On-chain metrics show major differences between Ethereum and Ethereum Classic

On-chain metrics show major differences between Ethereum and Ethereum Classic On-chain metrics show major differences between Ethereum and Ethereum Classic

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Analysts tend to compare Ethereum and Ethereum Classic in terms of their technicalities and price action. However, IntoTheBlock took a different approach to determine the fundamental differences between the two.

Ethereum vs. Ethereum Classic

In a recent blog post, Nicolas Contasti, head of business development at machine learning and statistical modeling firm IntoTheBlock, explained how Ethereum and Ethereum Classic differ from a fundamental perspective. Using an on-chain analytics approach, Contasti evaluated which of these two cryptocurrencies represented a better investment vehicle.

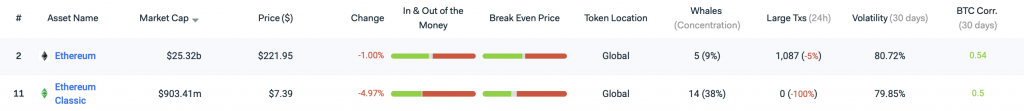

A glimpse at IntoTheBlock’s dashboard, for instance, reveals that ETH has a market cap and price 26 times higher than ETC, according to Contasti. The former is also more correlated to Bitcoin and the number of larger transactions taking place on its network is significantly higher than the latter.

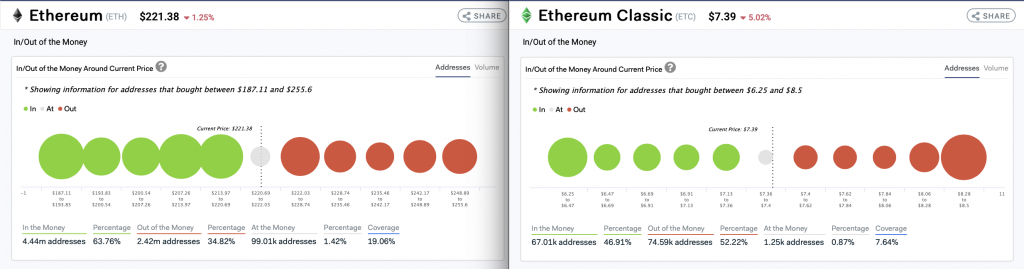

A deeper dive into the In/Out of the Money (IOM) indicator portrays a bigger difference between these cryptocurrencies. This fundamental index provides a “holistic view” of how well investors are doing by holding these digital assets.

Contasti explained:

“In a nutshell, [the IOM] averages all on-chain positions, compares them to the current price, and through a Machine Learning algorithm, it organizes the data into the 10 most significant groups in terms of both addresses and volume of tokens. Those addresses above the current price are those ‘In the Money’, where those that have a dollar average balance below current price are said to be ‘Out of the Money’.”

The IOM shows that approximately 47 percent of all addresses holding Ethereum have a positive balance. Thus, these market participants are considered to be “in the money.” Meanwhile, roughly 36 percent of the addresses holding Ethereum Classic has a positive balance.

Although the difference between investors that are in profits is of about 10 percent, the activity on the network of these cryptos shows a bigger discrepancy.

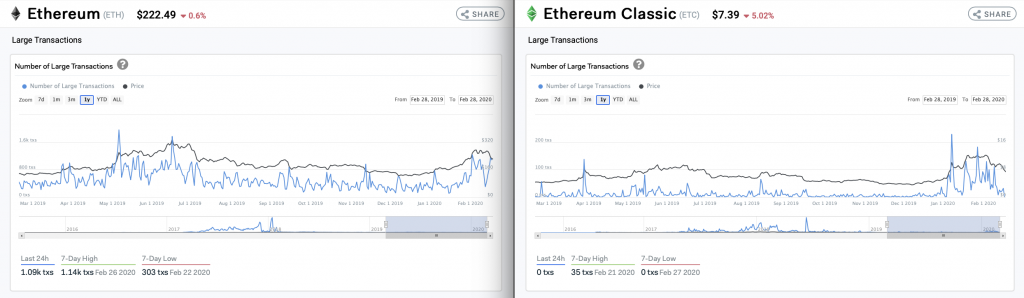

In fact, the number of transactions with a dollar value greater than $100,000 on the Ethereum network ranges from 150 to 1000 in a single day. For Ethereum Classic, however, Contasti argues that large transactions are less frequent with some days like on Feb. 27 where there were none. The number of large transactions for ETC ranges between 0 and 150.

The big gap in large transactions between these cryptocurrencies could be correlated to the activity by exchanges, over-the-counter desks, hedge funds, and other big players, said Contasti.

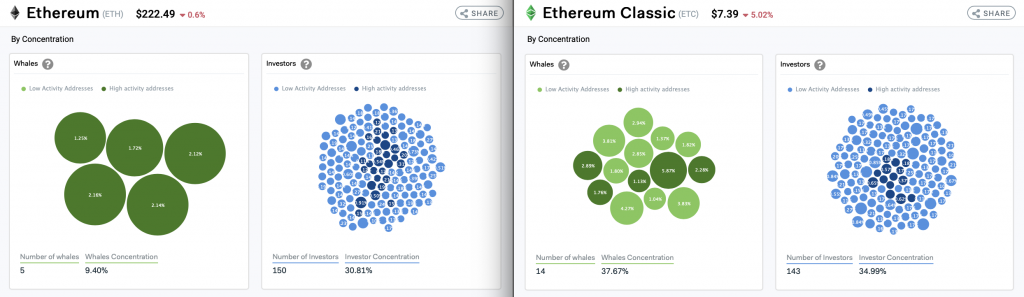

IntoTheBlock’s Ownership by Concentration model shows that there are five Ethereum whales holding 9.33 percent of its circulating supply. There are also 150 investors, which concentrate between 0.1 to 0.99 percent of the circulating supply, holding a total of 40.14 percent and the remaining 59.86 percent is distributed among retail investors.

On the other hand, Ethereum Classic is less distributed than Ethereum. Approximately, 72.65 percent of the tokens in circulation are concentrated in the hands of big players—15 whales hold 39.82 percent and 140 investors hold 32.8 percent. The other 27.35 percent is distributed among retail investors leading Contasti to believe that “exposure to these players is considerably higher.”

It is worth mentioning that throughout the bull rally that the cryptocurrency market went through since the beginning of the year Ether saw its price surge over 127 percent while Ethereum Classic skyrocketed nearly 215 percent. Considering the price percentage increase and the different metrics mentioned above, Contasti believes that ETH could represent a better investment vehicle than ETC.

Nevertheless, the analyst does not advise anyone to invest in any of these two cryptocurrencies without an understanding of the risks involved.

Contasti concluded:

“Making an investment decision in a highly volatile environment must be a well-understood action. Consequently, the more valuable data we have at our hands the better our investment decisions will be.”

Farside Investors

Farside Investors