CleanSpark mined 3,750 BTC in FY’22, BTC reserves down 40% since January

CleanSpark mined 3,750 BTC in FY’22, BTC reserves down 40% since January CleanSpark mined 3,750 BTC in FY’22, BTC reserves down 40% since January

The company also announced tripling its hash rate and recording a 235% increase in revenue.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

CleanSpark’s hash rate hit 6 EH/s on Dec. 21, compared to 2 EH/s on Dec. 31, 2021 — marking a 3x increase on an annual basis.

The company hit its year-end goal for the hash rate and said it expects to hit 16 EH/s by the end of 2023.

2022 financial highlights

CleanSpark mined a total of 3,750 Bitcoin (BTC) during the 2022 fiscal year ending Sept. 30 — up 320% on an annual basis, according to its annual financial report.

Meanwhile, revenue for the year was up 235% to $131.5 million from $39.3 million in 2021.

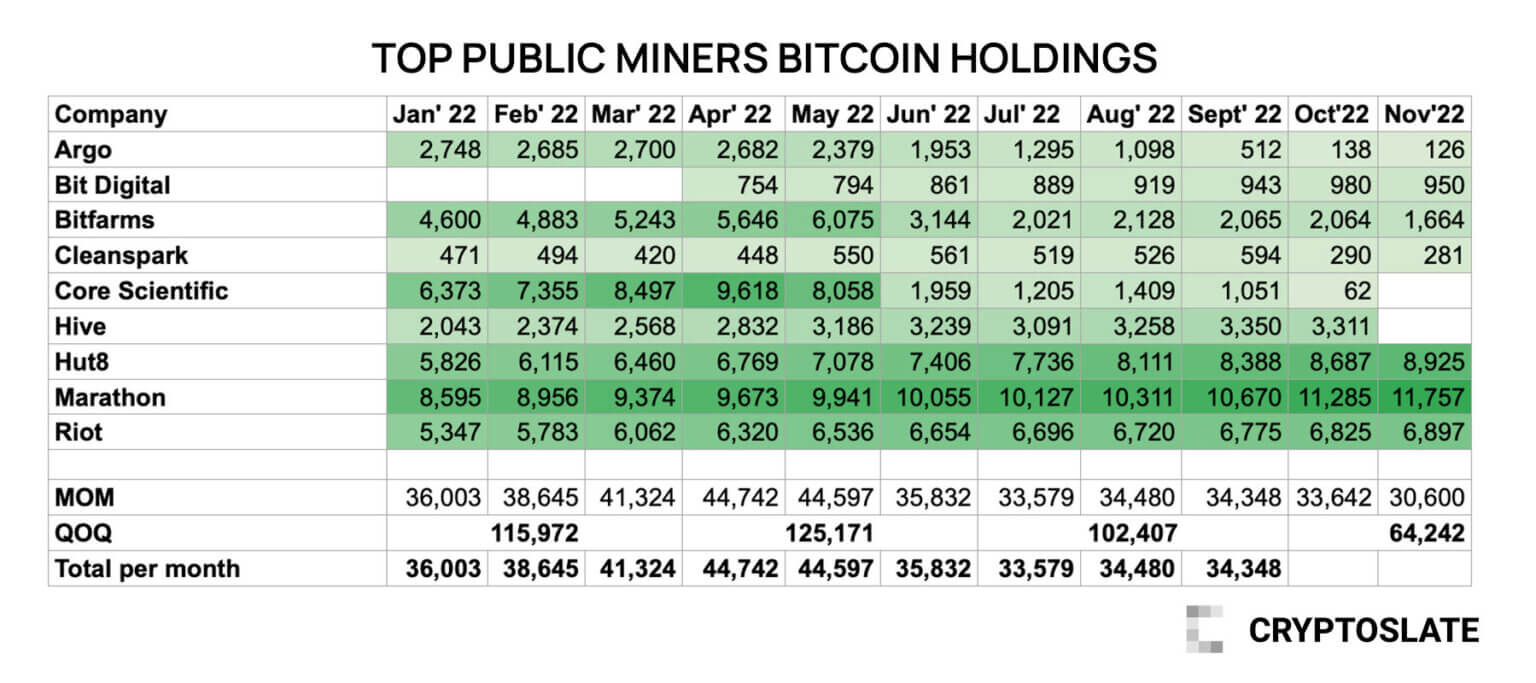

However, despite the 2x and 3x increase in revenue and mined BTC, the company’s BTC reserves are down 40.3% to 281 BTC as of Nov. 30, compared to 471 on Jan. 31, according to CryptoSlate data.

According to the report, CleanSpark holds $20.5 million in cash and $11.1 million in BTC as of the end of September 2022. Together with its mining assets, CleanSpark’s total assets equate to $452.6 million for the fiscal year of 2022.

BTC reserves down 40.3%

CryptoSlate data shows that CleanSpark sold off 304 BTC in October and a further 9 BTC in November, following the end of its fiscal year.

As of Nov. 30, the company held 281 BTC in reserve, compared to 594 at the end of September and 471 at the end of January.

According to the numbers, CleanSpark started the year with 471 BTC and managed to increase this amount to 594 BTC in September, which is the end of CleanSpark’s fiscal year.

On Sept. 30, BTC was being traded for around $19,422. At this price, 594 BTC equates to around $11.1 million, which is also stated in the 2022 fiscal year report amongst CleanSpark’s assets.

However, the data also shows a sharp 51% decrease from 594 BTC in September to 290 BTC in October. This number fell to 281 BTC in November, equating to a 40.3% decrease from January’s 471 BTC.