27 stats about NFTs in 2022 – who are the big winners?

27 stats about NFTs in 2022 – who are the big winners? 27 stats about NFTs in 2022 – who are the big winners?

At the beginning of the year, when the crypto market was red hot, it was extremely tough to understand what was going on in the NFT industry.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

At the beginning of the year, when the crypto market was red hot, it was extremely tough to understand what was going on in the NFT industry.

The massive influx of collections, new marketplaces, and easy money in the space created the perfect mix of incentives for fraudulent activity. As we know, I published an article in October about NFT wash trading, several “OpenSea killers” were built entirely on fake activity, and not everything was as it seemed when you looked at NFT collection leaderboards. As the market crashed, so did activity across the board (both fake and organic).

But not all was negative. Several highly innovative NFT collections broke the mold of zany PFP images and proved a market for digital, non-fungible art existed.

While there was a proliferation of small collections and grassroots community-building in some corners of the industry (e.g., Solana and Magic Eden), the year also saw consolidation with the birth of the first NFT megacorp in Yuga Labs.

Instead of telling you what to think about 2022 and where the NFT world is heading in 2023, this article has the essential stats from last year so you can create your own analysis.

9 Stats about the NFT Industry

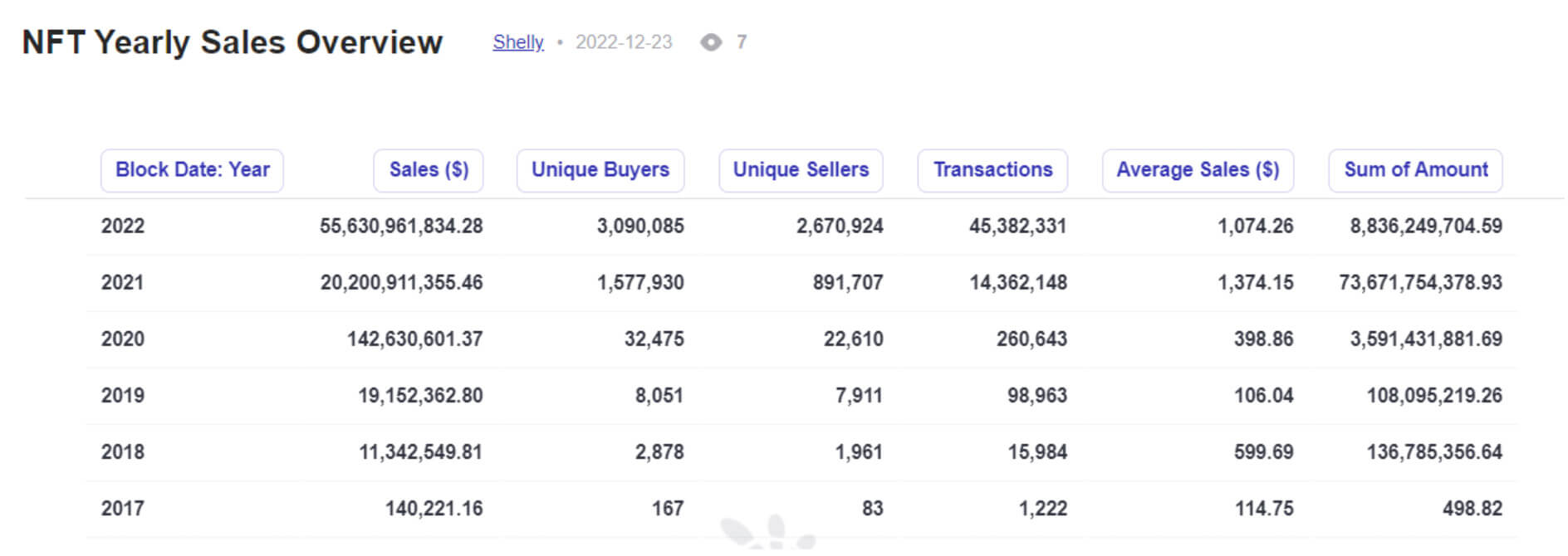

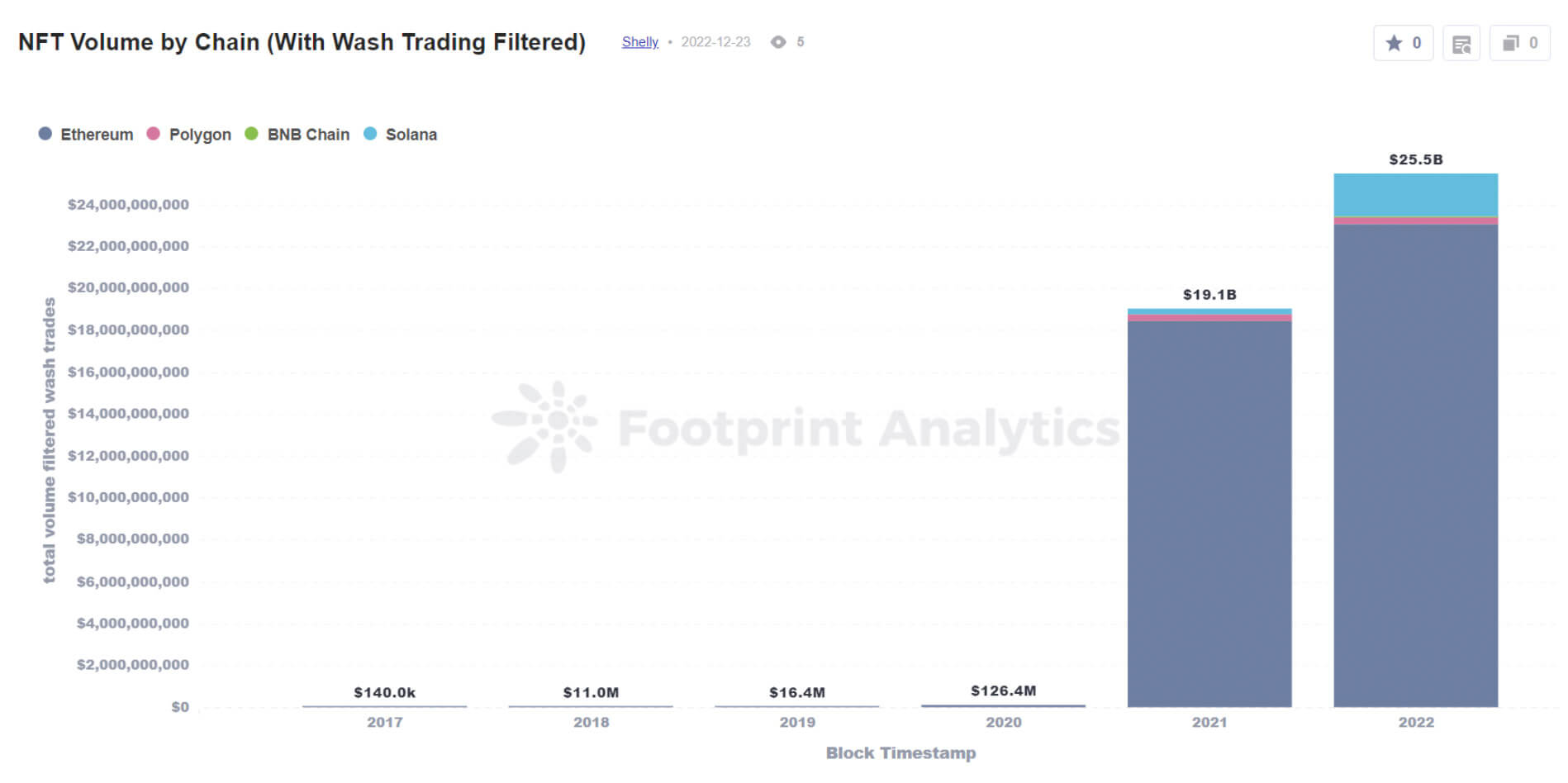

1. Total sales of NFTs in 2022 was $55.5B

This is up 175% from $20.2B in 2021. When you compare 2020 to 2022 total sales, it is 390X more.

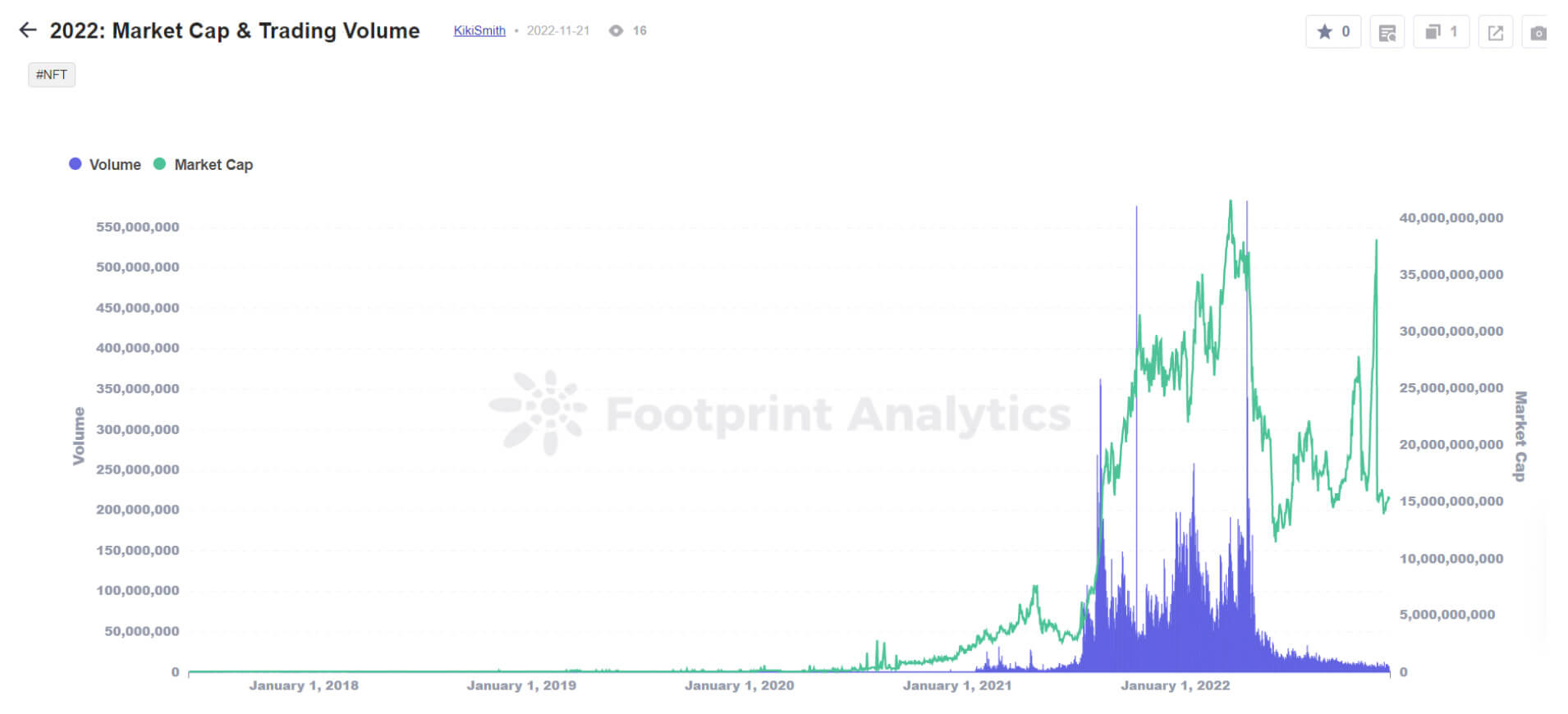

2. The market capitalization of the NFT industry peaked on April 4th at $41.5B

Market capitalization is calculated as the sum of each NFT valued at the greater of its last traded price and the floor price of the collection, respectively. Suspected wash trades have been filtered out.

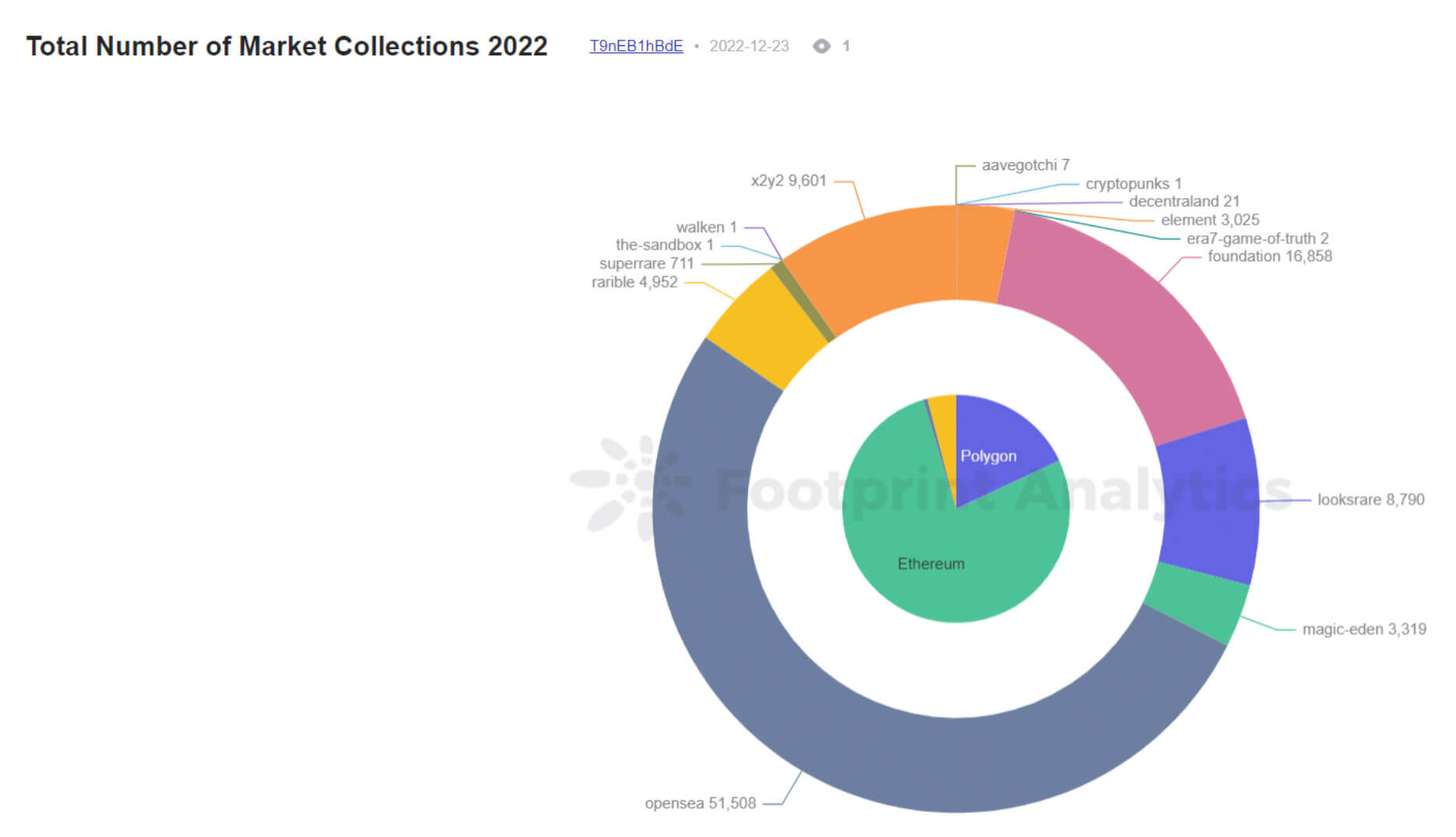

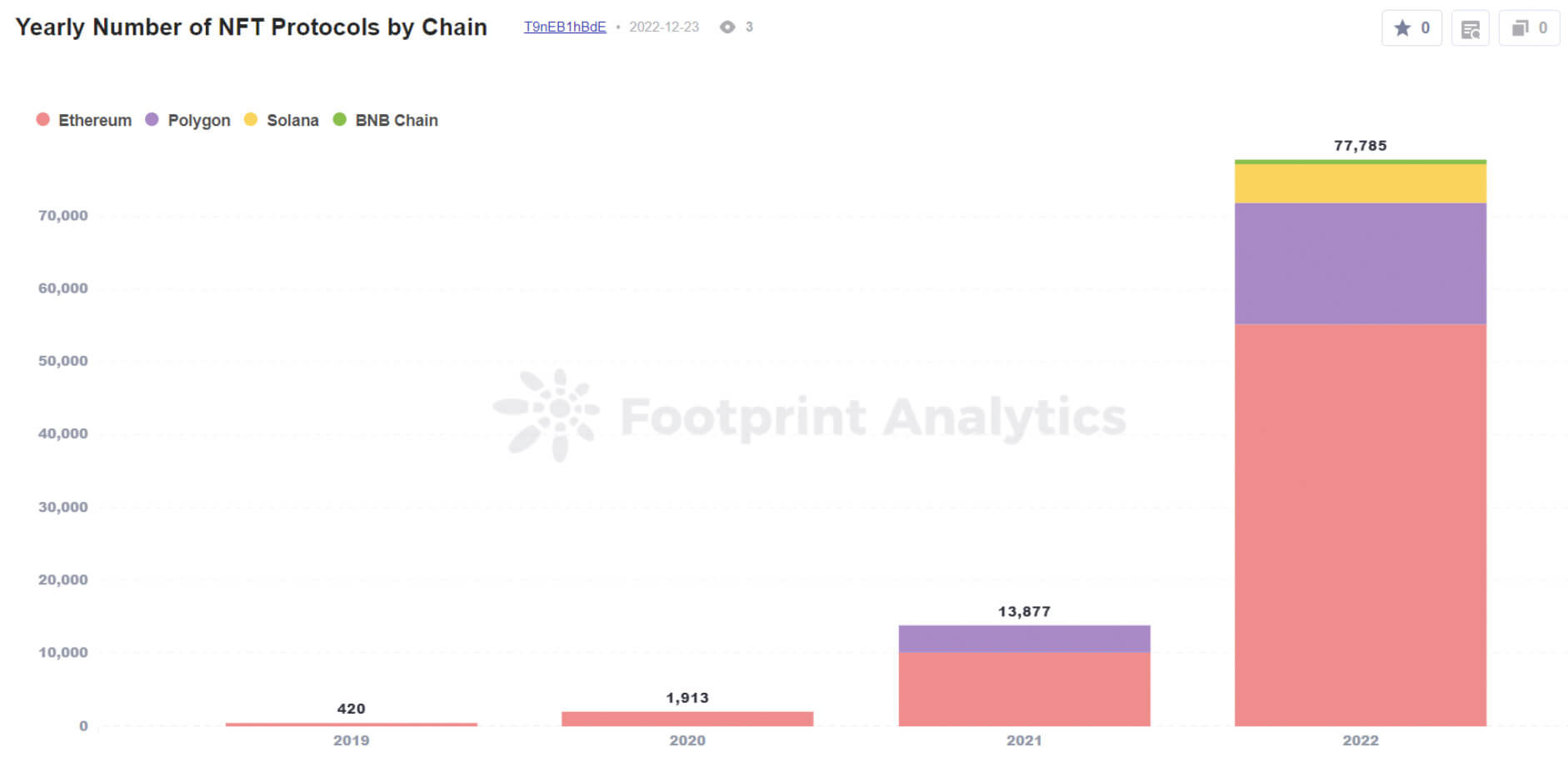

3. Roughly 85K NFT collections were launched last year

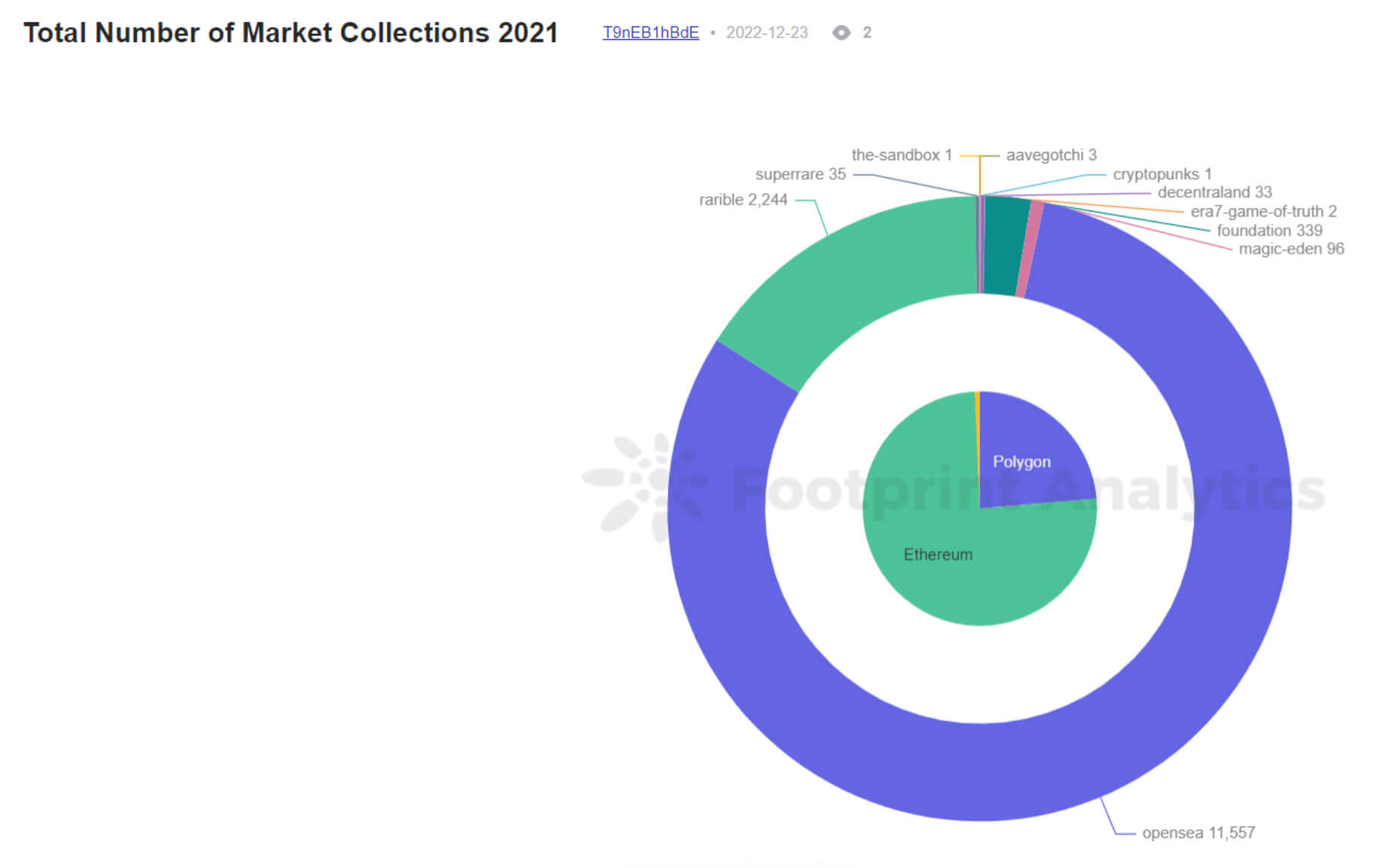

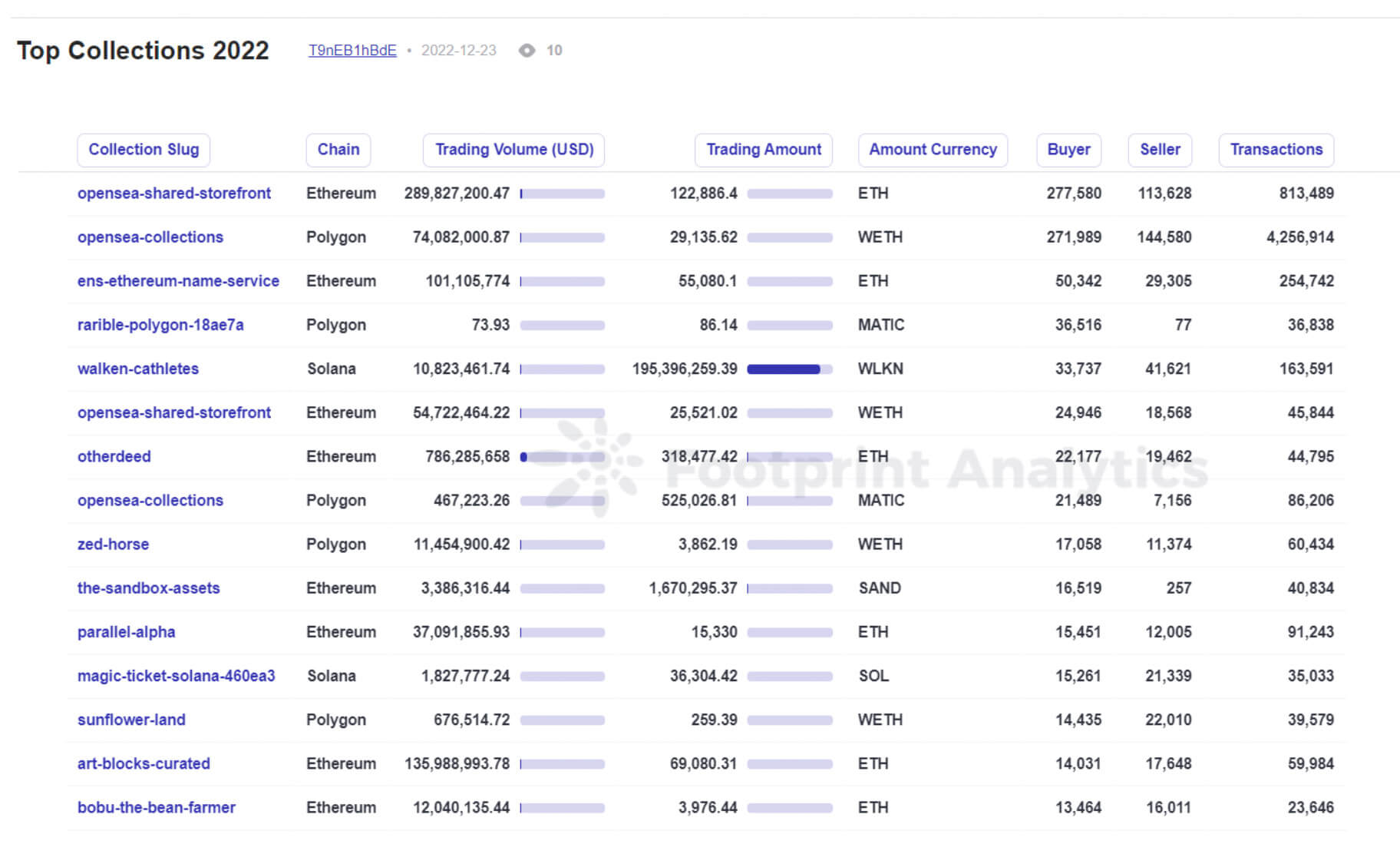

In 2021, there were around 14.5K collections, while the number nearly reached 99K by the end of 2022. Notice that Opensea remains the leader in both years.

4. About 7,700 collections had trading volume over $100K

Do note that the majority of this activity did not come from a legitimate, organic interest in the project based on the date collected.

5. Only 2,623 collections had more than 1000 unique buyers

As with all stats in the NFT industry, this one should be taken with a grain of salt due to the significant amount of wash trading, especially during the year’s first half.

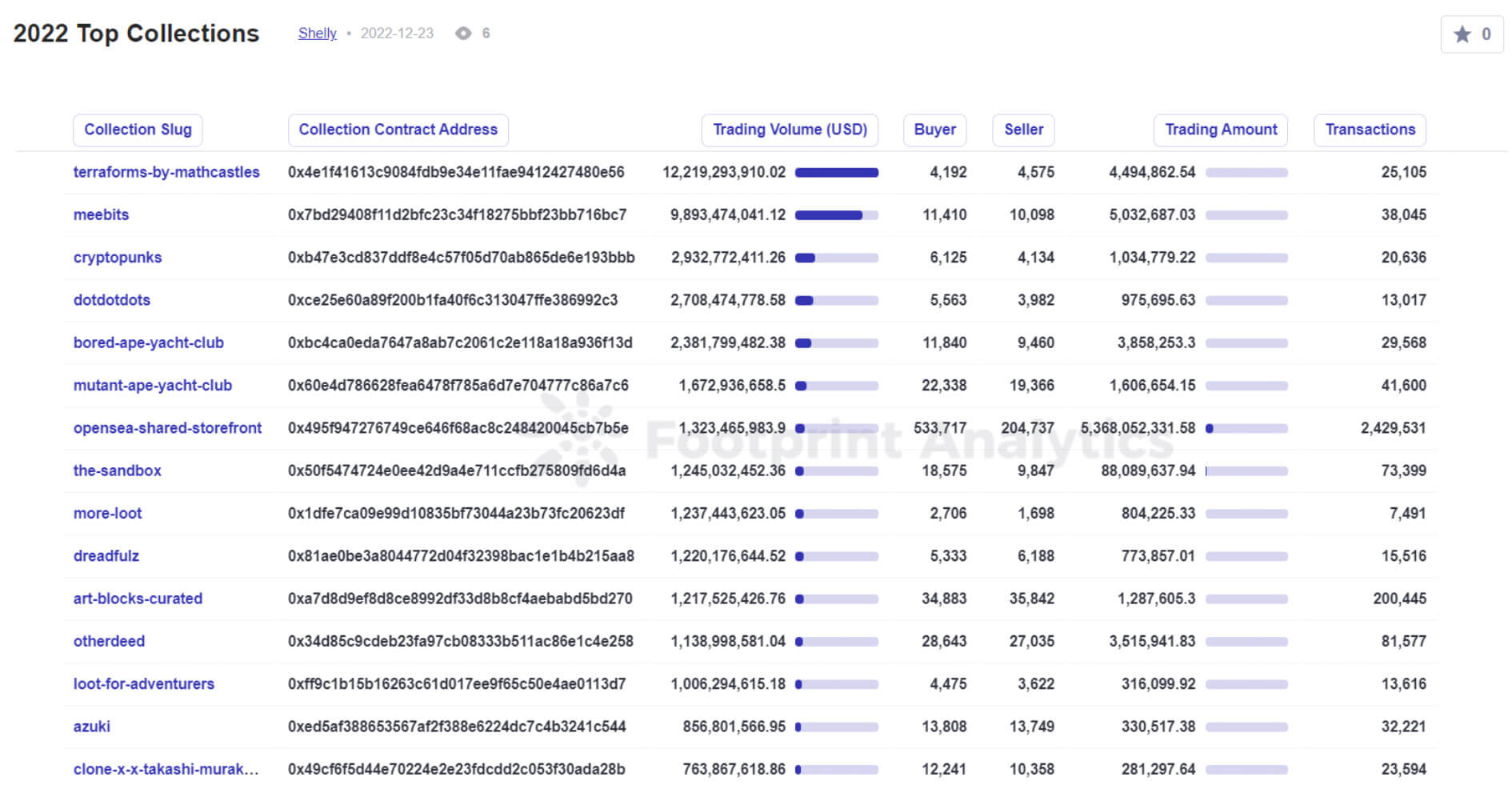

Reference: Top Collections 2022

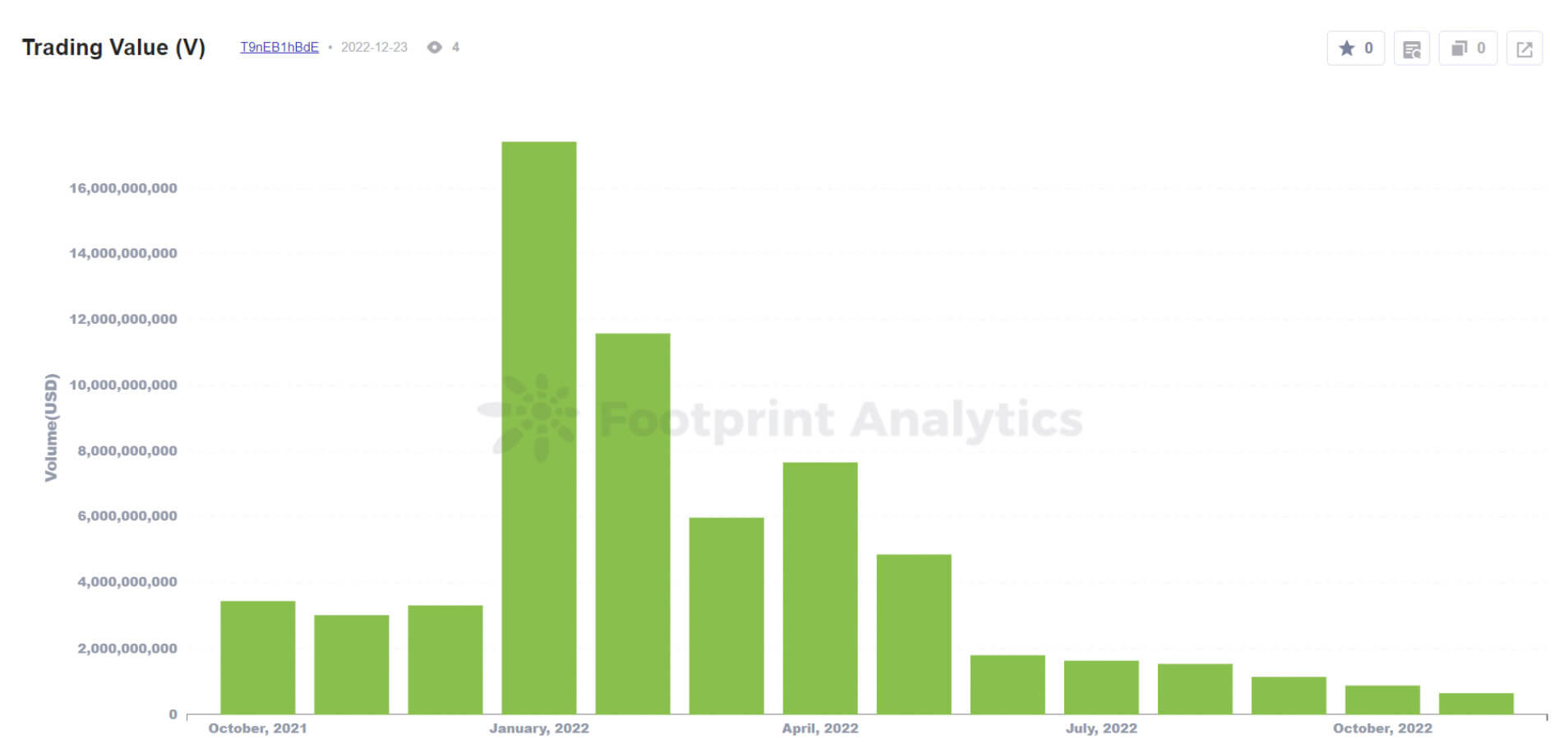

6. NFT trading volume reached its 2022 peak in January, with $17.4B in value

This was more than a 4x jump from the previous month (December 2021). This was also the month when Google searches for the keyword “NFT” reached their all-time high.

Reference: Trading Value (V)

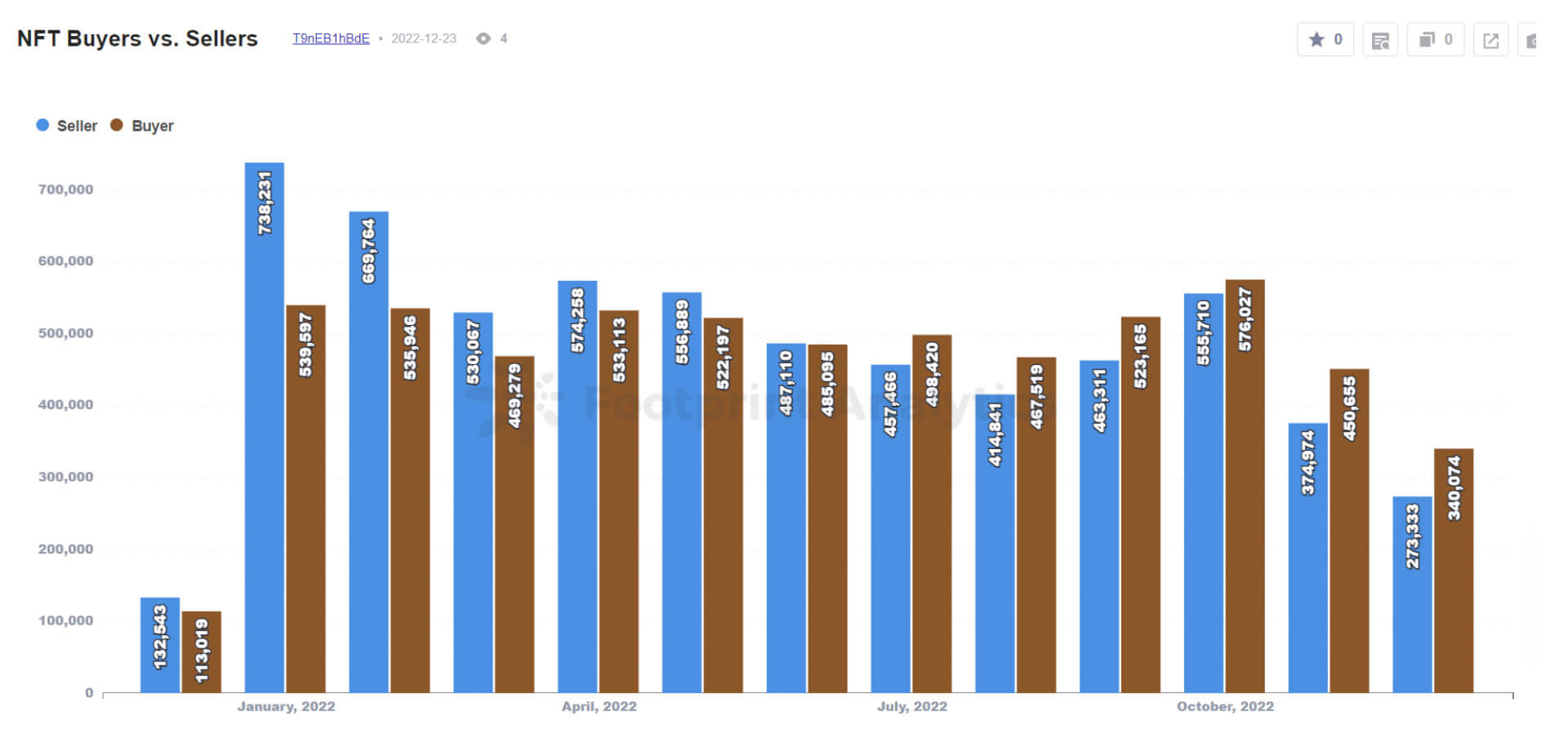

7. The biggest gap between the number of sellers and buyers was in January, with about 200K more sellers than there were buyers.

Yet January was also the hottest month for NFT prices for most major collections, indicating that using these metrics as an analog for supply and demand has flaws.

Reference: NFT Buyers vs. Sellers

8. Last year, 46% of total NFT trading volume was likely to be caused by wash trading

There are several indicators and filters to detect suspicious activity. To identify these types of transactions, I use Footprint Analytics’ filters to separate transactions to the following formula:

- a.) Overpriced NFT trades (10x OpenSea Average Price)

- b.) Collections with 0% royalties (except CryptoPunks and ENS)

- c.) An NFT bought more than a normal amount of times in a day (currently filtered for more than 3+)

- d.) An NFT bought by the same buyer address in a short period (currently filtered for 120 minutes)

6 Stats about NFT Collections

9. The collection with the largest market cap by the end of the year was CryptoPunks at $1.1B

Crypto Punks, launched by Larva Labs in 2017, was the first NFT collection to become a household name and have the highest floor price in the industry. Yuga Labs acquired the IP of the collection in March 2022.

Reference: 2022: Top Collections by Market Cap

10. Trading volume of major collections in the Yugaverse—Yuga Labs’ portfolio of products—was $3.1B

This sum includes Bored Ape Yacht Club, Mutant Ape Yacht Club, Bored Ape Kennel Club, Otherside, and CryptoPunks. It excludes Meebits, which had more trading volume than all of these combined,

Reference: Yuga Labs (Trading Volume in 2022)

11. Yuga Labs’ portfolio accounts for about 20% of the total market cap of the entire NFT industry

This sum includes Bored Ape Yacht Club, Mutant Ape Yacht Club, Bored Ape Kennel Club, Otherside, CryptoPunks and Meebits.

12. Without any wash trade filtering, Terraforms by Mathcastles had an astounding $12B in trading volume, more than any other collection, across 11,341 transactions

However, 99.8% of the volume and 46.3% of transactions were detected as wash trading.

Reference: NFT – Collections

13. When filtering out wash trading, CryptoPunks had the highest volume ($2.9B) followed by Bored Ape Yacht Club ($2.3B)

Reference: 2022: Top Collections by volume

14. ArtBlocks Curated was the 4th most traded collection by volume and amassed a market cap $325M

ArtBlocks demonstrated that there is a market for high-end artistic NFTs—it stands out among Yuga PFP projects, and metaverse land NFTs at the top of the rankings

15. There were 7 major collections whose volume was over 95% wash trading

For this stat, “major” means having over $1M in real trading volume. Terraforms by Mathcastles, More Loot, dotdotdots, Dreadfulz, Audioglyphs, CryptoPhunksV2, and Meebits.

6 Stats about Chains and Markets for NFT Projects

16. Ethereum had 95% percent of volume, 47% of transactions, and 71% of protocols

These figures are almost the same as in 2021. Based on the data, Ethereum is still the most widely used for NFT.

Reference: 2022 Market Share of Transactions by Chain and 2022 Market Share of Trading Volume by Chain and Yearly Number of NFT Protocols by Chain

17. Solana went from having no NFT protocols in 2021 to 5,335 in 2022

Solana is ranked third globally at the point of writing.

Another thing to note is that Ethereum grew from 420 in 2019 to 55,144 in 2022.

18. OpenSea hosted 53% of all total collections

OpenSea remained the marketplace of choice for Ethereum and Polygon. However, Magic Eden capitalized on its Solana first-mover advantage to be the marketplace of choice for collections on this chain (OpenSea started listing them in April.) Note: a collection can list on multiple marketplaces.

Reference: 2022: Number of Marketplace Collections by Chain

19. Solana had more active users in October, with 411K, than Ethereum, with 392K

While most of the blue-chip collections and collectors transact on OpenSea and Ethereum, Solana built up a sizable community of NFT enthusiasts in 2022. Solana’s active users hovered between 20-45% of the total market share—October was the only month it overtook Ethereum for this metric

Reference: Chain Monthly Active User

20. OpenSea had 96,459 unique wallets make a transaction on the protocol on Feb. 2

This is more transactions than any other marketplace on any other day.

Reference: 2022 Marketplace Daily Active User

21. Over $903M in platform fees were generated on OpenSea, going to both the marketplace and creators

This made OpenSea the most profitable marketplace in terms of fees generated from trading (which went to the platform and are disbursed to creators.)

Reference: Top Marketplaces

6 Stats about NFT Investment & Fundraising

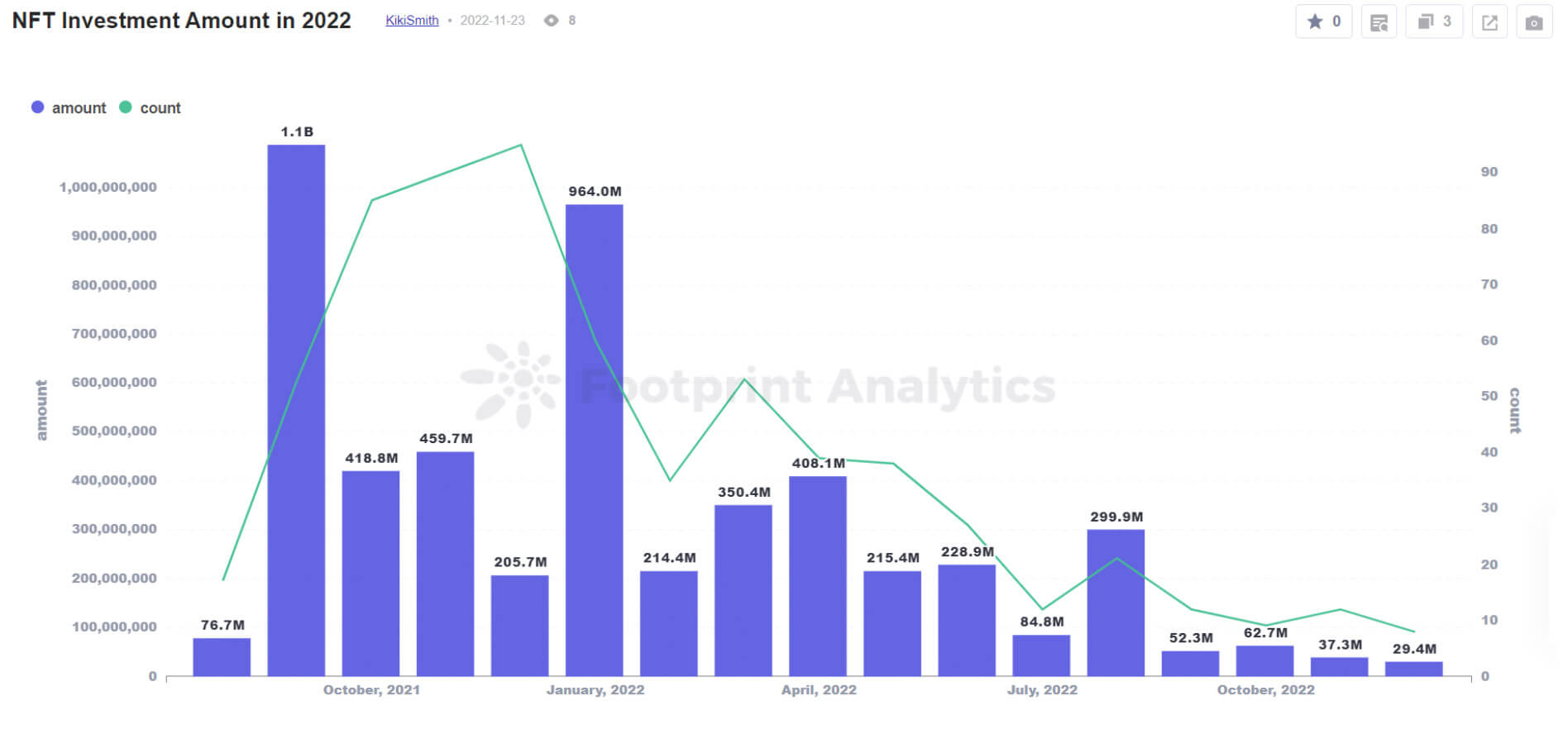

22. The NFT industry received a total of $2.98B in fundraising in 2022

The highest was in January 2022 at $964M. The lowest is in December at $29.4M.

23. Animoca Brands closed the largest round of the year, $358M led by Liberty City Ventures

Animoca has said it will use the funding for strategic acquisitions and investments, develop its games and metaverse products, and acquire licenses for popular intellectual properties.

Reference: 2022 NFT Fundraising Details

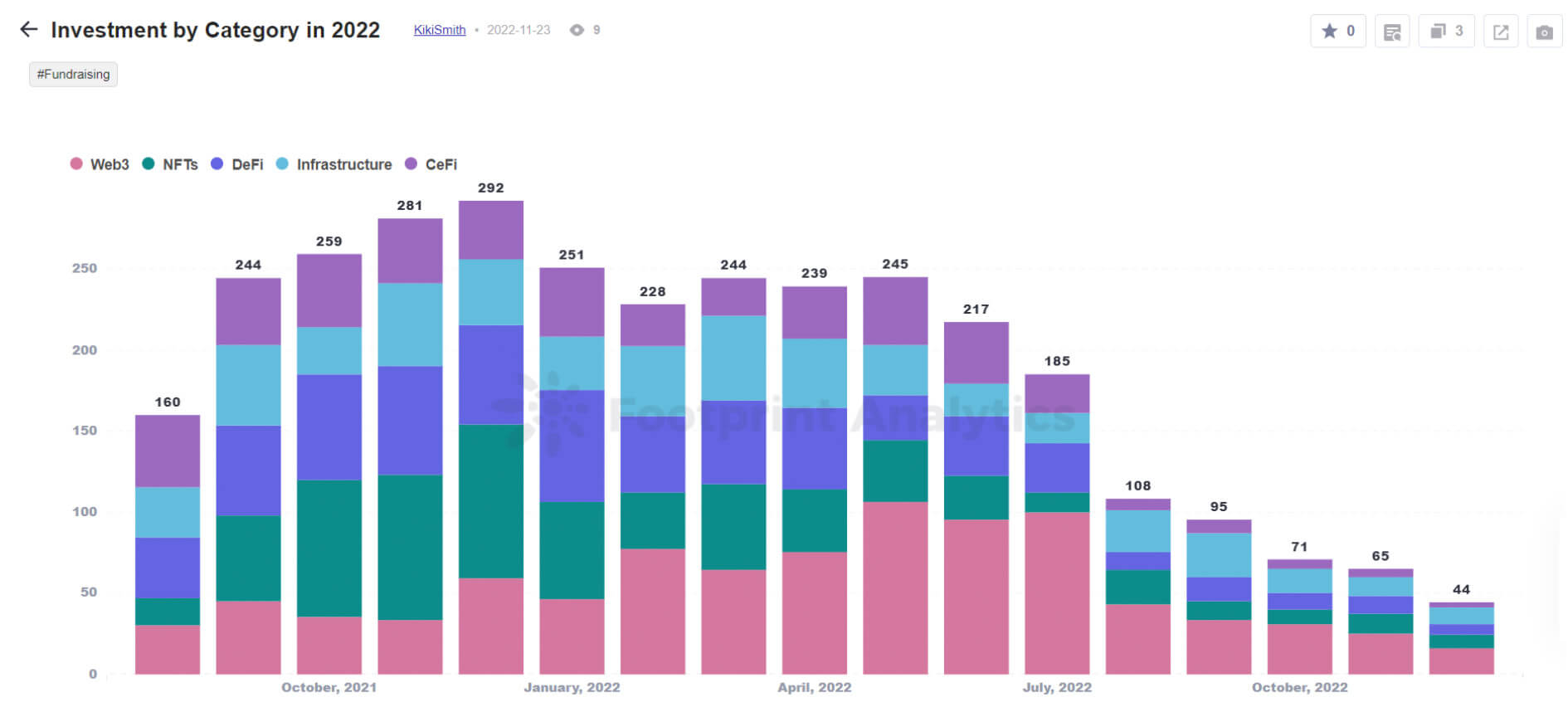

24. There were 1,992 total fundraising rounds in 2022, 756 more than in 2021

Reference: Investment by Category in 2022

25. While NFT-related projects were the most popular category among VCs by the number of rounds, they were the 2nd-least popular in 2022

In 2022, general Web3 projects closed the most rounds (711), followed by DeFi (362), infrastructure (331), NFTs (326), and, finally, CeFi (257).

26. Seed rounds made up 81% of total NFT funding rounds

Reference: NFTs Funding Rounds

27. The 2 largest rounds for pure NFT projects went to OpenSea ($300M) and Dapper Labs ($250M)

The OpenSea round was one of only 5 Series C or D rounds in 2022. Dapper Labs is the studio behind the NBA Top Shot collection.

Key Takeaways

As we can see, Web 3.0 is proliferating. NFT is undoubtedly part of the whole Web 3.0 ecosystem. In the Web 3.0 ecosystem, NFTs are often used to facilitate the buying and selling of unique digital assets on decentralized platforms. These platforms use smart contracts to enable transactions without the need for intermediaries. They can facilitate the buying and selling of NFTs and allow NFT holders to earn passive income by lending out their NFTs. There are many use cases to showcase.

Web 3.0 will continue to draw more investment in 2023 based on some of the deal flows I see in the market. OKX Ventures and GSRV co-lead a $2 Million seed round for a Web 3.0 decentralized Identity platform. Binance Labs launched a $500M fund to support promising Web 3.0 projects and start-up firms with great potential earlier this year. Du Jun, the co-founder of cryptocurrency exchange Huobi Global, runs ABCDE Capital, a $400M Web 3.0 venture capital fund is dedicated to investing in web3 builders.

Apart from the crypto firms-led firms, it’s also true that traditional investment companies are beginning to take notice of the Web 3.0 ecosystem and are starting to invest in companies and projects that are working on decentralized technologies, such as blockchain and non-fungible tokens (NFTs).

There are several reasons why traditional investment companies might be interested in investing in web3 technologies. One reason is that the Web 3.0 ecosystem is still in its early stages and has much growth potential. Decentralized technologies have the potential to revolutionize many different industries, from finance and real estate to art and collectibles.

Another reason is that the Web 3.0 ecosystem is relatively uncorrelated with traditional financial markets, which can offer diversification benefits for investors. This can be especially appealing in times of economic uncertainty, when traditional financial markets may be more volatile.

Ending with a quote:

“Web 3.0 brings endless opportunities to many people, changes lives in Kenya, removes barriers in India and empowers developers in China to service global audiences during the COVID lockdown period. Your gateway to Web 3.0 is just one click away. Let’s innovate.” – Anndy Lian.