Realized Bitcoin loss from the FTX fallout surpasses LUNA collapse

Realized Bitcoin loss from the FTX fallout surpasses LUNA collapse Realized Bitcoin loss from the FTX fallout surpasses LUNA collapse

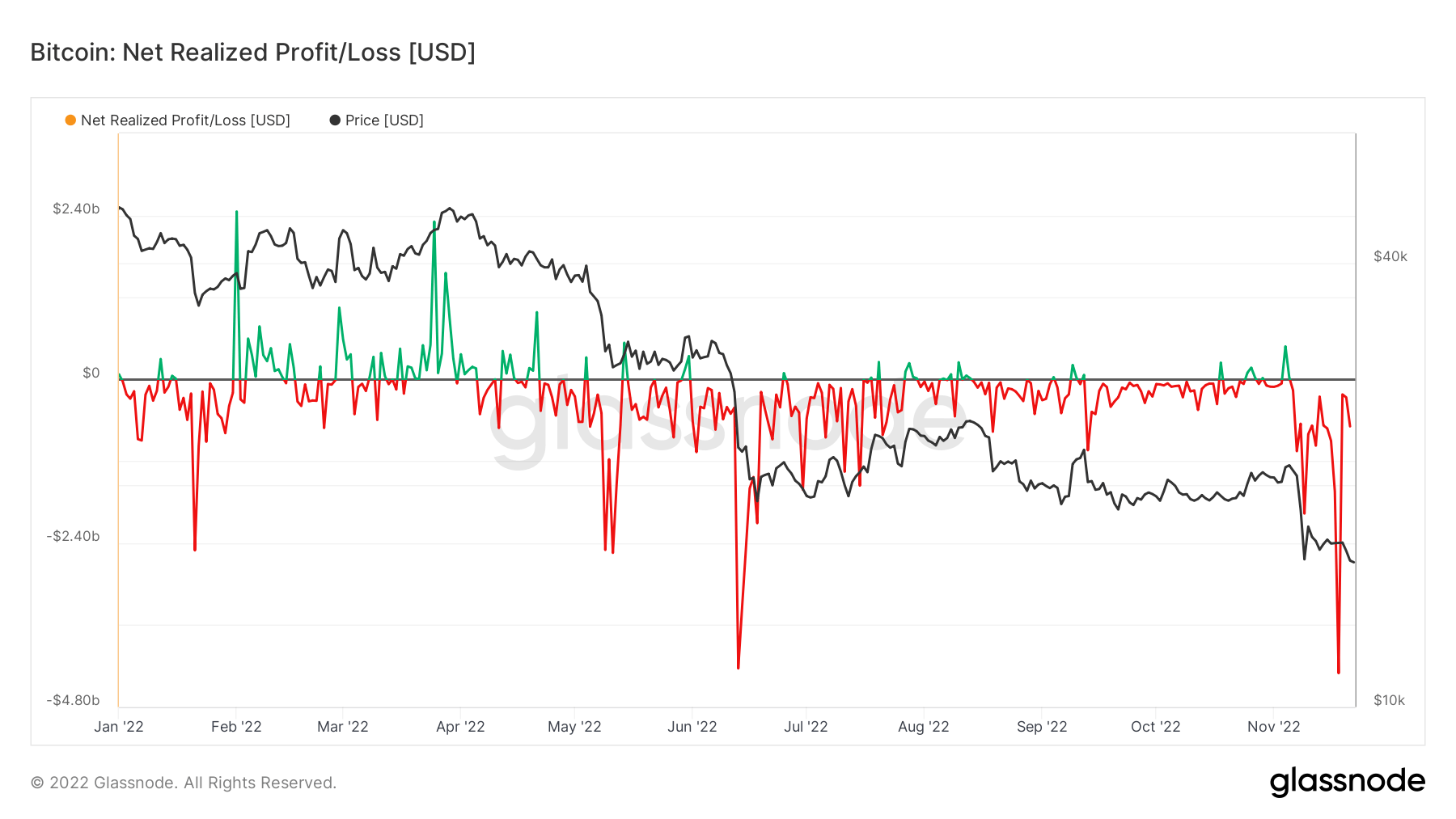

Investors suffered more realized losses from the FTX fallout than they did from the collapse of Luna, showing that the worst is not over yet.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The collapse of FTX wreaked havoc on the market, wiping out billion from the market cap. Bitcoin took its heaviest hit this year, dropping to a low of $15,500 and struggling to break through the strong resistance at $16,000.

Bitcoin’s volatility seems to have shaken the confidence of many investors and pushed them to sell well below their buying price. Glassnode data analyzed by CryptoSlate showed that realized Bitcoin losses reached their yearly high of $4.3 billion.

The first wave of selling pressure seen at the beginning of November pushed realized loss to around $2 billion.

A slight consolidation in losses led many to assume that the fallout was contained, but an additional wave of selling pressure pushed the losses even lower. The realized losses caused by the collapse of FTX are now higher than the realized losses caused by the Luna collapse in June this year.

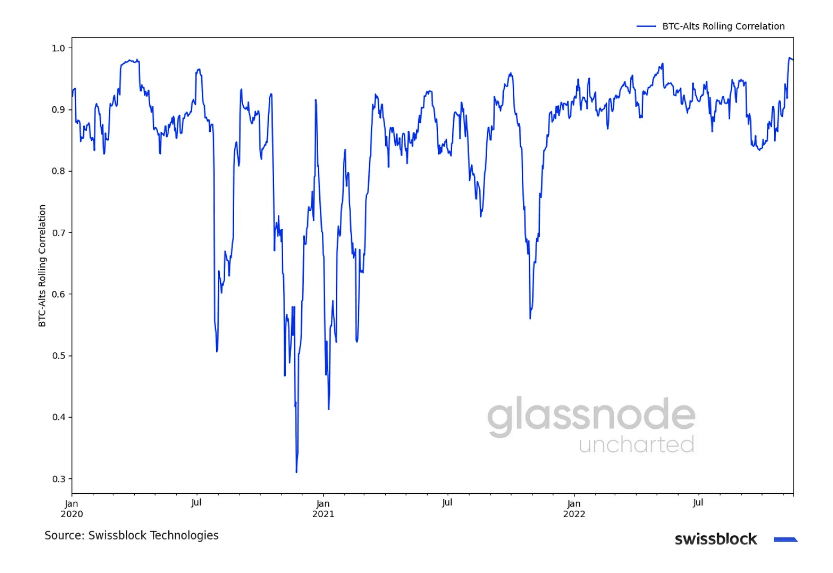

The losses suffered had an adverse effect on Bitcoin’s correlation to other cryptocurrencies. Bitcoin and altcoins have been trading at a 1:1 correlation since the beginning of November, indicating a level of volatility unseen since the beginning of the COVID-19 pandemic in March 2020.