Ethereum is the big winner of massive stablecoin growth as issuance hits record number

Ethereum is the big winner of massive stablecoin growth as issuance hits record number Ethereum is the big winner of massive stablecoin growth as issuance hits record number

Photo by Ihor Malytskyi on Unsplash

Ethereum has seen tremendous growth throughout the past several years, onboarding a significant amount of noteworthy decentralized applications to its blockchain while also enabling the growth of a billion-dollar DeFi ecosystem.

Now, a recently released report from a blockchain research platform is revealing that Ethereum has also been the big winner of the recent stablecoin boom, with the growth of these tokens built upon the platform allowing it to reach value transfer parity with Bitcoin.

This seems to make the case for ETH’s current price being highly undervalued given the strength and fundamental utility of the technology.

Ethereum sees massive issuance of new stablecoins on blockchain

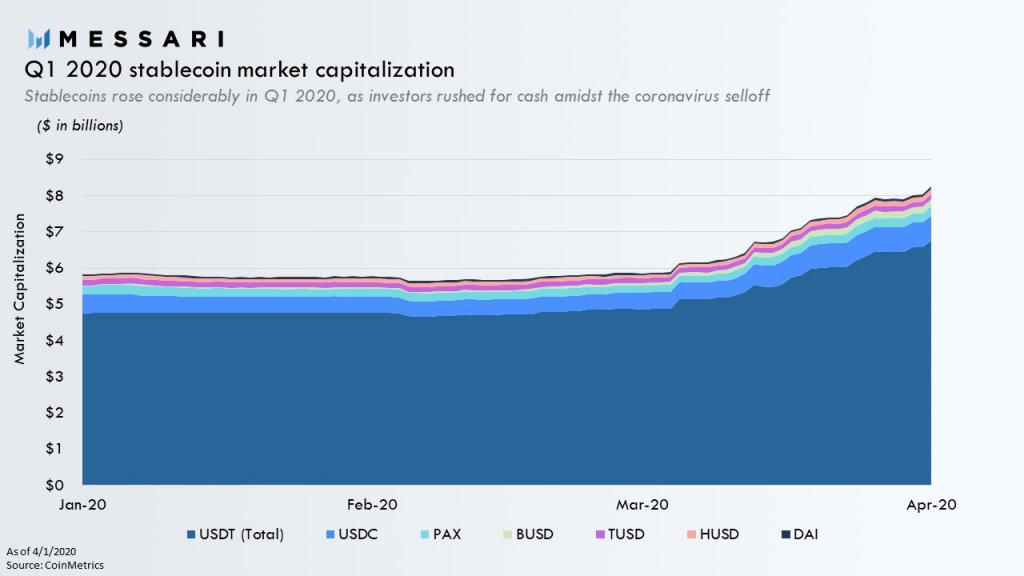

According to a recent report from blockchain analytics firm Messari detailing the notable developments within the crypto industry in the first quarter of 2020, the firm notes that the first few months of the year given rise to massive growth amongst stablecoins.

The total market capitalization for these digital assets sits at a whopping $8 billion, with investors relying on these assets as a way to hedge against the volatility seen by traditional cryptocurrencies like Bitcoin.

As reported by CryptoSlate last week, some industry leaders are even noting that the massive value of stablecoins currently sidelines on crypto exchanges could act as “dry powder” that fuels the next major uptrend.

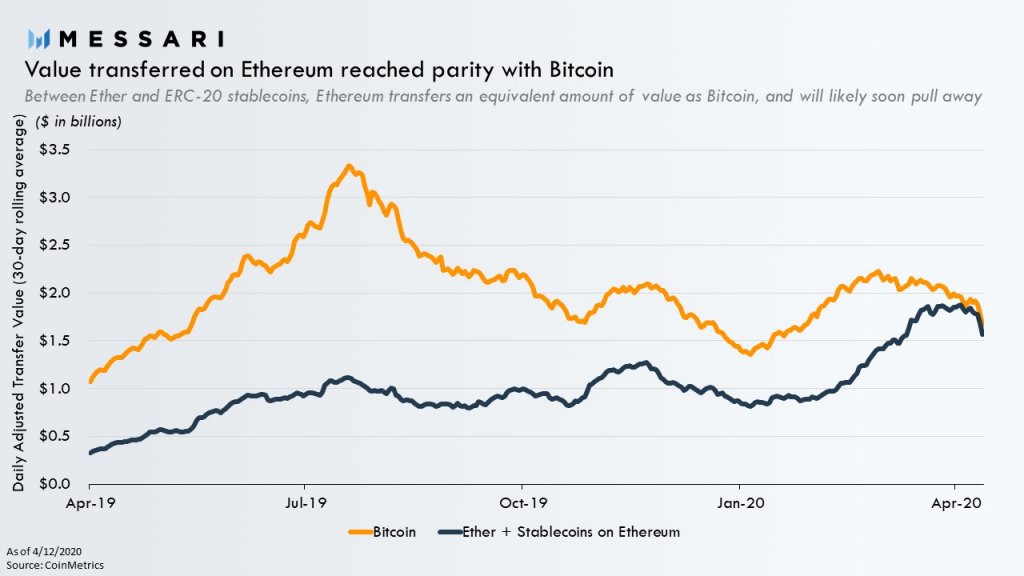

Messari also notes that Ethereum appears to be the big winner of this stablecoin boom, with the blockchain incurring significant new token issuance and heightened on-chain value transfer due to the rising popularity of the non-volatile tokens.

“One winner in the growth of stablecoins appears to be Ethereum, which recently reached value transfer parity with Bitcoin. Stablecoins now account for 80% of daily transfer value on Ethereum as it has proven to be the issuance platform of choice for new stablecoins.”

ETH’s foundation continues growing stronger

The increase in stablecoin issuance on Ethereum’s blockchain is one factor that points to growing fundamental strength and utility that could lead investors to conclude that ETH is currently undervalued.

Ryan Adams, founder of Mythos Capital and a popular Ethereum advocate, spoke about the platform’s fundamental growth in a recent tweet, explaining that he still believes it is highly undervalued based on its present utilization.

“In Feb 2016 the reserve asset of Ethereum traded at $2. If I told you then that 4 yrs later this network would host over $9b in stablecoins & that’s just one of its promising use cases you have been blown away. You would have backed up the truck. That’s how I feel about ETH today.”

As the utility and utilization of Ethereum continues growing, it is probable that crypto and non-crypto investors alike will eventually take notice.