All you need to know to invest in DeFi

All you need to know to invest in DeFi All you need to know to invest in DeFi

DeFi has been an ongoing hot topic in the blockchain space since 2019. There is no doubt that DeFi has become a heavy hitter in the crypto world.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

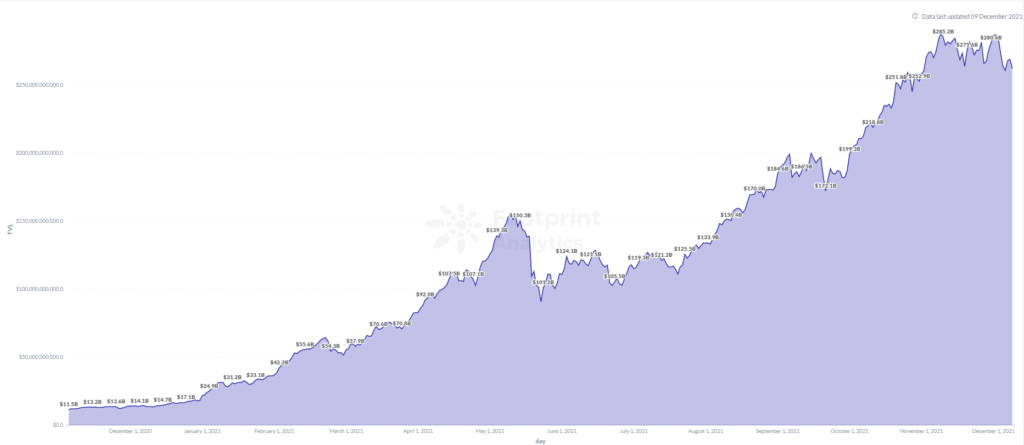

According to Footprint Analytics, DeFi has a TVL of $274.4 billion as of Nov. 23, 2021,while that was only $13 billion one year ago.

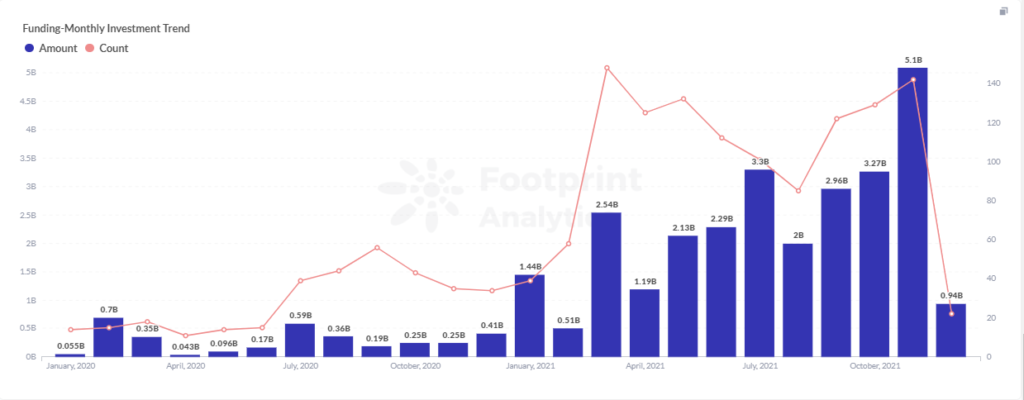

The rapid development and growth of DeFi has cheered all those involved in the blockchain space, resulting in a large number of investment institutions. As of press date, the accumulated funding amount since 2021 totals $24.8 billion, compared to that in 2020 of $3.4 billion, a 626% increase.

So what is this powerful beast known as DeFi?

What is DeFi?

DeFi is an acronym for Decentralized Finance, also known as Open Finance. With the rapid development of blockchain, its application scenarios are being enriched, among which finance is the most promising industry. It actually refers to the decentralized protocol used to build an open financial system, aiming to allow anyone in the world to participate regardless of time and place.

CeFi vs DeFi

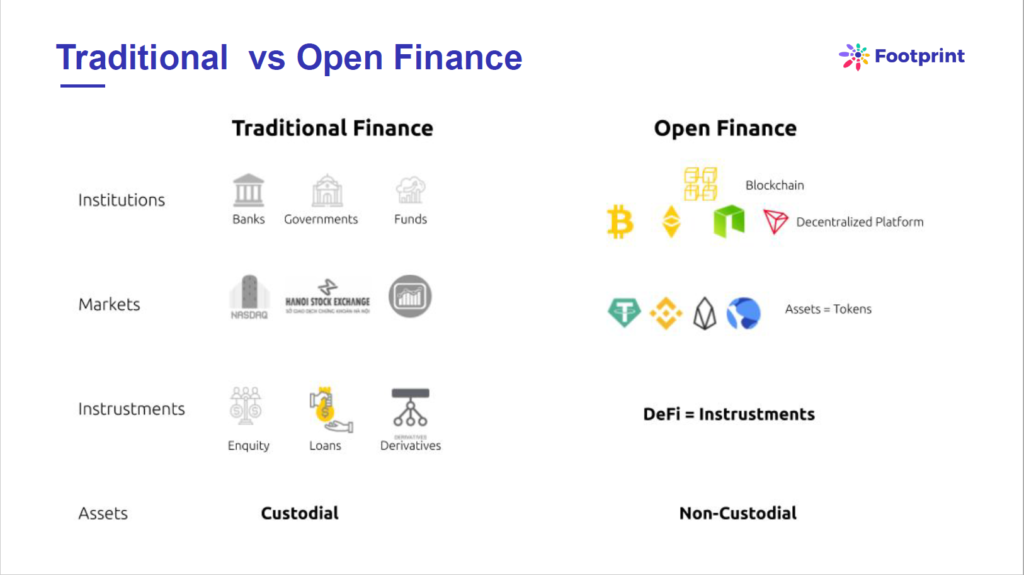

In brief, DeFI is to duplicate traditional finance into the blockchain network. Different from traditional finance, it achieves decentralization through blockchain and uses smart contracts to replace the privileged institutions in traditional finance, where users can enjoy financial services at a lower cost and higher efficiency. As shown below, all kinds of services of open finance can be found in traditional finance.

DeFi serves as an integral section of the vast crypto world, providing many of the mainstream financial services similar to the traditional financial world in a way that is controlled by the masses rather than a centralized entity.

History of DeFi

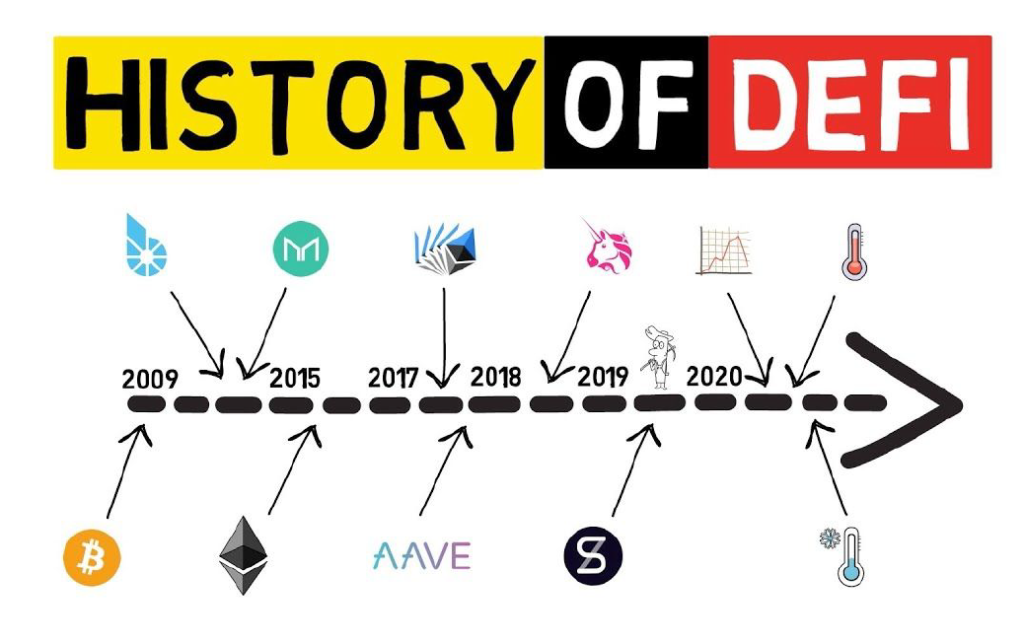

While Bitcoin has laid the foundation for peer-to-peer payment services since its launch in 2009, the Ethereum, launched on July 30, 2015, maximized the potential of blockchain in finance and encouraged the launch of new startups and projects to form an ecosystem for decentralized finance.

The MakerDao protocol go-live is a turning point for financial applications in the blockchain space – it allows users to do more with their money than just transferring money between two addresses. MakerDao is an Ethereum-based protocol that allows users to use digital assets as collateral to obtain DAI – a stable coin issued by MakerDAO that is pegged 1:1 to the value of the U.S. dollar – provided the first piece of Lego for building a new, open, permissionless DeFi ecosystem.

Since then, other smart contracts have come online, creating an increasingly dynamic and interconnected ecosystem.

Compound, released in September 2018, provides a marketplace for borrowers to over-collateralize their loans, while lenders receive revenue from the interest paid by borrowers. Its liquidity mining innovation also sparked the DeFi explosion in 2020, dubbed the Summer of DeFi.

Launched in November 2018, Uniswap – a decentralized exchange (DEX) platform on Ethereum – provides a convenient trading mechanism that allows users to exchange various tokens on Ethereum.

Since then, a wide variety of DeFi applications have emerged, from the most basic lending to more complex synthetic assets, payments, insurance. A rich, evolving, decentralized financial ecosystem has been developed.

6 Sectors of DeFi

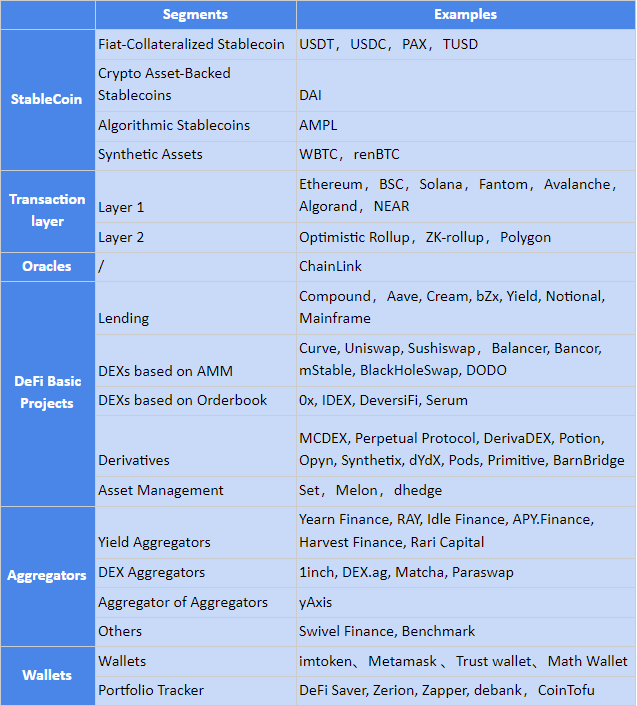

- Stablecoin: The foundation of the DeFi ecosystem

- Transaction layer: With the development of DeFi, the performance problems of blockchains are becoming more and more prominent, especially Ethereum. So at the transaction level, many blockchains are actively exploring solutions, with Layer 1 for performance improvement of blockchains, and Layer 2 for performance improvements. of Ethereum.

- Oracles: Oracles provides price information for all kinds of Dapp/protocols, it is the bridge to link the on-chain and off-chain worlds.

- DeFi Basic Projects: Stablecoin, Transaction Layer, and Oracles are the sectors that form the infrastructure in the DeFi ecosystem, with which various decentralized applications can be built on top. Among them, DeFi basic projects can be divided into several categories such as DEX, lending, and derivatives.

- Aggregators: The existence of spreads in lending platforms and between different DEXs has stimulated the formation of aggregators. They convert high and low based on the spreads between different platforms, thus increasing returns for investors.

- Wallet: It serves as one of the most important components of the DeFi ecosystem and is considered the browser for DeFi investors to use various Dapps.

Components of DeFi Knowledge

DeFi Basics

- DeFi Ecosystem

- DeFi Sectors

- Top DeFi Projects

Information of a Defi Project

- Ecosystem & Type

- Tokens & Economics

- Features comparison with competitors

- Ranking & Figures

Industry Updates

- Fundraising News

- New DeFi Projects

- Attacks News

- Reports & Books

How to get information about a DeFi project?

With so many DeFi projects out there, how can we get to know them better and faster? We can start from the following two aspects.

DeFi Information

- DeFiLlama:cross-chain data, project category

- Debank:cross-chain data, project category, date of issuance

- Footprint Analytics:cross-chain data, industry & project dashboards, visualization platform

Industry Reports & Books

Reports:

- CoinGecko: 2021 Q3 – Report

- Token Insights: Quarterly Report

- Footprint Analytics: Monthly DeFi Report

- Consensys: 2021 Q3

Intro Books

Summary

This article provides a brief introduction to what DeFi is, as well as some of its basic ecosystem, and ways to understand the projects.

Next, we will share further information on how to get involved in DeFi investment, and what features vary from different DeFi projects. You are welcome to subscribe, communicate. Let’s DeFi together!

This report was brought to you by Footprint Analytics.

What is Footprint

Footprint Analytics is an all-in-one analysis platform to visualize blockchain data and discover insights. It cleans and integrates on-chain data so users of any experience level can quickly start researching tokens, projects and protocols. With over a thousand dashboard templates plus a drag-and-drop interface, anyone can build their own customized charts in minutes. Uncover blockchain data and invest smarter with Footprint.

CoinGlass

CoinGlass

Farside Investors

Farside Investors