New Institutional Crypto Index Fund Offers Bitcoin, Ethereum, and Litecoin

Photo by John Salvino on Unsplash

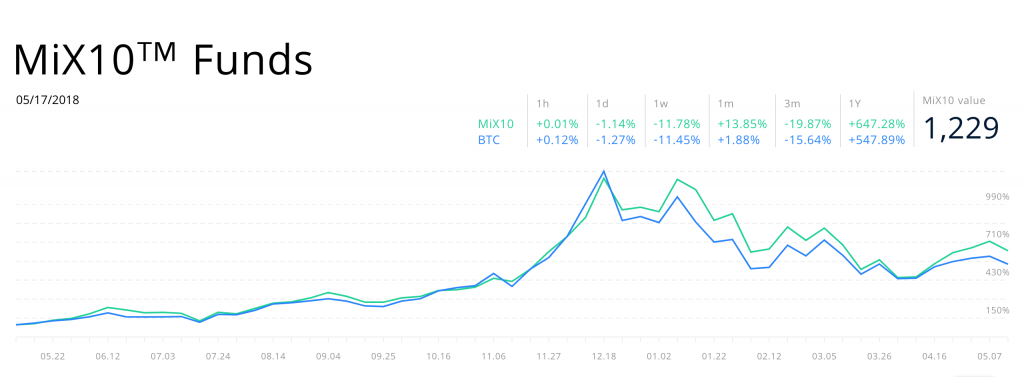

Claiming to be the world’s first cryptocurrency investment platform, IronChain Capital offers accredited investors a way to purchase an index of cryptocurrencies for long-term, diversified holdings. Announced on May 14, the nascent cryptocurrency investment platform will launch its two index funds MiX10 and MiX10 Institutional.

From Retail to Institutional Investment

As blockchain applications and integration continue to pervade industries worldwide, retail and institutional investors alike have grown to demand better instruments for measuring the overall cryptocurrency market.

Emerging this year, cryptocurrency indexes like the Bloomberg Galaxy Crypto Index (BGCI) and Coinbase Index Fund have made their way into the open market – allowing accredited investors a way to measure and invest in a diversified portfolio of digital assets.

Following this trend, new outlets for institutional investments have developed – including the MiX10 funds launched just two days ago by IronChain Capital.

About IronChain Capital

Using a basket of up to 10 of the top cryptocurrencies weighted by market cap, the MiX10 and MiX10 Institutional funds offer accredited investors a mutual fund-like instrument for long-term holdings.

Described on their website,

“Iron Capital was created with the vision of applying a rigorous framework similar to the S&P 500 to the cryptocurrency industry.”

According to this blog post by founder Jonathan Benassaya, IronChain seeks to resolve current issues surrounding cryptocurrency investment through improvements in liquidity and valuation.

The recently launched investment platform advertises a 1% management fee, daily liquidity, and institutional-grade security through partnerships with Kingdom Trust, Ledger, and Xapo. In addition, the funds utilize a hybrid liquidity pool drawing from both exchanges and OTC desks.

In an effort to streamline the investment process, Benassaya describes their inspiration for the new cryptocurrency investment platform here:

“IronChain Capital lowers the economical barrier by taking away the high price tag and eliminating many of the complications associated with investing, such as picking the right digital assets, trading them and having to worry about safekeeping them.”

Major Cryptocurrencies Boosted by Index Funds

With the rise of funds like those of IronChain and Coinbase, a new facet of opportunity for major institutional investments in cryptocurrency are made available.

The normalization of cryptocurrency investing has evolved into structures similar to those used to invest in traditional asset classes, establishing a secure platform for future investors to join the market.

Given that these funds track the top cryptocurrencies by market capitalization, coins like Bitcoin, Ethereum, and Litecoin become backed by the pooled funds that invest in them – boosting their overall valuation and serving as a cushion for their future growth.

Cryptocurrency continues to attract new retail and institutional funding, and we can only expect more outlets for investment to become available as the industry matures.

Farside Investors

Farside Investors