Can’t remember crypto addresses? Ripple’s new partnership makes XRP, RippleNet payments simpler

Can’t remember crypto addresses? Ripple’s new partnership makes XRP, RippleNet payments simpler Can’t remember crypto addresses? Ripple’s new partnership makes XRP, RippleNet payments simpler

Image by Miloslav Hamřík from Pixabay

A newly-formed group of 40 startups, tech, and crypto firms is joining the Open Payments coalition — with the latter providing unique, simple to read, payment identifiers that open inter-operability between SEPA, bank, and crypto payments.

Making this possible is the launch of PayID, the universal identifier solution of the Open Payments Coalition.

Part of the group is Ripple, the San Francisco-based payments protocol, along with other crypto-firms like BitGo, BitPay, and Brave.

Together with over 40 global companies and nonprofits, Ripple joins the Open Payments Coalition to help drive innovation forward and simplify global payments for all. Discover the coalition’s #PayID, an exciting step for global interoperability. https://t.co/LU0WcxDftV

— Ripple (@Ripple) June 18, 2020

Financial inclusivity

In a blog on Friday, Ripple said it was joining the launch of PayID, with the latter envisioned as a global payments network that allows any individual/business to pay any other entity seamlessly and without middlemen.

Part of the appeal is cutting out types of complex bank addresses and identifiers, such as bank numbers and long cryptocurrency addresses.

The coalition is open-for-all. Ripple noted PayID allows for organic growth and no single organization can control the joining process. The latter’s site features a developer kit for those interested in proving the option for their respective users.

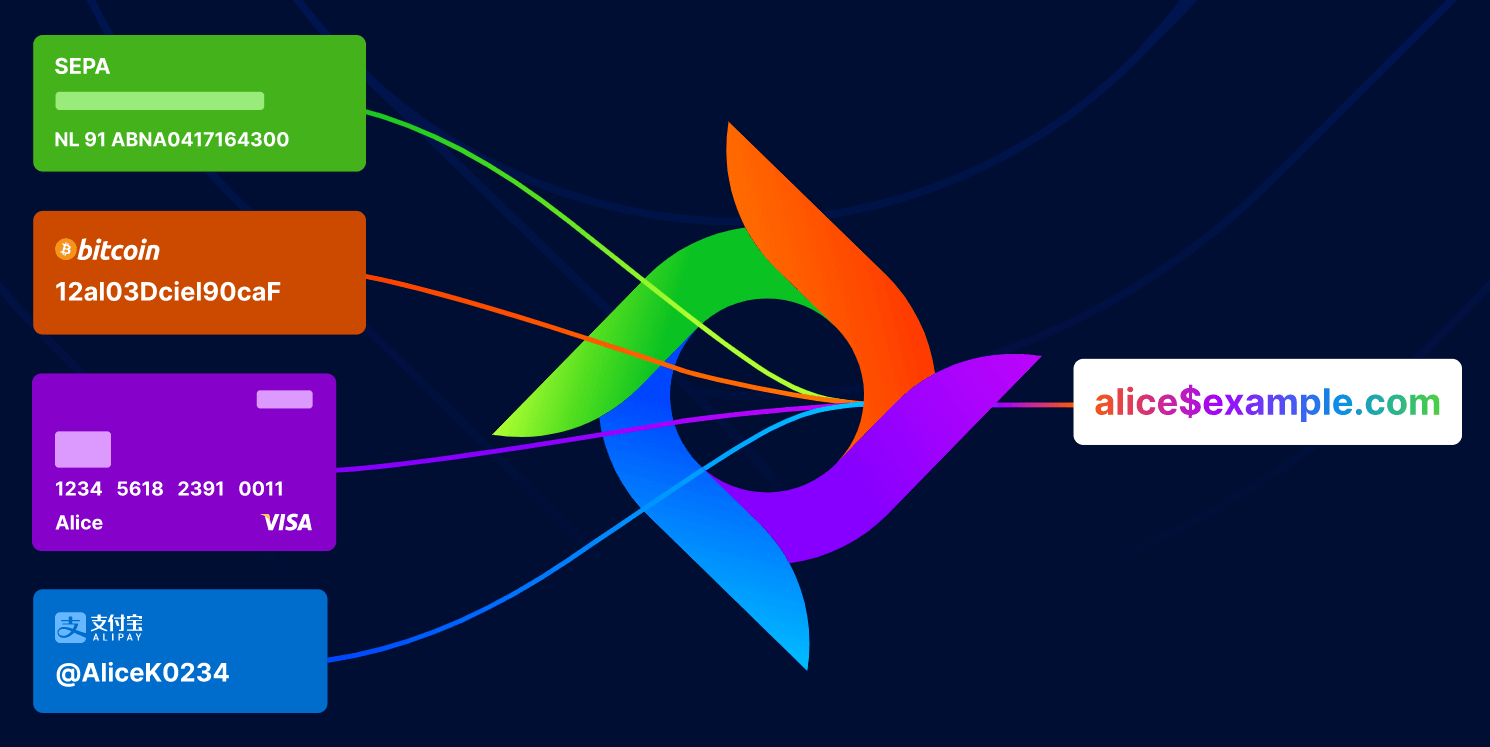

The below graphic shows how PayID identifiers could look, and collate various payment options into one:

XRP, RippleNet to benefit

Ripple said it was integrating PayID into RippleNet, the firm’s blockchain framework that enables interoperability for cross-border payments used by financial enterprises worldwide.

RippleNet’s On-Demand Liquidity (ODL), which CryptoSlate recently reported was moving from larger treasury payments in favor of smaller enterprises, also uses XRP to instantly settle global transactions.

Ripple’s ODL corridors experienced big growth last month. The framework saw significant adoption, and transfers, in developing markets and even developed countries like Australia.

Meanwhile, Ripple CTO David Schwartz tweeted in the regard:

C) PayID gives cryptocurrency companies a way to meet regulatory requirements such as the travel rule.

— David Schwartz (@JoelKatz) June 18, 2020

The crypto adoption conundrum

Cryptocurrency addresses are infamous for their long, complex, difficult-to-remember alphanumeric phases that can extend to well beyond 25 characters.

This, understandably, makes cryptocurrency transfers a process that requires undue user attention, dissimilar to how conventional payments work in broader society. Funds once lost, in the crypto market, cannot be recovered or returned to sender accounts — there’s no margin for error when it comes to digital asset transfers.

While the narrative of being one’s own bank, which the crypto industry pushes, holds true — most users do not want to deal with complicated wallet addresses, with some research even suggesting users may feel “anxious” while transacting with cryptocurrencies.