Bitcoin drives Morgan Stanley fund’s strategy with key positions in IBIT and MicroStrategy

Bitcoin drives Morgan Stanley fund’s strategy with key positions in IBIT and MicroStrategy Bitcoin drives Morgan Stanley fund’s strategy with key positions in IBIT and MicroStrategy

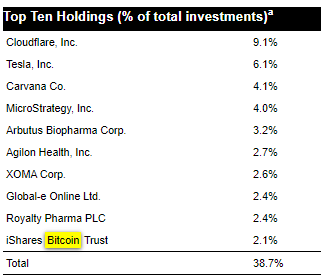

MicroStrategy ranks fourth in Morgan Stanley's Bitcoin-heavy fund with 4.0% weighting.

Quick Take

According to a recent SEC filing, the Morgan Stanley Institutional Fund, Inc. – Counterpoint Global Portfolio reported total net assets of $10,042,729 as of June 30, 2024. The portfolio holds 216 different investments and has a portfolio turnover rate of 51% for the first half of the year.

Among the portfolio’s top ten holdings, notable investments include the iShares Bitcoin Trust (BlackRock IBIT ETF), which represents 2.1% of total assets—roughly a $211,000 stake. MicroStrategy, known for its significant Bitcoin holdings, ranks fourth with a 4.0% portfolio weighting, or approximately a $402,000 investment. While not a dedicated digital assets company, Tesla is the second-largest holding, accounting for 6.1% of the portfolio, reflecting its notable Bitcoin exposure as part of its corporate strategy.

These positions highlight the portfolio’s significant exposure to digital assets and related companies, reflecting a broader interest in Bitcoin and its influence on the corporate sector.