Ethereum’s network revenue plunges by 99%, sparking ‘death spiral’ concerns

Ethereum’s network revenue plunges by 99%, sparking ‘death spiral’ concerns Ethereum’s network revenue plunges by 99%, sparking ‘death spiral’ concerns

Coinbase-backed Base network paid only $11,000 to Ethereum in August despite generating almost $2.5 million revenue.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

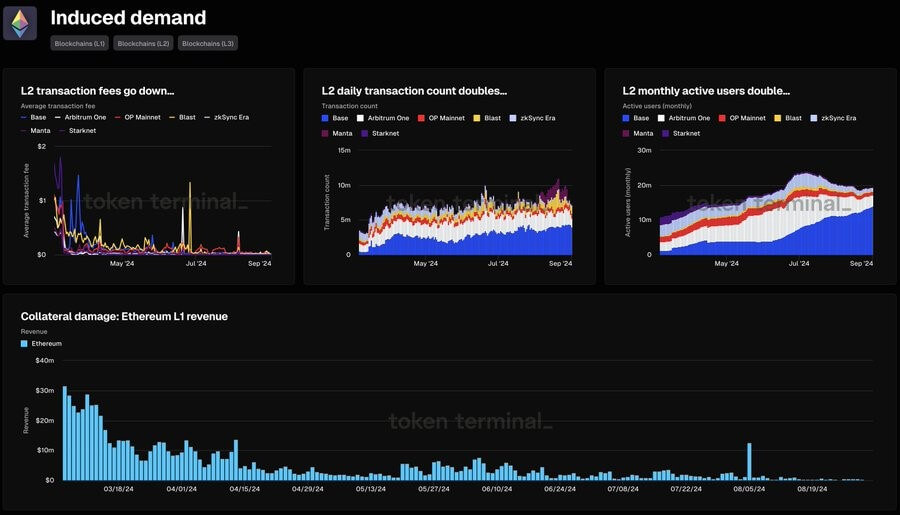

Ethereum’s layer-1 network has witnessed a drastic decline in revenue, plummeting by 99% since March 2024.

Data from Token Terminal reveals that network revenue peaked at over $35 million on March 5. However, by Sept. 2, daily revenue had plunged to a yearly low of around $200,000.

Market observers attribute this decline to the growth of layer-2 (L2) networks and the March Dencun upgrade, which reduced fees for L2 transactions and reshaped Ethereum’s revenue structure. Token Terminal stated:

“Key metrics that show how lower transaction fees on L2s have increased usage, but also driven down the revenue on the L1.”

Post-upgrade transaction activity has shifted from Ethereum’s mainnet to L2 networks, leading to increased daily transactions and active users on these platforms.

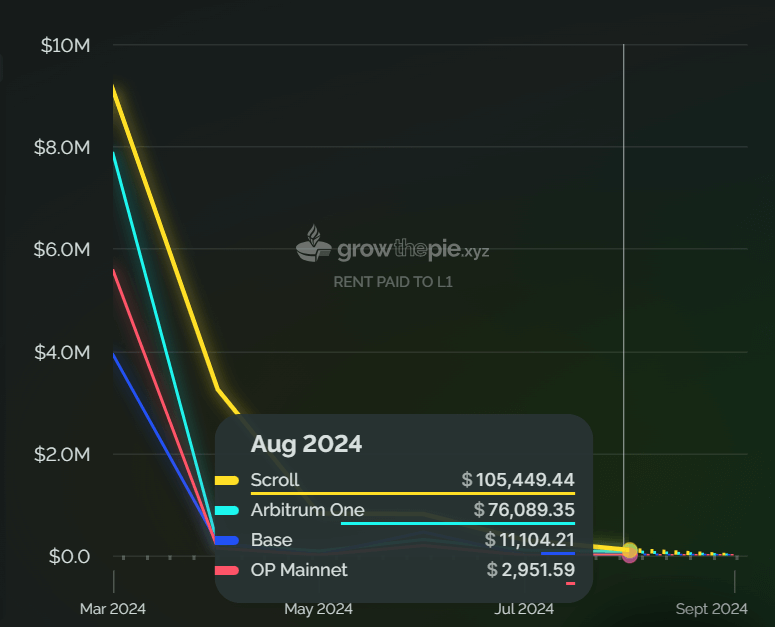

However, this migration has significantly impacted Ethereum’s fee revenue. For instance, Coinbase’s L2 network, Base, generated $2.5 million in revenue in August but paid only $11,000 to settle on the mainnet, underlining the shift in value from Ethereum’s base layer.

Crypto analyst Kun warned that if this trend continues, L2 networks could dominate and potentially abandon Ethereum’s mainnet, especially for consumer applications. He emphasized the need for Ethereum to develop valuable use cases on its mainnet or risk a severe valuation issue.

He added:

“ETH L1 needs valuable use cases on mainnet that cannot be sieged or you have to hope that L2 usage is so big that basically you need 100000 times the usage on L2 to get the same value you did on mainnet with a tiny fraction which then creates a valley of valuation issues.”

‘Death spiral’

Bitcoin investor Fred Krueger has echoed these concerns, suggesting that Ethereum could face a “death spiral” if its low revenue situation persists.

He pointed out that Ethereum’s current fee revenue of $200,000 per day equates to $73 million annually, far from sufficient to sustain its market cap of $300 billion.

Krueger argues that a more realistic valuation might be closer to $3 billion, underscoring the disconnect between Ethereum’s fee income model and its market valuation. He said:

“[Ethereum is] not equivalent to a company making $73 million a year in profit, or even a company making $73 million a year in revenue. That $73 million is not even sufficient to buy back all the inflation that naturally comes to ETH validators.”