Liquid staking protocols TVL could ‘flip’ DEXs TVL soon

Liquid staking protocols TVL could ‘flip’ DEXs TVL soon Liquid staking protocols TVL could ‘flip’ DEXs TVL soon

Since the Shappella upgrade, the top 10 liquid staking protocols have seen their TVL grow by an average of 10%.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The total value of assets locked (TVL) on liquid staking protocols is near that of decentralized exchanges (DEXs), according to Defilama data.

The 81 liquid staking protocols tracked by DeFillama have a cumulative TVL of $19.31 billion — with Lido being the dominant player in the sector.

Meanwhile, the total value of assets locked on the 799 DEX protocols sits at $19.48 billion, according to DeFillama data.

DeFi analyst Patrick pointed out that the “flippening” could occur any day now.

Liquid staking protocols allow users to earn staking rewards while providing them liquidity for other crypto-based activities. Examples of this protocol include Lido, Frax Ether, Rocket Pool, etc.

Earlier in the year, liquid staking protocols became the second-largest DeFi category when it usurped the lending protocols category. At the time, the liquid staking protocols enjoyed enormous interest due to the anticipated Shapella upgrade.

Liquid staking protocols rise post-Shapella

Since the Shappella upgrade, the top 10 liquid staking protocols have seen their TVL grow by an average of 10% in the last seven days. For context, the number of Staked Ethereum on Lido (LDO) crossed 6 million — worth $12.93 billion— on April 18, according to DeFillama data.

CryptoSlate’s data corroborates the increasing value of liquid staking platforms. According to the data, the market cap of the protocols in the sector grew to $4.44 billion in the last seven days.

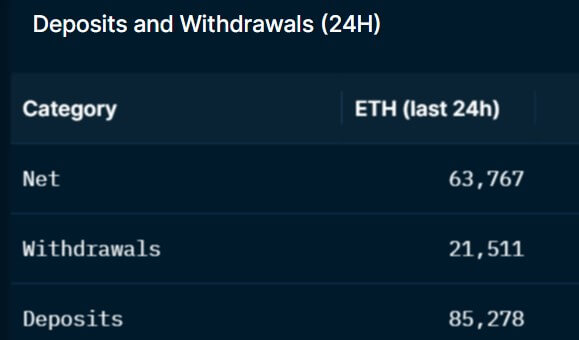

Blockchain analytical firm Nansen’s dashboard showed that more Ethereum is being deposited than they are being withdrawn for the first time since the network completed the Shapella upgrade.

According to the dashboard, over 85,000 ETH was deposited in the last 24 hours, while less than 22,000 ETH were withdrawn during the same period.

Meanwhile, blockchain analyst Lookonchain reported that some addresses withdrawing their staked ETH were immediately re-staking them. The on-chain sleuth reported two whales that staked over 50,000 ETH tokens via the liquid staking protocol, Agility.