Solana (SOL) flips XRP to become the sixth-largest crypto. Surges to $210.

Solana (SOL) flips XRP to become the sixth-largest crypto. Surges to $210. Solana (SOL) flips XRP to become the sixth-largest crypto. Surges to $210.

The high-speed blockchain has steadily climbed into the top ten cryptocurrencies by market cap.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Solana displaced Ripple (XRP) this morning to become the sixth-largest cryptocurrency by market cap, data from multiple sources shows. The feat puts it at a $60 billion marketcap—one that took a little under 24 months to achieve.

The Solana lure

So-termed the world’s ‘fastest’ blockchain, Solana boasts transactions per second (tps) speeds of over 65,000 and has a booming ecosystem of Web3 apps, DeFi protocols, and NFTs building atop it. The project is backed by the likes of FTX founder Sam Bankman-Fried and other influential crypto investors, adding to SOL’s lure among investors.

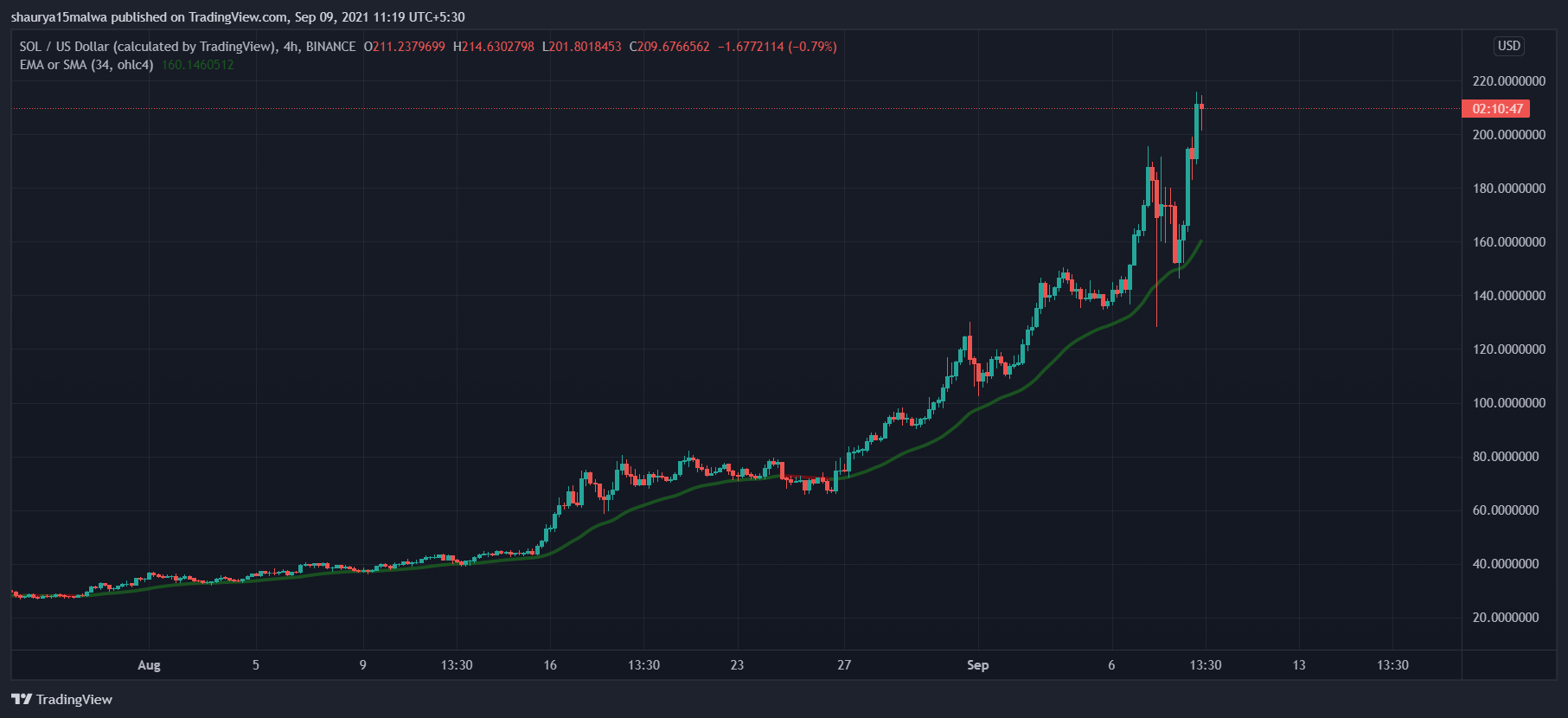

And lure it does. SOL traded at just $2.7 at the start of 2021, rising to over $50 in April-May as the altcoin market heated up and topped out. But the past month saw it rise to $76, correct to $65, and then embark on a moon mission to its current $210 at press time.

SOL prices reached as high as $214 this morning before briefly correcting. A dip to $201, however, was short-lived and quickly rebought by investors. As such, the token has been on an uptrend since the $28 price level—trading well above its 34-period moving average—and has returned over 88% to investors in the past week alone (and nearly 1,000% since the start of this year).

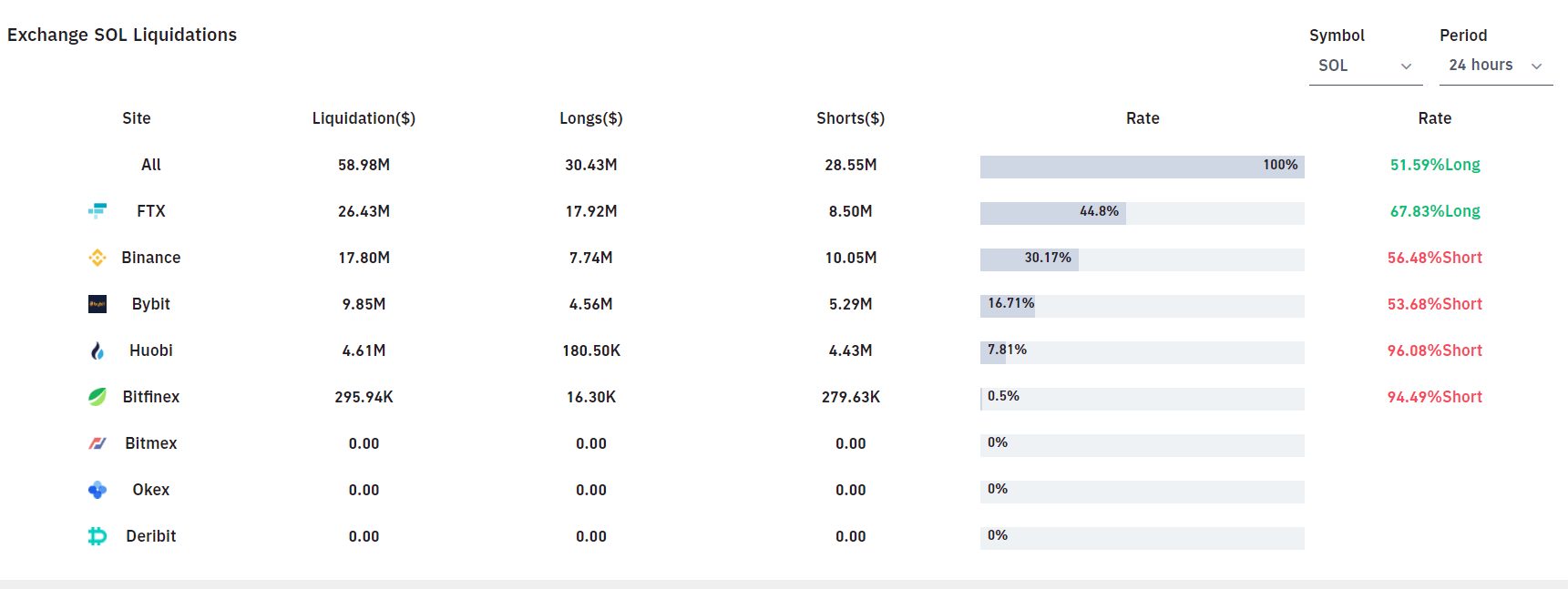

Meanwhile, short sellers continued to pay the price yesterday as Solana prices surged. As per Bybt, over $58 million worth of SOL trades were liquidated yesterday, of which $28 million—or 49%—came via ‘shorts’ alone. Liquidations, for the uninitiated, occur when leveraged positions are automatically closed out by exchanges/brokerages as a “safety mechanism.”

Binance saw the biggest number of Solana short liquidations at $10 million, followed by FTX at $8.5 million and Bybit at $5.29 million. A relatively smaller $279,000 worth of shorts also originated from Bitfinex.