Crypto market cap drops $51 billion as Silvergate crisis deepens

Crypto market cap drops $51 billion as Silvergate crisis deepens Crypto market cap drops $51 billion as Silvergate crisis deepens

Top cryptocurrencies see losses as Silvergate uncertainty spooks the market.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

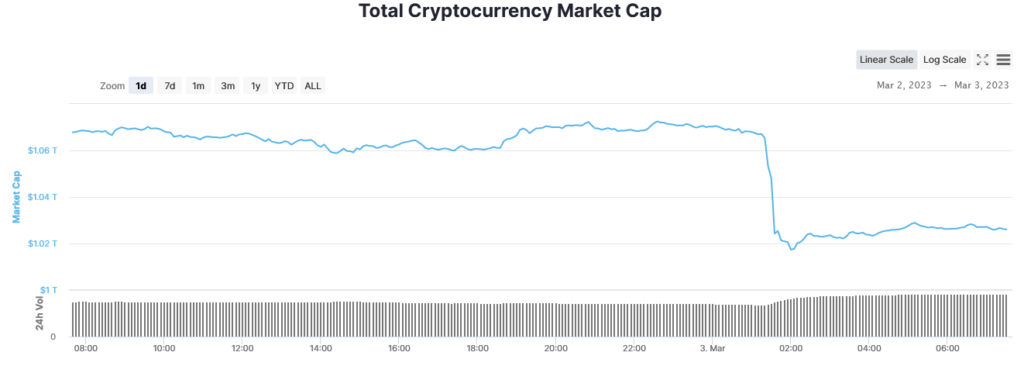

The total crypto market cap fell $51 billion as the crisis at Silvergate Bank deepened.

Over the last 24 hours, the total market cap lost $50.62 billion to bottom at $1.017 trillion around 02:00 GMT on Feb. 3.

A muted bounce saw a gradual uptick that peaked at $1.028.5 trillion three hours later. But, in the aftermath of the sell-off, market sentiment remains braced for further drops as Silvergate uncertainty takes hold.

Crypto market weakness

Market leader Bitcoin dipped briefly below $22,000 as bears ran riot – marking a 16-day low.

Zooming into a smaller timeframe showed an immediate bounce at support to close with a top-heavy candle body. An attempt to recapture $22,470 was rejected, leading to a contraction of activity – as denoted by decreasing candle sizes.

A further rejection at the $22,470 zone occurred at 09:00 GMT, suggesting another drop lower is on the cards due to buyer weakness.

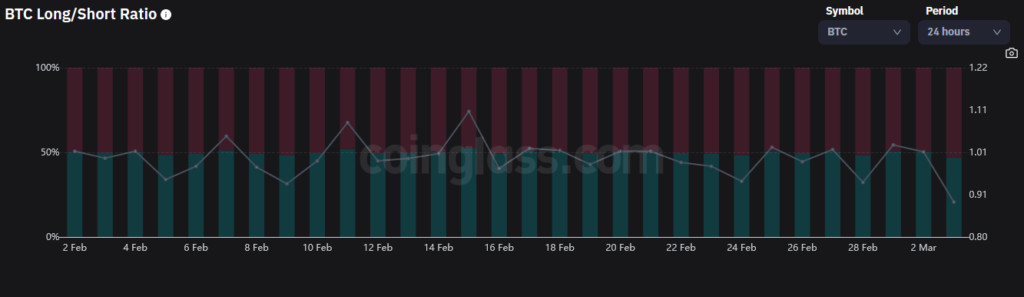

Bitcoin traders flipped majority short, at 53%, leading to the lowest long/short ratio in a month. Likewise, longs were liquidated to $243.5 million in the last 24 hours – a 303% increase over the previous day.

The top 10 (excluding stablecoins) saw Litecoin fare worst, down 8% over the last 24 hours, followed by Dogecoin, which fell 6%. However, the biggest top 100 loser was dYdX, sinking 13.9% over the same period.

Silvergate uncertainty

On March 1, Silvergate said it could not meet the March 16 10-K report filing deadline. The accompanying statement mentioned unspecific events that contributed to the filing delay.

“A number of circumstances have occurred which will negatively impact the timing and the unaudited results previously reported in the Earnings Release, including the sale of additional investment securities beyond what was previously anticipated…”

The announcement was met with a nearly 50% drop in stock price. Analysts have raised the alarm on the company as a going concern amid rumors of FTX overexposure. Several crypto firms moved to cut ties with the beleaguered bank, including Coinbase, Circle, and Paxos.

Meanwhile, under preliminary investigations, FTX disclosed an $8.9 billion black hole in customer funds. The firm said it had identified $2.7 billion of customer funds, but outstanding balances owed amount to $11.6 billion.

Company CEO John Ray reiterated previous comments on incomplete records, adding that the figures are subject to change.