3 important factors driving Avalanche’s 504% growth

3 important factors driving Avalanche’s 504% growth 3 important factors driving Avalanche’s 504% growth

What caused this epic climb, and what exactly makes Avalanche's growth unstoppable?

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

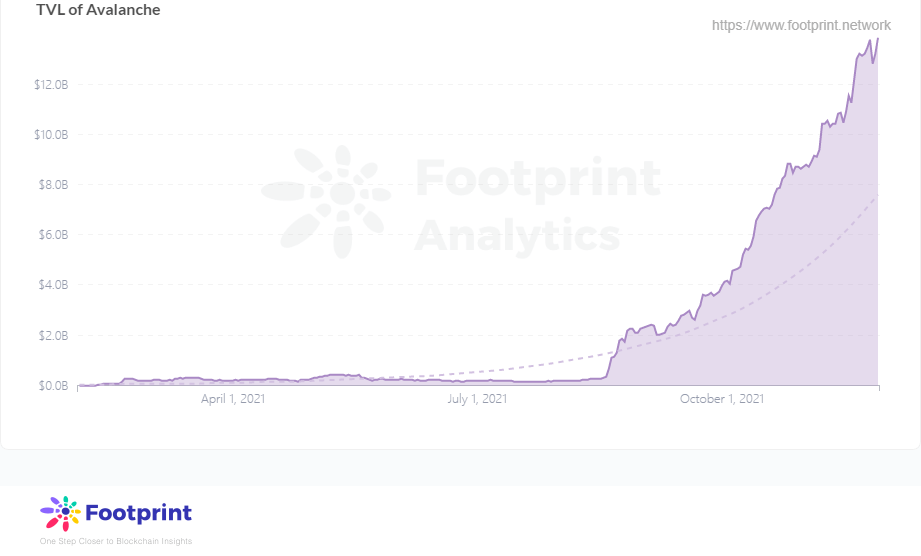

Since the previous article on Avalanche in September—”Avalanche Gains Momentum as Blockchains Battle Breaking Out” by Footprint — Avalanche’s TVL has risen from $2.3 billion to $13.9 billion.

1. Sustained ecosystem support

The Avalanche Foundation launched Avalanche Rush on August 18, a $180 million liquidity mining incentive program that drove Avalanche’s first surge. Since then, the project’s incentive mechanism has been ramped up. Benqi, a native lending project, also launched a $3 million liquidity mining incentive program with the Avalanche Foundation, rewarding AVAX and protocol token Qi for users who borrowed on Benqi, which became the highest TVL protocol on the chain in less than a week.

Two months later, the Avalanche Foundation re-launched a $200 million fund (Blizzard), that will be used to incentivize four key areas of the Avalanche ecosystem (DeFi, enterprise applications, NFTs and culture applications), while seeking other emerging applications. Avalanche’s support for the project will include equity investments, token purchases and various forms of technical, business development and ecosystem integration support.

Avalanche is also expanding its external ecosystem. Shopping.io, a well-known crypto e-commerce platform, has announced support for users to use Avalanche’s token AVAX to shop on Amazon, Walmart, eBay and other platforms, with a 2% discount in some areas.

Wyre, a U.S. cryptocurrency payment infrastructure provider, has also integrated its payment network into Avalanche’s ecosystem, supporting users in more than 50 countries/regions in converting nine currencies, including the US dollar, to AVAX.

2. A strong multi-chain framework

Avalanche is a proof of stake chain and the prominent difference from other blockchains is the adoption of three core chains. Each of the three chains takes on a different role by using different data structures.

X-Chain (Exchange Chain)

- Used for trading and creating assets and has a fast transaction speed

- X-chain allows users to create and trade assets on other instances of X-Chain and AVM (Avalanche Virtual Machine)

C-Chain (Contract Chain)

- Made for creating, deploying and interacting with smart contracts

- Since the chain supports the EVM (Ethereum Virtual Machine), it is fully compatible with all smart contracts on Ethereum

- Usually, users will use C-Chain for mining and lending

P-Chain (Platform Chain)

- Supports creating subnets, adding validators, and creating blockchains as the metadata blockchain on Avalanche

Previously, the transaction fees were high compared to other blockchains due to the complex multi-chain. However, Avalanche activated the Apricot Phase Three upgrade to optimize API requests in August, which reduced transaction fees by 66%.

With this mechanism, Avalanche has been able to increase the overall transaction speed on the chain, with a TPS of over 4500, while the cheaper transaction fees make Avalanche a superior transaction experience compared to Ethereum. With the addition of the native cross-chain bridge, Avalanche Bridge, users can easily move their assets from other blockchains.

3. A developer-friendly dApp ecosystem

EVM compatibility makes it easy for developers in Ethereum to migrate all kinds of dApps to Avalanche. Unlike other blockchains that focus more on their own dApps, Avalanche deploys early on to bring in the leading protocols on Ethereum and gets more growth and more attention.

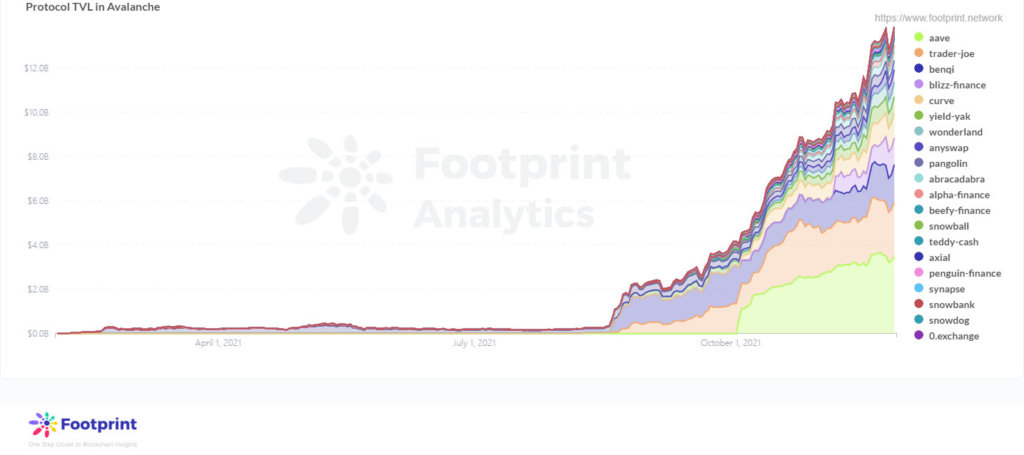

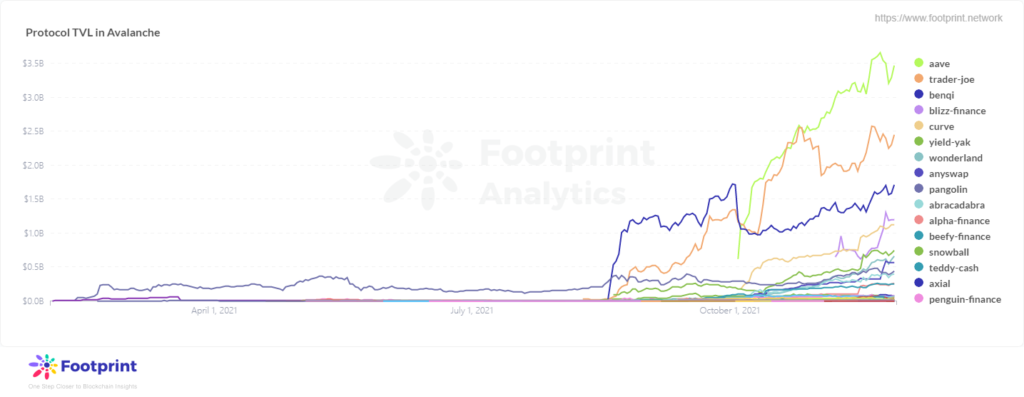

Aave and Curve, the current leading DApps on Ethereum, have been deployed to Avalanche and contribute about 33% of TVL, with Aave quickly overtaking Trader Joe and Benqi at the top of the pack after its launch in October.

The number of protocols on Avalanche that exceeded $100 million in TVL rose rapidly from just 4 in August to 12 in November, with five exceeding $1 billion. In November, Avalanche Fund also announced that it would begin a 3-month liquidity mining bonus program together with SushiSwap totaling $15 million, half of which from each part.

In addition to protocols from Ethereum, Avalanche’s own protocols have grown rapidly under various incentives.

In the DEX category, Pangolin has been a slow riser in TVL despite being the earliest player on Avalanche. In contrast, Trader Joe, which started to grow rapidly in August, is now top of the DEX with $2.3 billion. Trader Joe offers trading, but also lending and liquidity asset management. Users can convert a single asset directly with LP capital that provides liquidity through a streamlined operation and have a one-stop experience here.

In the lending category, Benqi, the native lending project, has a relatively stable TVL. Due to Aave’s airdrop in October, Benqi’s TVL suffered a setback and gradually recovered to its former peak of $1.7 billion subsequently, but its market share has been gradually swallowed by Aave. Benqi’s operations include lending and liquidity mining, support for depositing protocol tokens QI and a variety of stablecoins, WETH, WBTC and other assets from Ethereum cross-chain to Avalanche.

In the yield category, Yield Yak, the first yield protocol in Avalanche, currently has a TVL of $700 million and is committed to minimizing slippage for users when trading. Yield Yak gains revenue by farming in each protocol, which is automatically compounded and currently supports stablecoins, single tokens, and LP Tokens.

Conclusion

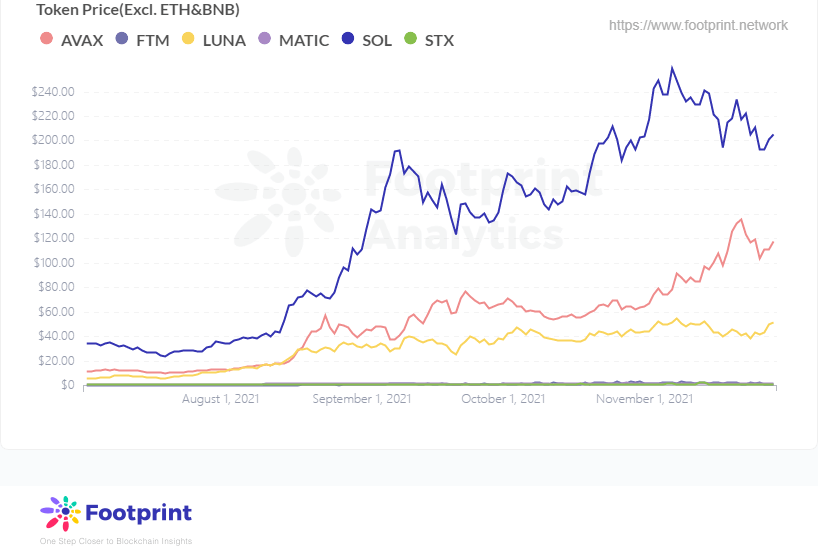

Avalanche is currently ranked fourth in TVL among all the blockchains and is poised for further growth. The price of Avalanche’s token, AVAX, is also on the rise, nearly doubling from its price in early September. By the end of November, at $205, it was behind only ETH, BNB and SOL.

The above content represents the personal views and opinions of the author and does not constitute investment advice. If there are obvious errors in understanding or data, feedback is welcome.

What is Footprint

Footprint Analytics is an all-in-one analysis platform to visualize blockchain data and discover insights. It cleans and integrates on-chain data so users of any experience level can quickly start researching tokens, projects and protocols. With over a thousand dashboard templates plus a drag-and-drop interface, anyone can build their own customized charts in minutes. Uncover blockchain data and invest smarter with Footprint.