Ethereum leads with 96% of all DeFi transactions as Tron, EOS, and NEO show promise

Ethereum leads with 96% of all DeFi transactions as Tron, EOS, and NEO show promise Ethereum leads with 96% of all DeFi transactions as Tron, EOS, and NEO show promise

Photo by Joshua Golde on Unsplash

Data shows a staggering 96% of all transactions on decentralized finance (DeFi) applications take place on Ethereum, the world’s second-largest blockchain network by market cap.

This is despite there being faster and low-fee networks available on the market today, suggesting both developers and participants have yet to fully trust and adopt newer blockchains.

DeFi has boomed this year on the back of yield farming and other non-custodial crypto applications like lending and DEX trading. The industry was worth under $600 million at the start of this year but has quickly grown to amass over $11 billion in locked assets.

“Best quarter” for DeFi

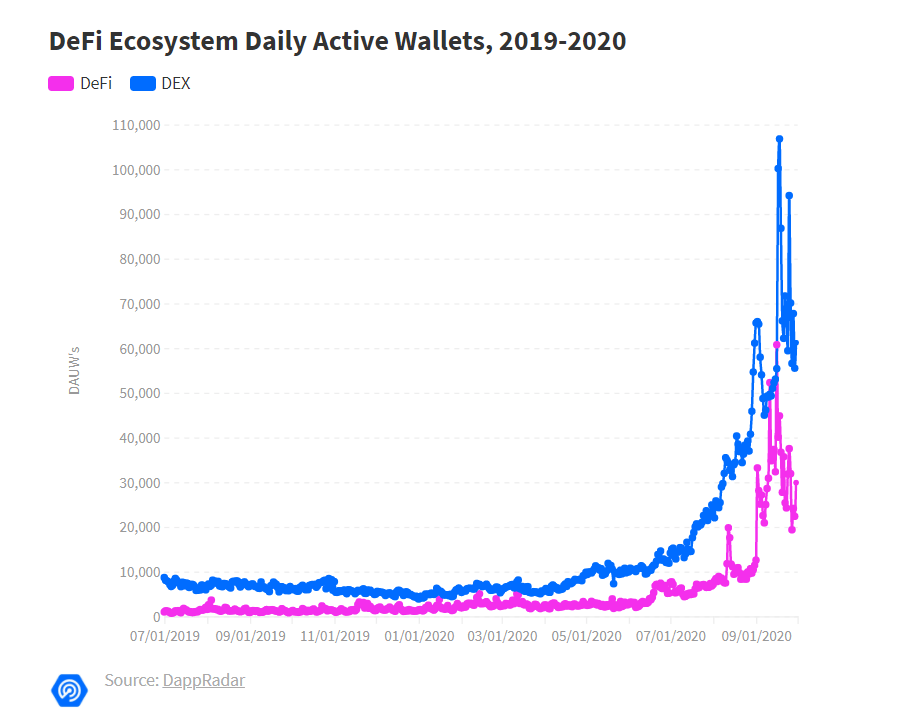

Dappradar, which published the findings in a recent report, said the DeFi industry has grown more than ten times in Q3 of 2020. The firm analyzed on-chain activity and data from blockchain networks such as Ethereum, Tron, and EOS, but also included its findings from IOST, Ontology, and NEO.

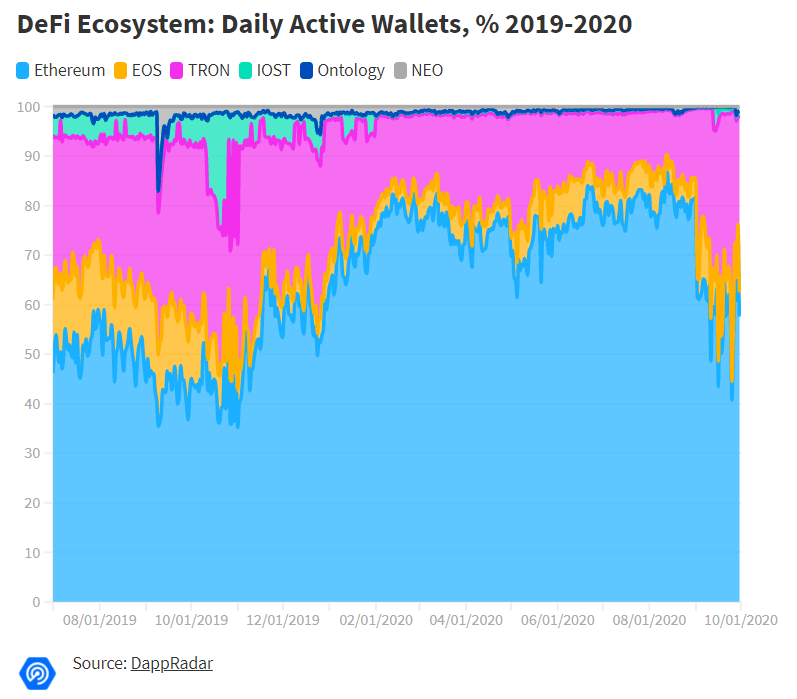

The report said that Ethereum, TRON, and EOS account for 97% of daily active wallets, with the strategy of distributing the so-called “governance tokens,” which allow holders to partake in network decisions and, and yield farming have become “key to successful dapp growth.”

It added that Q3 2020 was the “best quarter for the DeFi ecosystem so far.” Dappradar also noted the overall DeFi ecosystem transaction volume surpassed $123 billion, with 96% of that total belonging to Ethereum.

In terms of the $11 billion in total value locked (TVL) assets, Uniswap, MakerDAO, and Curve. The growth of Uniswap was driven mostly by the introduction of the UNI governance token.

Data from active daily wallets, a metric that measures on-chain transactional activity, showed 57% of such activity comes from Ethereum wallets. Tron and EOS, both controversial for being centralized blockchains, saw over 35% and 5% of all activity. The remaining is split among other blockchains.

The report noted:

“The biggest contributors to the Ethereum protocol were Uniswap, Sushiswap, Balancer, and Compound. Together they have generated 56% of the daily active wallets.”

New dapps see surge after “DeFi” pivot

Tron dapps like JUST, Zethyr Finance, and Oikos.cash along with a few new projects like Sun, Unifi Protocol, and SharkTron gained popularity and generated more than 32,000 daily active wallets, the report added.

Meanwhile, the report stated “smaller” blockchains like IOST, Ontology, and Neo produced similar DeFi products in Q3 this year and saw a surge in both their active wallets and transactional volumes

The daily active wallets of IOST, Ontology, and NEO have increased by 357%, 1,589%, and 840% respectively, while in terms of transaction volumes, IOST accounted for over $123 million with Neo and Ontology generating $12 million and $1.6 million respectively.

Farside Investors

Farside Investors