Bloomberg analyst shares 5 reasons why he’s bullish on Bitcoin in 2020

Bloomberg analyst shares 5 reasons why he’s bullish on Bitcoin in 2020 Bloomberg analyst shares 5 reasons why he’s bullish on Bitcoin in 2020

Photo by Waldemar Brandt on Unsplash

Although Bitcoin’s market capitalization is still extremely small compared to that of other assets, like the dollar or Apple, the cryptocurrency is rapidly gaining traction with mainstream investors.

Paul Tudor Jones, a multi-billionaire hedge fund manager, called BTC the “fastest horse” in the asset race, noting how the cryptocurrency looks like gold did in the 1970s, prior to an exponential rally.

And now, Bloomberg Intelligence senior commodities strategist Mike McGlone is weighing in, giving a confluence of reasons why he and his desk believe Bitcoin’s rally is supported and could just be the start of a greater move higher.

Reason #1: Bitcoin is outperforming the stock market

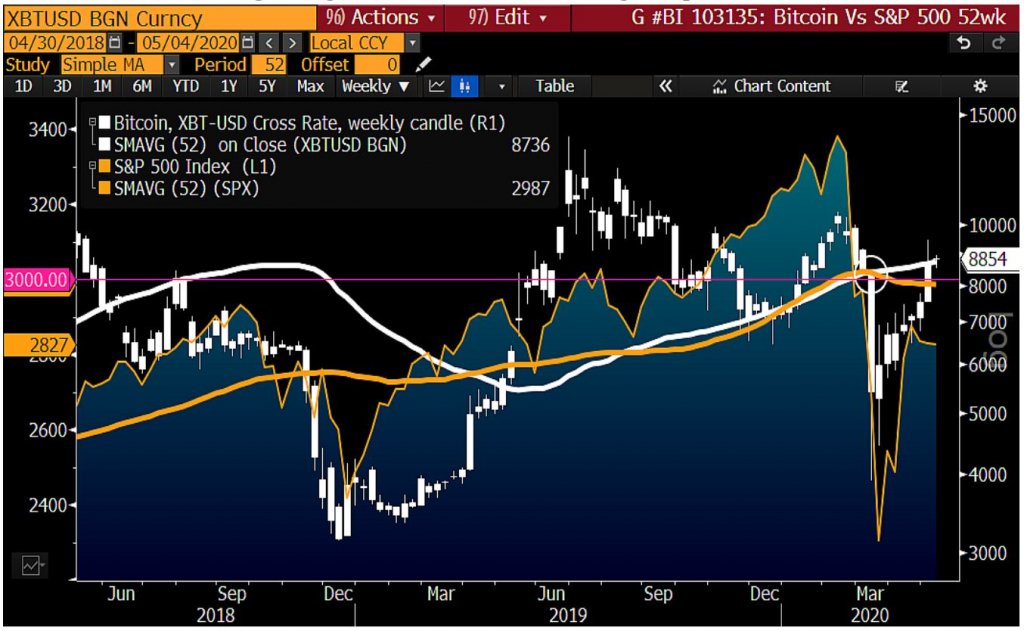

While the S&P 500 has surged since its March lows, Bitcoin is largely outperforming the stock index, “showing divergent strength versus the wobbly stock market.”

WIth BTC managing to retake key resistances like the 52-week moving average and $8,000 while the S&P 500 falters, McGlone wrote that “BTC appears to be functioning less as a risk asset, and more toward an alternative store of value like gold.”

Reason #2: Bitcoin’s volatility is dropping as stock volatility rises

In a similar vein, McGlone noted that Bitcoin’s volatility has “never been lower versus the stock market, favoring price appreciation” in BTC should historical trends hold.

Bloomberg’s analysis found that the last time Bitcoin’s volatility against the volatility of the S&P 500 was this low as in late-2015 to early-2016, near the $200 bottom that led to a 10,000 percent rally to $20,000 in the two years that followed.

Reason #3: BTC is gaining adoption via futures & other products

To add to the outperformance of the stock market, Bitcoin has been seeing increased institutional adoption over the past few weeks, as evidenced by the increase in the CME BTC futures open interest metric. This indicates:

“Maturation, pressure on volatility, increasing adoption and price support.”

Add to this that Grayscale saw a record raise last quarter, meaning that it now holds nearly two percent of all BTC, and McGlone said that this is a good sign the “first-born crypto continues its historical ascent.”

Reason #4: Number of Bitcoin addresses is swelling

According to data from Coin Metrics, the “10-day average of unique addresses” used on Bitcoin is “nearing last year’s high.”

This is important as the last time the metric exceeded this peak, it “preceded the recovery in the Bitcoin price.”

McGlone added that if you plot the number of active BTC addresses over the chart, the current levels we’re reaching with this on-chain metric suggests a fair price of $12,000 — 20 percent above the current price.

Reason #5: The halving is imminent

Finally, the Bitcoin block reward halving is just a mere three days away, estimates suggest.

McGlone sees this as important as compared to Bitcoin, when supply mined drops, miners can’t go out to find more coins, but must instead grapple with BTC’s scarcity.