Crazy bullish for Bitcoin: Federal Reserve still intends to spend trillions on the economy

Crazy bullish for Bitcoin: Federal Reserve still intends to spend trillions on the economy Crazy bullish for Bitcoin: Federal Reserve still intends to spend trillions on the economy

Photo by Alec Favale on Unsplash

Despite the roaring recovery in the S&P 500 (and Bitcoin for that matter), many facets of the global economy remain in recession, with dozens of millions unemployed, consumer spending down, and a global supply chain that has come to a screeching halt.

It’s an unfortunate fact that has not been reflected in the financial markets, for some reason or another, though it is being reflected in the fiscal and capital situations of the world’s governments, firms, and individuals.

Hence, the world’s central banks and governments have continued to do everything they can to keep the economy afloat.

While largely deemed necessary, this is a trend that has continued to bolster Bitcoin’s bull case.

Federal Reserve doubles down on a dovish monetary policy

In a statement Wednesday, Jerome Powell, Chairman of the Federal Reserve, warned that the U.S. economy is currently in its worst rut in history due to the outbreak of COVID-19:

“We are going to see economic data for the second quarter that is worse than any data we have seen for the economy. There are direct consequences of the disease and measures we are taking to protect ourselves from it.”

The recovery will not be V-shaped, Powell added, asserting that it may take a while for life to return to pre-virus levels due to the long-lasting effects of the shutdown of the world’s biggest economic powerhouse.

With this in mind, Powell asserted, “promised” even, to continue to lead the Federal Reserve in keeping interest rates low, creating capital facilities for crucial markets, and injecting liquidity into the inner workings of the economy.

Powell didn’t say it explicitly, but market-watchers immediately took this statement as a clear signal that the Federal Reserve is committed to “limitless” quantitative easing, meaning the central bank will purchase any sum of assets to “support smooth market functioning.”

INSTANT ANALYSIS: FOMC pivots to limitless QE until economy is in line with its mandates$USD $ES $ZN pic.twitter.com/xvklC6Vga4

— RANsquawk (@RANsquawk) April 29, 2020

Bitcoin’s bull case strengthens

All this, analysts say, is good for Bitcoin and decentralized assets.

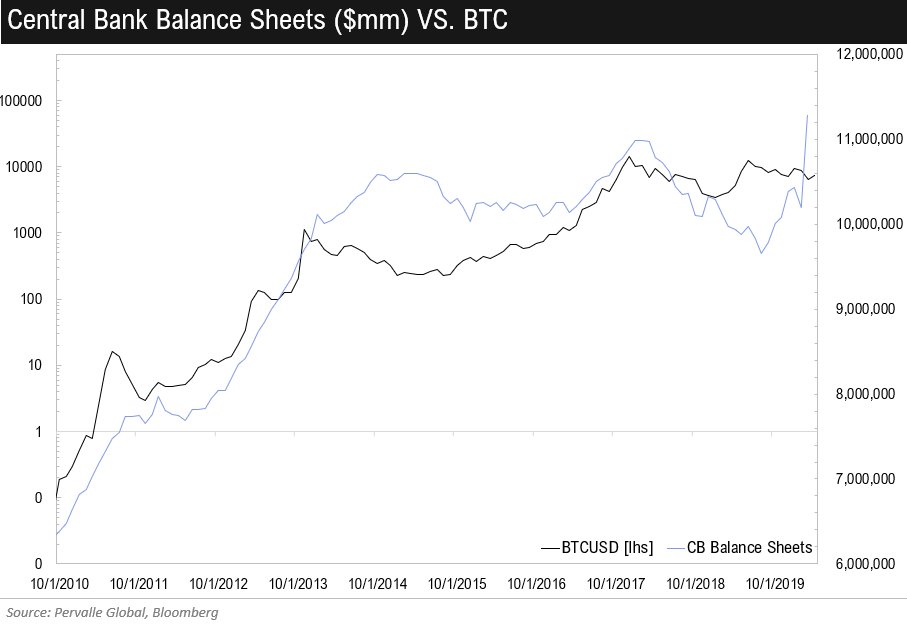

As reported by CryptoSlate previously, Teddy Vallee — founder and CEO of Pervalle Global, a global macro hedge fund — found that Bitcoin’s logarithmic chart has a potential correlation with the total amount of assets the world’s central banks hold.

For instance, when central bank balance sheets started to plunged in early-2018, so did the crypto market. It isn’t a perfect correlation, but it is clear that there is some relationship forming.

Jerome Powell signaling that the biggest central bank in the world, which has already inflated its balance sheet by 50 percent in the past two months, intends to print trillions is decisively bullish for Bitcoin, should this trend continue of course.

Fundamentally, this makes sense. As best explained by Dan Morehead — a Wall Street trader-turned-head of one of the first crypto funds, Pantera Capital:

“As governments increase the quantity of paper money, it takes more pieces of paper money to buy things that have fixed quantities, like stocks and real estate, above where they would settle absent an increase in the amount of money. The corollary is they’ll also inflate the price of other things, like gold, bitcoin, and other cryptocurrencies.”