Finance Guru Ronnie Moas Digs for $10 Billion in Cryptocurrency Gold

Finance Guru Ronnie Moas Digs for $10 Billion in Cryptocurrency Gold Finance Guru Ronnie Moas Digs for $10 Billion in Cryptocurrency Gold

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Ronnie Moas is known as a finance guru with a 15-year track record of picking stocks. Later in his career, he ventured into cryptocurrency, claiming himself to be “synonymous with Bitcoin.” That success, however, has taken a turn towards conflict.

Background on Ronnie Moas

Ronnie Moas is the founder of Standpoint Research. The Florida-based company conducts market analysis on securities, bonds, cryptocurrencies, and other assets, and is a one-man operation dependent on Moas, according to a Bitcoin Podcast interview.

According to Moas (via Standpoint Research subscriber emails):

“I am one of the most highly regarded and highest ranking analysts in the financial services industry. I have a top 20 ranking for my performance versus more than 4,700 professionals… and my company was ranked # 5 on Wall Street in 2017.”

He is also a Twitter, TV, and radio influencer, having been featured on dozens of interviews and with a following of over forty-thousand on Twitter. He has a prolific record, having published and distributed over 900 research reports, and issued more than 600 stock recommendations since July of 2003, according to Bloomberg.

Moas goes so far as to claim that his expertise extends into the cryptocurrency markets, saying that his name “has become synonymous with Bitcoin,” predicting that it “will hit $28,000 by the end of 2018”

According to Bloomberg’s Executive Profile, Moas began his career on Wall Street as an analyst at Herzog Heine Geduld. Moas was responsible for making sector, industry, and stock recommendations. And, according to the biography, “he demonstrated remarkable accuracy with his market forecasts and stock recommendations.” He left the firm to found Standpoint Research, Inc. in 2004.

Based on statements from Moas and estimates from other sources, Standpoint Research has between 2,500 and 3,000 subscribers. This earns Moas a tidy $1.5 million to $4 million in revenue a year.

Standpoint Sells Stock Picks

Standpoint Research makes money through its subscription service. Subscribers get access to research, stock picks, and information curated by Ronnie Moas. The company uses its proprietary “artificial intelligence overlay applied to a 155-variable computer model” for generating its predictions.

For $599 to $1,119 per year, subscribers get access to Standpoint’s exclusive research. The company asserts that it helps subscribers pick investments “…so that you do not have to do that research on your own.”

Doing Deals with Dignity (DIG)

In July of 2017, Arbitrade, a company which is developing a cryptocurrency exchange and trading software, contacted Moas to conduct an analysis of their company for “internal use,” according to court documents. The report was meant for accredited investors and institutions interested in Arbitrade, executives from the company said.

Arbitrade is the parent company of Cryptobontix, a company which issued a cryptocurrency called Dignity Token, which is important later in the article.

Moas was paid $60,000 and 2 million DIG tokens, for a total in $100,000 in compensation for his report. He provided the company with a 122-page report on September of 2017, with 34 pages of that pertaining directly to DIG, based on statements from Moas and the court case.

Background on Dignity Token (DIG)

Dignity is a cryptocurrency which claims that each of its tokens is backed by $1.00 in gold. Cryptobontix, the company spearheading the project, had previously stated in its retracted white paper that it plans to pay for the gold using profits from mining farms.

The company was later acquired or merged with Arbitrade at an unspecified date. Arbitrade is a company which is “leveraging proven financial technology” that “combines a financial matching engine… and smart contracts to enable market participants and institutions to buy and sell regulated security tokens.”

The cryptocurrency Dignity was largely traded on Livecoin, a small cryptocurrency exchange that claims to be based in London.

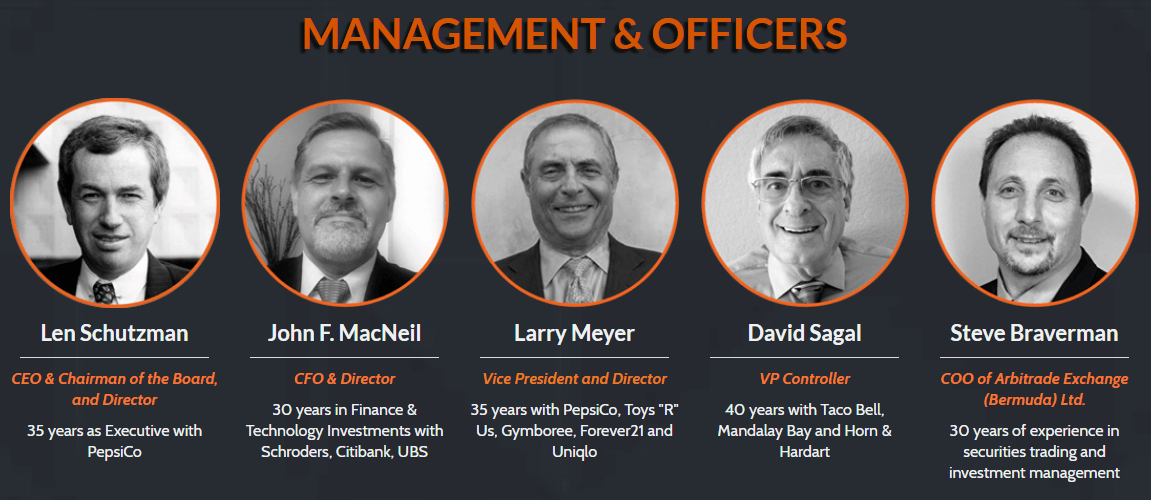

Arbitrade also features an impressive management board, with all officers listing over 30 years experience at companies such as PepsiCo, Citibank, Uniqlo, Toys ‘R’ Us, and Taco Bell.

CryptoSlate reached out to over 10 of the members listed on Arbitrade’s website over the last five days to confirm their involvement with Arbitrade. Only one, Steve Braverman, responded with the following comment:

“I will speak with our attorney and get back to you.”

Braverman did not provide any further comments.

Digging for Billions in Gold

The first iteration of the Cryptobontix white paper claims that the profits from cryptocurrency would pay to purchase the billions needed in its gold reserves.

Miraculously, the company was able to “receive title” to the gold. The company claims to have title over 395,000 kg of gold, worth roughly $16 billion at current prices.

The amount of gold is equal to roughly one-eleventh the amount of gold held in Fort Knox, a United States army fortress which once held a large portion of the country’s gold bullion when the country still used the gold standard. Today, it still holds an outlandish amount of gold.

And, in the ultimate display of legitimacy, Arbitrade purchased Nelson Mandela’s solid gold hands for an additional $10 million. Despite the strong messaging, some members of the community have warned that Arbitrade is a scam.

Ronnie Moas Catches the Gold Rush

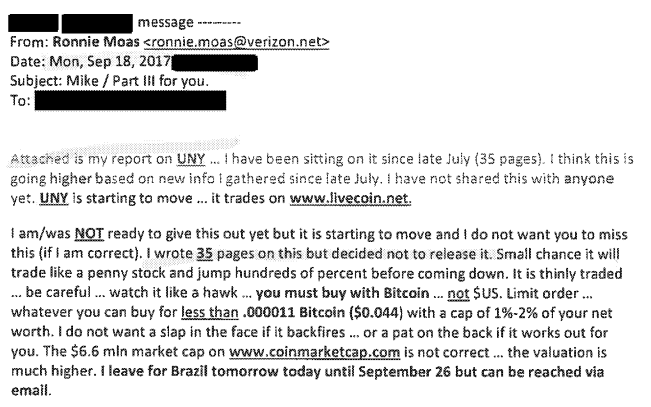

On Sep. 18th, 2017, a small group of Standpoint’s paid subscribers were given the recommendation to purchase DIG, along with his report on UNY (the former ticker for DIG). Court filings and testimonies from several of his subscribers confirm this.

A few months later, on Feb. 8th, 2018, Moas allegedly sent a blast out to his entire subscriber base with the recommendation to buy DIG. In an interview on the Bitcoin Podcast, he describes it as an “impulsive reaction” and stated that a huge move in the coin’s price motivated him to share the report:

“The reason I released the paper, the catalyst… was seeing it move eleven hundred percent in one day, and I felt that it was an insider buy and I decided within a few minutes to jump on it.”

After February, Moas would publicly describe Dignity Tokens (DIG) as his “best idea in 20 years,” both on Twitter, and in his email letters:

Maybe my best idea in 20 years already up 300% in four weeks. I think it is getting ready to #rockandroll I see another 500% upside in the next 30-60 days … stay away from the snakes https://t.co/JlWsPzNzDp … #ACDC #blockchain $btc #crypto #cryptocurrency #bitcoin #Ethereum

— Ronnie Moas (@RonnieMoas) March 5, 2018

Florida Gold Frenzy

In June of 2018, Moas allegedly notified his subscribers that he visited an Arbitrade location and was “blown away” by the premises and operations of the facility. He also assured buyers that “every day that goes by, my confidence level in [Arbitrade’s] operation increases, and the amount of risk I see decreases,” according to redacted tweets in the court filings.

Ronnie Moas then continued to boast the merits of the Dignity Token, assuring buyers that the coin is completely and totally legitimate:

And saying that that it couldn’t be a scam, because scams are too expensive to pull off at this scale:

Moas continued to purchase DIG throughout 2018, stating in his interview that he had purchased 440,000 DIG as late as Nov. 27th, worth roughly $8,000 at the time. Over hundreds of Tweets and emails, Moas would routinely set price targets of $0.40 by the end of 2018. Meanwhile, the value of DIG eroded from $0.28 in May to less than $0.01 over the year—an over 95 percent decrease.

Flip the Script

From Dec. 16th until two weeks ago, Moas still “thought that this [Arbitrade] was legitimate.” From mid-November, Moas completely reversed his opinion about DIG, calling the cryptocurrency and the project a scam. He then proceeded to call the founders of Arbitrade fraudsters and crooks and berated them on a near-daily basis over social media.

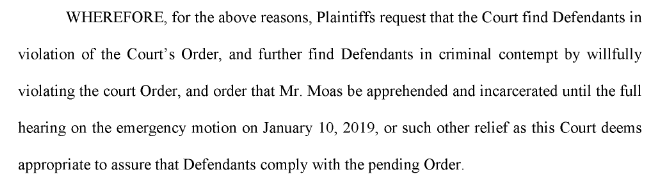

Eventually, Moas’ accusations allegedly reached a fever pitch, posting the addresses, phone numbers, license plates, and other identifying information for the executives behind Arbitrade. He went so far as to encourage his subscribers to physically threaten the executives over email, according to the court documents.

Unfortunately, CryptoSlate is unable to list the tweets in total because they were deleted from Ronnie Moas’ account on Jan. 8th. That said, some of the accusations are listed, in hard copy, in the court filings.

The threats and accusations publicly listed by Moas culminate in a formal legal complaint from Arbitrade’s executives for libel, cyberstalking, and tortious interference, among other charges. Additionally, the documents list hundreds of incriminating emails, tweets, and correspondence with Moas, with the three executives attesting to the legitimacy of the content under penalty of perjury.

According to the filing, Moas tweeted 394 threatening tweets towards Arbitrade, 34 of which included personal information or directly tagged them on Twitter. The company issued a cease and desist, but that only caused Moas to double down.

Moas becomes despondent, with some of the messages emphasizing this:

“I have a very hot temper and I am very impulsive… emotional and sensitive and I will if I believe in something I will fight until the death for it… if a man does not have a cause worth fighting for his life is not worth living… and I will fight to the death for my subscribers and the reputation that you have destroyed in the last few months with your bullshit.”

And, at his lowest, he even talks about contemplating suicide:

“In fact, the thought of ending my own life crossed my mind several times already today, but that would be a victory for you. I just took anti-anxiety medicine for the third time this weekend you filthy scumbags. God sees everything, and you will get what is coming to you.”

Is Ronnie Moas the Victim?

Based on testimony from Moas’ paid subscribers and evidence from the court proceedings, the finance professional allegedly never disclosed his payments from Arbitrade or his personal holdings and investment in Dignity Token.

Thomas McLoughlin, the CEO of Blockstake and former banking analyst, reaffirms this in correspondence with CryptoSlate:

“In neither Ronnie’s buy recommendation to his paying subscribers in November of 2017, nor his subsequent follow-ups was this compensation mentioned. In fact, this conflict of interest was only disclosed after the company publicly brought forth these facts.”

Not only that, many of Moas’ subscribers allegedly warned him of the red flags surrounding Arbitrade, including McLoughlin:

“After being asked by a third-party to run diligence on Dignity, a number of red flags surfaced… checkered past of numerous key executives, unsustainable business model… deadlines continually missed or ignored, and most importantly any lack of concrete evidence to Arbitrade’s gold or mining operation. In addition, Dignity token was and is traded only on a small exchange called Livecoin and had severe technical disruptions throughout the course of the year.”

In response to McLoughlin’s concerns, Moas had this to say:

“You are making a complete fool of yourself. I will not waste my time on this garbage message. My subscribers know EXACTLY what is going on.”

When asked about the warning signs around Dignity on the Bitcoin Podcast, Moas said the following:

“I haven’t done background checks on anyone in 20 years. I don’t have time to do that. My subscribers expect a name from me every week.”

His defense: they were “charming people,” and he had no idea that any of this was happening. For the remainder of the interview, Ronnie Moas asserts he was the victim, that he was duped, and that he was, and still is, innocent.

Even though Moas wrote a 122-page report on the company, and was supposedly paid $100,000 to investigate the merits of Arbitrade—apparently he “doesn’t have the time” to do background checks, according to commentary in the Bitcoin Podcast interview.

Finally, when asked if his involvement could be construed as a “pump and dump” on the Bitcoin Podcast, he had the following eloquent statement:

“Now go fuck yourself,” and left the interview.

Subscribers Outraged

As Ronnie Moas turned sour towards Arbitrade, his subscribers turned furious. Many were angry that they were shilled DIG. There are dozens of people who have called him a fraud because of his behavior. Some of these people lost tens of thousands following his recommendation.

$DIG is not a scam.

Ronnie Moas is a liar and a fraud.@ArbitradeX who owns $DIG, just filed an injunction and lawsuit today because of it.

Do some homework. Happy to provide all 10 pages. pic.twitter.com/UpTRQTjJcd

— Brandon William (@azbill_brandon) January 3, 2019

Despite Moas’ allegations, there are still many who assert that Arbitrade is legitimate on Twitter.

Michael Kelly, who claims to be one of Moas’ paid subscribers, made the following testimony to CryptoSlate:

“He is quite honestly the most unprofessional and odious man I’ve ever had the displeasure to come across, a pathological liar who refuses to admit his wrongdoing, instead blaming Arbitrade for all this after his extortion attempts fell flat. I never acted on a single one of his tips, that’s the level of his service. I guess I should be thankful for that.”

We reached out to Ronnie Moas on multiple occasions and received no comment.

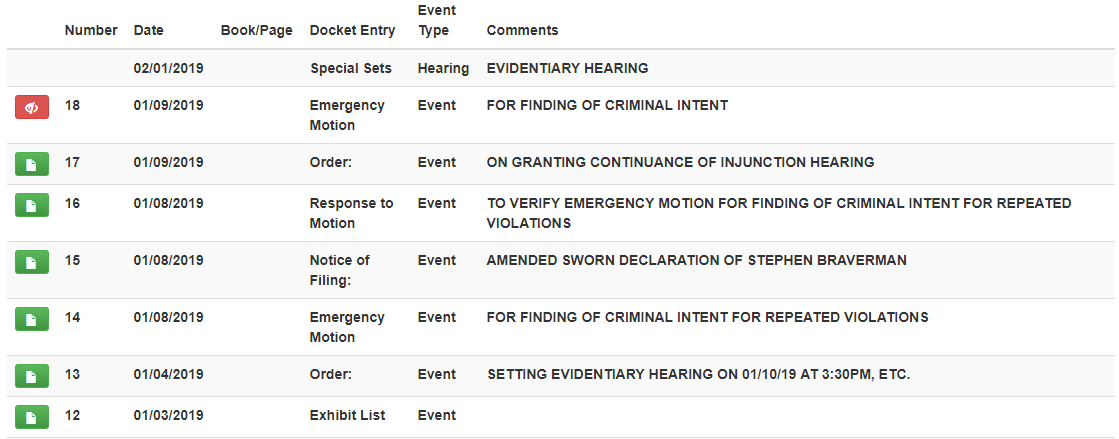

Legal Battle Intensifies

The civil case (search Moas, Ronnie), James Goldberg et. al. vs Ronnie Moas has intensified over the last few days. After repeated accusations of “criminal intent,” the courts have granted several emergency motions to determine potential criminality:

According to new documents filed on Jan. 8th, James Goldberg et. al. alleges that Ronnie Moas has repeatedly violated the court’s orders, and that Goldberg was in “fear of physical harm for himself and his family,” and filed a formal complaint listing Moas’ violations over Twitter and email after furnishing Moas a cease and desist complaint.

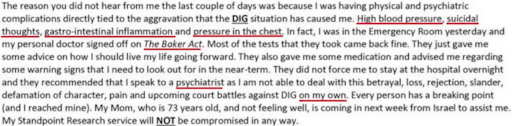

Meanwhile, one of Moas’ subscribers claims that he sent out the following email today:

Summary

Ronnie Moas claims to be a “highly regarded and highest ranking analysts in the financial services industry, someone whose name is ‘synonymous with Bitcoin.’”

Moas received a large sum of money to write a report on a company. He then allegedly leaked this report to his subscribers—without providing disclosure of his conflict of interest or his stake in Dignity Token.

Then, Moas proceeded to promote the project for over a year. Suddenly, he changed the narrative and called the project an outright scam. His subscribers and those who follow him on social media have lost tens of thousands of dollars as a result of his recommendations.

In Moas’ words, he’s the victim. When asked why concerns over DIG did not surface during the 122-page report he wrote for Arbitrade, his explanation was that “he doesn’t do background checks.”

Moas then allegedly proceeded to threaten and harass Arbitrade’s executives to the point where they fear physical harm to themselves and their families. Moas then told his subscribers that the reason for his absence is because of medical complications.

“Standpoint Research service will NOT be compromised in any way,” Moas allegedly said in his email to subscribers today. CryptoSlate will continue to follow the story and release updates as the civil lawsuit unfolds and as more information becomes available on Arbitrade.

Jan. 10th, 01:40 UTC: Clarified that Arbitrade only has “title” to the gold reserves.

Farside Investors

Farside Investors

CoinGlass

CoinGlass