Grayscale Bitcoin Trust’s discount narrows to 8% amid growing ETF optimism

Grayscale Bitcoin Trust’s discount narrows to 8% amid growing ETF optimism Grayscale Bitcoin Trust’s discount narrows to 8% amid growing ETF optimism

Grayscale intends to turn its GBTC fund into a highly-anticipated spot Bitcoin ETF, pending approval by the SEC.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

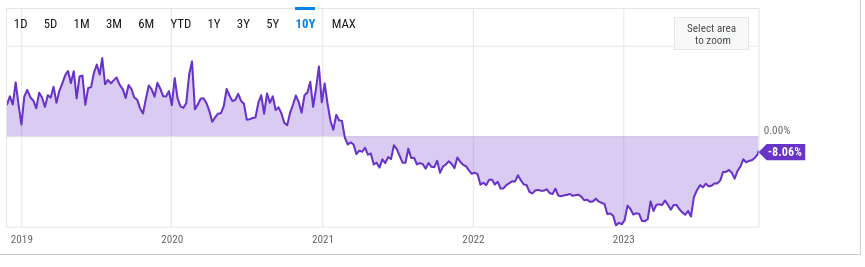

According to market data from YCharts on Nov. 24, the Grayscale Bitcoin Trust (GBTC) discount rate has narrowed to 8.06%.

The “discount” refers to the situation where the Grayscale Bitcoin Trust (GBTC) shares are trading at a price lower than their underlying net asset value (NAV).

GBTC began trading at a discount in early 2021, sometime after Grayscale halted GBTC redemptions. As trading continued, the asset discount reached its lowest point at 48% in late 2022. The discount gradually began to narrow in early 2023, culminating in the current 8% discount. An 8% discount has not been seen since mid-2021.

Before March 2021, GBTC was trading above its net asset value, known as a premium. However, according to a separate report from experts, it is unlikely that the fund will trade at a premium again. One expert even suggested that if Grayscale’s plan to convert GBTC into an ETF is realized, any existing premium will likely vanish.

Investor optimism may be narrowing discount

Recent developments have likely contributed to the latest change in value and the fund’s larger trend toward a 0% price difference.

Over time, the general optimism about Grayscale’s proposal to transition GBTC into a spot Bitcoin ETF seems to have contributed to the narrowing of the discount. The company won a court case in June that compelled the U.S. Securities and Exchange Commission (SEC) to review its spot ETF application. Reports from October indicated that the SEC would not appeal the ruling.

More recently, in late November, Grayscale said that it had entered talks with the SEC around its proposal. It also submitted an updated filing to the SEC. Additionally, Ark Invest — another company that is seeking its own spot Bitcoin ETF — sold about $10 million of GBTC shares starting in late October. Those sales may have affected the price of GBTC directly or influenced other trading activity.