BlackRock closing the gap with Grayscale with just 50,100 BTC difference

BlackRock closing the gap with Grayscale with just 50,100 BTC difference Quick Take

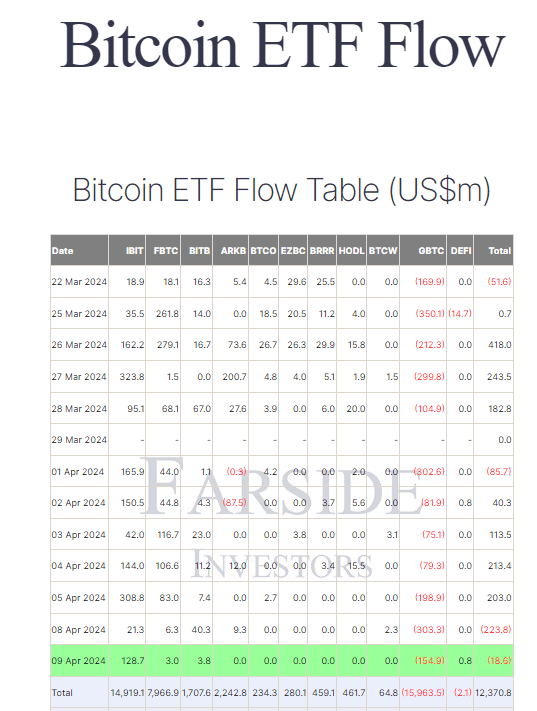

Data from Farside reveals outflows for Bitcoin (BTC) exchange-traded funds (ETFs) on Apr. 9. BTC ETFs experienced an outflow of $18.6 million, marking consecutive outflows.

Grayscale’s GBTC saw outflows of $154.9 million, the smallest daily outflow since April 4, bringing its total outflows to $15.9 billion. In contrast, BlackRock IBIT witnessed an inflow of $128.7 million, its largest since Apr. 5, with total inflows now standing at $14.9 billion.

Overall, according to Farside data, BTC ETFs have attracted $12.3 billion in net inflows, indicating a continued interest in this asset class.

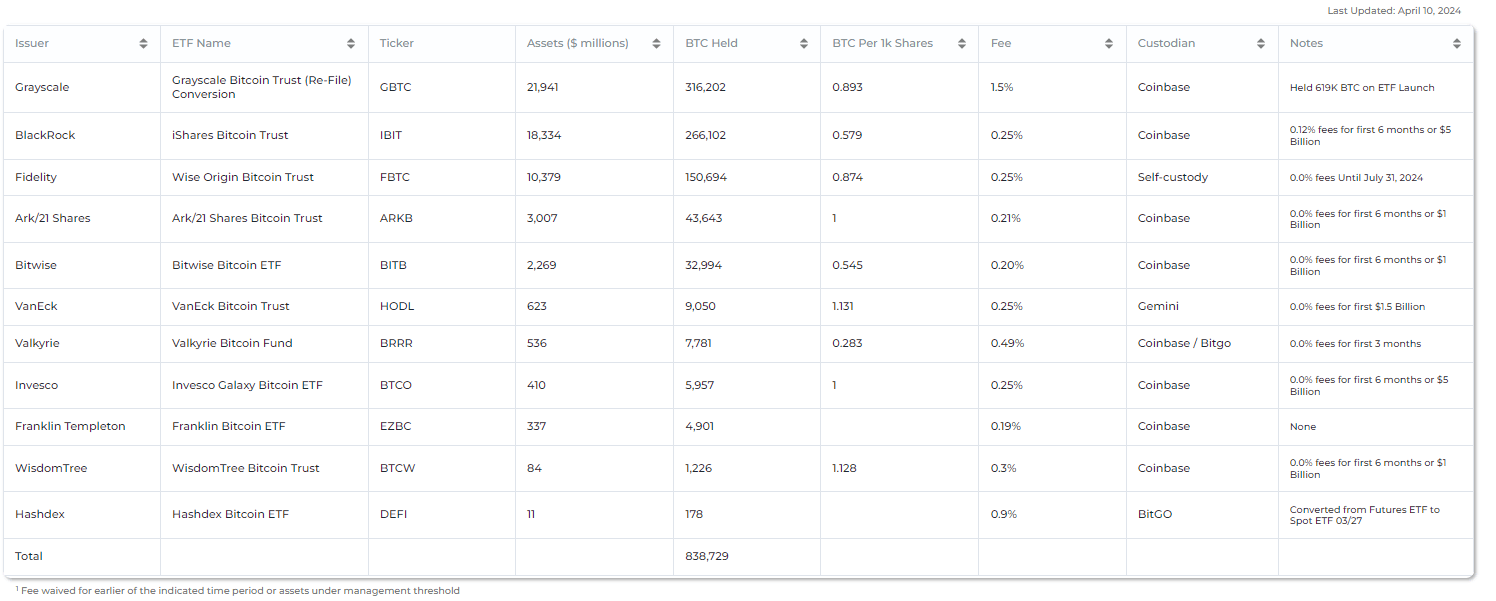

Data from heyapollo shows that in terms of BTC holdings, GBTC currently holds 316,202 BTC, while IBIT holds 266,102 BTC, a difference of 50,100 BTC.

Meanwhile, Fidelity FBTC has accumulated 150,694 BTC, showcasing the growing interest from institutional investors.

Collectively, the 11 BTC ETFs hold an impressive 838,729 BTC, highlighting the significant amount of Bitcoin now held by these investment vehicles.

CryptoQuant

CryptoQuant