This Chainalysis report reveals a stunningly optimistic trend for the crypto market

This Chainalysis report reveals a stunningly optimistic trend for the crypto market This Chainalysis report reveals a stunningly optimistic trend for the crypto market

Photo by Jude Beck on Unsplash

Crypto advocates have long looked upon Bitcoin’s utility as being split into two primary fractions: a store of value and a currency.

Although BTC is no doubt used as a currency on a widespread basis, it does seem to be garnering significant use as a store of value. Prominent investors have echoed this sentiment, with the likes of Paul Tudor Jones and other comparing it to gold.

A new report from crypto analytics firm Chainalysis seems to indicate that many investors are increasingly treating the benchmark digital asset as a safe-haven asset.

This is overwhelmingly positive for the crypto market as a whole, as it suggests that most investors are adopting long-term investment strategies.

Report: Crypto investors largely treating Bitcoin as a long-term investment

Per a recent report from blockchain analytics firm Chainalysis, the vast amount of circulating Bitcoin is currently dormant within wallets, being held as a long-term investment by crypto market participants.

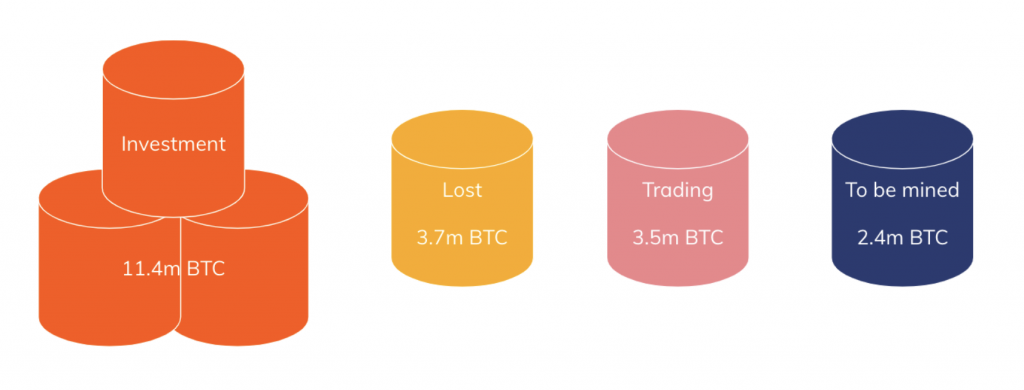

The firm explains that of the 18.6 million Bitcoin that has been mined, roughly 60% is held by either people or businesses that have never sold more than 25% of their holdings. They label this dormant Bitcoin as long-term investments.

“Roughly 60% of that Bitcoin is held by entities — either people or businesses — that have never sold more than 25% of Bitcoin they’ve ever received, and have often held on to that Bitcoin for many years, which we label as Bitcoin held for long-term investment.”

They also note that 3.7 million BTC has been lost, while another 2.4 million has yet to be mined.

This indicates that there is only 3.5 million BTC that is actively used for trading, while the vast majority of crypto investors take a long-term approach to their holdings – despite the market largely being driven by active traders.

BTC’s “digital gold” narrative grows stronger

The aforementioned data bolsters the narrative regarding Bitcoin being a “digital gold.”

Chainalysis spoke about this within their report, explaining that this adds to the cryptocurrency’s fundamental strength, while its active traders provide it with volatility that makes it attractive to traders.

“The data shows that the majority of Bitcoin is held by those who treat it as digital gold: an asset to be held for the long term. But this digital gold is supported by an active trading market for those who prefer to buy and sell frequently.”

The recent halving event also pointed the spotlight towards the benchmark crypto’s scarcity, perpetuating narratives regarding its status as a hard asset.

Farside Investors

Farside Investors