other blockchains from the performance, development ecosystem and innovation. The blockchain industry will be a multi-chain coexistence.

Can Ethereum continue to occupy the leading position in the market? We will see how the data integration problem brought by the cross-chain projects and how the cross-chain governance problem will be solved.

This report was brought to you by Footprint Analytics.

What is Footprint

Footprint Analytics is an all-in-one analysis platform to visualize blockchain data and discover insights. It cleans and integrates on-chain data so users of any experience level can quickly start researching tokens, projects and protocols. With over a thousand dashboard templates plus a drag-and-drop interface, anyone can build their own customized charts in minutes. Uncover blockchain data and invest smarter with Footprint.

CryptoQuant

CryptoQuant